11+Things You Didn’t Know About Repairing Your Credit Rating

In cash-strapped times, the money guardians with the cash to lend – want to keep their hands on all they have, protecting it all costs.

Three protection companies let them do that.

The official term for them is Credit Reporting Agencies (CRAs).

The big three are Experian, Equifax and CallCredit.

What they really are, are information havens. Used by all lenders to assess your level of financial risk.

- Understanding how they work,

- Controlling your information,

- Knowing how lenders use your financial records…

Well, that’s how you go about improving your credit score. Being declined credit isn’t a joyous moment. Being refused repeatedly… that’s doing major damage. The more credit applications you have rejected, the worse your situation becomes.

You fall into the bad credit trap

Accessing short-term finance becomes problematic. Suddenly, it dawns… if you want that new home; you need a bad credit mortgage.

A sad sign of our times is that you have to prioritise taking care of the information held by the credit reference agencies, more than you take care of your personal finances. That’s the sad state of the economy we live in.

And if you don’t and wind up having to access emergency credit through fast loans, you’ll fall into a credit history black hole and be left there for six years before the evidence of your financial hardship is removed from your credit report.

Is it really that bad?

Read on to find out about…

11 Things You Really Ought to Know (but don’t) About the UK’s Credit System

Added Bonus is You’ll Learn How to Fix Your Credit Rating

The Blacklist

You’ll hear time and again that there’s no blacklist. When we explain to our customers about how to get bad credit mortgages, we mention that it may be worthwhile checking with the National Hunters Database. This is a company owned by banks and building societies. Its purpose is to prevent fraud. They’re not the only player in the fraud prevention game though – there’s also CIFAS. For consumers, it’s only useful ‘after’ you’ve had your identity stolen.

2015 statistics from CIFAS, revealed that the UK saw a 57% rise in identity theft. That was 148,000 people’s details listed on the National Fraud Database (NFD) – Wrongfully. Whilst the database itself is a good thing, it serves the financial sector more than it does for individuals. If a bank is at financial risk, these databases let them know. Since they don’t know that you’re not actually a fraudster, they aren’t going to notify you. All you’ll hear is the same message repeatedly of computer says no every time you apply for finance.

“If you’re a victim of identity theft, it can lead to fraud that can have a direct impact on your personal finances and could also make it difficult for you to obtain loans, credit cards or a mortgage until the matter is resolved.” ~Action Fraud

The National Fraud Database is not a credit blacklist but it will most certainly block your every attempt to obtain credit because guess what… banks don’t want to do business with fraudsters.

Check if they’ve mistakenly or purposely put your details on that register. If it’s a mistake, get it fixed, and if it’s the latter – The system’s working.

The Majority of Lenders Use the Electoral Roll to Verify Your Identity

The Electoral/Voters Roll isn’t just used to permit you to vote for the next political party to wreak havoc across the nation. It’s also a verification method that certifies you’re a UK citizen.

Without being listed here, there’s uncertainty about your rights to be living in the UK, let alone trying to mortgage a home to live in… Or rent it out and earn yourself (and the HMRC) a nice chunk of change in the process.

The Electoral Roll is one of the key methods used by lenders for identity verification purposes. If your details are out-of-date, you’re likely to have an application for a mortgage declined.

A common problem is people move address and don’t bother with that letter the postman or woman drops through your door asking you to inform the Electoral Commission of everyone living at your address. If that’s not returned to your Local Electoral Registration Office, (or completed online) your details will be out of date and therefore, won’t match the records held by the credit reference agencies.

Did you know: 25% of people aged 18 – 24 years old are clueless about the impact that a failure to register to vote has on future personal finances?

For the 18 – 24 age group, pay attention to the Right to Vote because it has far more impact than the number of times you mention ‘wasted’ on your Facebook timeline. That said if you believe the craziness to grace us from the States; register to vote, but waive your right to use it. We don’t want our new National Anthem to be God Save Us All (or are we already there?) We’d all be royally screwed if our Facebook rants were used by CRAs to assess our ability to manage our personal finances. Can you imagine?

You Could Be Doing Yourself a Disservice by Paying Outstanding Debts

This one may surprise you because of all the other money advice centres around… wait for it… paying your bills. And then we’re here saying don’t! Well, not quite don’t. Stick with it here…

When you miss a payment, default or just blanket refuse to pay a company what you owe, those details get reported to the credit reference agencies. Experian, Call Credit and Equifax – any or all companies are used to do a financial background check on you. Lenders will know about all those warning letters with the big red bold print demanding you pay going ignored, maybe not quite that you shredded them, but they will know of your failure to respond.

Those missed payments, defaults and other bad money decisions you may or may not have made, become the knowledge of lenders and that’s why you’re refused credit. Not because you have a bad credit score, but because you fall below their acceptable lending criteria.

A misconception of credit scores is that you actually have one. The fact is you don’t. It’s a guideline only because every lender will have a different way they use the data from your credit report to assess your level of risk. Each lender has its own scoring system.

- Credit Reference Agencies provide access to your financial history,

- Credit scores are the result of what lenders do with the information they get from your credit report.

On a side note: Due to the volume of applications larger firms receive, many will use loan servicing software, which could mean your application is denied before any human decision-maker reviews your application.

To fix your credit to a state when you aren’t being filtered out through automation, don’t listen to lenders who tell you to take up discrepancies with the credit reference agencies. Take it up with both of them.

For example, if you agree to a repayment plan for outstanding debts, make it on the terms that the company you are paying update your actions to the credit reporting agencies. That single entry can influence lenders decisions to provide credit and the rate of interest they apply to that credit.

For debts that have been sold to debt collection agencies, or even before that has happened, you still have one last Ace left to play…

Early settlement

It’s not uncommon for debt collection agencies and lenders to make you an offer whereby they accept partial payment. If this happens, take heed of Kevin Boon’s advice of The Independent and ask (no insist) that your credit files are updated to show that the settlement figure is “Full and Final Settlement”. Not “Partially Settled”. And get that in writing. As Kevin states in his advice column – this protects you from being pursued later for the remainder of the unsettled portion.

And it’s better to have your credit report show full and settled rather than partially settled.

Credit Reports Don’t Need a Subscription or Free Trial (and you don’t need all three either)

The Data Protection Act requires firms to let you know the information held about you. Therefore, there’s no need to be paying a fortune for a single access fee to access your report. £2 for admin costs is all you need to pay to get statutory credit reports from Experian and Equifax. CallCredit will give you the details for free through Noddle.co.uk, or ClearScore.com (not that this one will do you much good… we’re getting to that bit).

For £4 in administration fees, you’ll get access to all the data you need.

Experian and Equifax reports are needed so you can check for errors that may be blocking your every attempt to obtain credit. Mistakes happen and when they do, nightmare scenarios like Joanne Smith encountered become a fiasco to fix.

Get a hold of the information the credit reference agencies hold about you, check the list – double check it – and get any errors corrected or removed. If the information isn’t accurate, it shouldn’t be there.

When going through your reports pay attention to dates, in particular with payday loan entries.

The Financial Ombudsman reviewed this sector of the lending market in 2014, publishing the findings in the Payday Lending Report. Damage to credit reports accounted for 24% of complaints; the fourth highest type of complaint the ombudsman received. Not all complaints were able to be upheld. The general consensus is consumers aren’t fully aware of how personal credit files work.

So here’s what should happen before a default goes onto your credit file:

“The lender must have notified you of their intention to register a default against you at least 28 days before doing

so, in order to give you time to make an acceptable payment or reach an agreement with them on an arrangement.”

The exception to that is when there’s “evidence of fraud” or “The account is or has been included in a bankruptcy, CCJ, Individual Voluntary Arrangement (IVA) or similar.”

If a negative entry is reported on your credit reports and you can prove that you were not given 28-days notice of the intention to register a default, you may be able to challenge the entry with the credit reference agency.

…And that’s why you should keep your letters. So you can check the dates. Source: Principles for the Reporting of Arrears, Arrangements and Defaults at Credit Reference Agencies

Making Sense of Your Credit Report

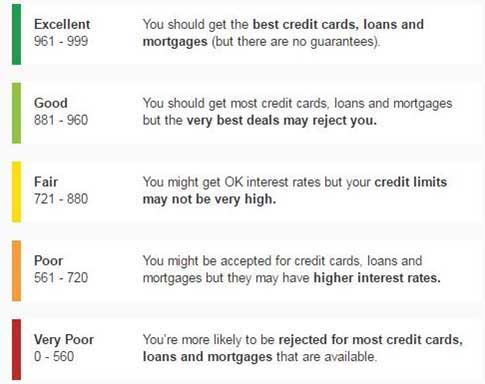

When you get your credit reports, there’s a score assigned to it. If this is your first time checking it, or perhaps you didn’t know that it’s not what lenders use when making a decision, you’ll likely ask yourself – what is a good credit score?

To answer that, both Experian and Equifax use different scoring systems. CallCredit scores don’t matter (yet anyway). The Experian credit score ranges from 0 – 999 and the Equifax credit scores range from 0 – 600. Equifax credit scores considered to be good, range from 420 – 466. Experian credit scores considered to be good, range from 881 – 960. ClearScore.com reports 76% of UK lenders use

Experian, and 54% use Equifax, therefore, it makes sense to focus more on improving your Experian credit score.

Or so you’d think…

The Money Team of MoneySavingExpert.com come up with a great idea, followed through on it and came up with this invaluable dataset, listing detailed information tables showing you what companies use Experian, Equifax, and CallCredit.

It’s a great reference point for you to use before you apply for finance. With it, you’ll can check your own data before you allow a lender to hard check your credit report.

Experian is the clear front runner for financial products, whereas for mobiles, broadband, store cards and utilities companies, Equifax is used more frequently by companies providing those products and services.

There’s only a handful of firms use CallCredit exclusively, which is why it’s were near a waste of your time and energy working to boost your CallCredit score. The majority of businesses use CallCredit alongside either Experian, or Equifax and in some cases, both. This suggests that CallCredit is used as a secondary check by lenders, therefore, your efforts will be better served by focusing on Experian, then Equifax and lastly CallCredit.

Source: Experian.co.uk

Even Great Credit Scores Can Go Against You

A few of the big-name lenders use your credit report to uncover how you manage your finances. If your records show your credit cards are paid monthly in full to benefit yourself by avoiding interest charges, they can deny your application to benefit themselves. Credit firms aren’t obligated to give you finance. If they know you aren’t going help their profit margins, they’re doing nothing wrong by rejecting you. That’s the world we live in. If you won’t pay, they’ll find a way take it away.

You Can Ask for a Quotation Search When Applying for Credit to Minimise Hard Checks on Your Credit Report

It’s easy to make an application to obtain a quote for anything. Just pop your details in online, fill out a form, or listen to a company rep blabber jargon down the phone until you say “yes” and agree to them hitting your credit files up with a hard search.

Protect your credit report at all costs. Do that by asking for a quotation search first based on your personal information and circumstances, this results in a soft check and won’t affect your credit rating.

Soft checks don’t retain the history of the search on your files. Hard checks do and that’s why you shouldn’t let more than two hard credit checks on your name happen within a year. If you’re rejected for credit, leave it six months before you make another application for finance.

Records of a hard pull on your credit report are retained and shown to lenders for 12 months. On that note, if you’re intending to apply for a mortgage, or re-mortgage, it’s advisable not to apply for any type of credit in the six months before you apply for a mortgage product to help improve your chances of obtaining finance. For that matter, any large line of credit you’re planning on applying for, halt applying months before you go for the big one.

The other thing to consider when planning for a credit application for a large line of credit is what you have available already. SimplyFinance.co.uk offers a free debt to income calculator. Run your figures through that and if you get a score of 1 or above, you’re tapped out. When that happens, you’re a risk to lenders – not to mention yourself. If that’s the case, you may be able to release equity from your home by re-mortgaging.

Related: How re-mortgaging works | Bad credit re-mortgages

Bad credit is not the same as not being able to obtain credit

The only way you won’t be able to obtain credit is if your details are logged in the National Hunters Database or CIFAS. A bad credit score just means you need to approach the sub-prime market – A marketplace where lenders specialise in loans, adverse credit mortgages and providing financial products to those who have made poor money decisions in the past. The only catch is they up the interest rate they charge, or the deposit amount to cover the higher level of risk you’re asking them to take on.

You can still get all types of credit with a poor financial background. Even bad credit interest only mortgages are accessible, with the right approach.

Every Company/Service Provider is a Lender – Use Them!

Since any company with access to the Credit Referencing Agencies can register details on your credit report, you can use that to your advantage. Take for example a phone contract. A credit check will be run and you’ll be notified of it at the time you apply to take out the contract. Before you do that, know that they’re likely to accept a guarantor so have someone lined up before applying.

For small services like a 12-month contract, the only purpose of the credit check is to settle any worries that you won’t see the contract through, fail to pay and in the case of mobile contracts – keep the phone, leaving them at a loss.

Make it less of a risk for them by not asking for credit on an Apple iPhone 7 Plus at fifty-quid a month. Accept you’re not the not the ideal customer and be honest with the sales rep. Tell him or her that your credit is tanked, that you’re working to improve your credit reports, have a guarantor and want the cheapest monthly contract phone on the minimum contract length. You won’t be the first to be upfront about this. Only ask for the least amount of credit and you’re more likely to be accepted. Do what you can to remove financial risks by upping the security of you paying.

YesMobilePhone.co.uk discusses getting a phone contract with bad credit and if you look at the process, you’ll see it’s all about compromise. You can do that with any service provider. Even your home phone line rental can be paid for upfront. Perhaps pay for six month in advance, and then roll onto the monthly payment plan later, perhaps even paying for your service six months in advance.

Payday Loans can kill any chance of getting a mortgage

So the doomsayers say anyway. It depends on the mortgage broker or lender you apply for a mortgage with. High street banks are likely to write you off because you’re viewed as cash-strapped poor and incapable of managing your personal finances.

That may hold true for big name lenders, but for independent mortgage brokers with the time to listen to you, things aren’t as gloomy. Records are on your credit file for six years, so if you’ve been in a financial emergency and had to use a payday loan, you’ll need an empathetic mortgage broker in your corner. The reason is because these loans raise a red flag with lenders.

What we mean by an empathetic mortgage broker is instead of writing you off; they’ll instead inquire about the reasons for the emergency loan. Provided it’s a justifiable emergency you had, he or she can convey your reasons to mortgage underwriters who are the people to make the final lending decision.

Mortgage Brokers have a working relationship with the financial decision makers so that’s the person you want to be speaking too. Not the sales person of the high street bank, who’s real job is a glorified data entry clerk, doing their job with judgement and leaving the decision making to the computer.

The Credit System is Not Comparison Compatible

Every other purchase you make, comparison shopping is great. Finance though, try to compare the market and you’ll wind up snookered. Every check affects your credit score, unless you take the quotation approach to avoid hard checks. The more hits there are, the more desperate you look. With every hard check done by lenders, you’re being morally judged on your ability to handle money. The more lenders you’ve asked for some cash, the worse risk you’re assumed to be.

Despite the system working against you, you can turn the anchors and start gaming the system by playing the credit game – being careful not to become too obviously good at avoiding charges. Banks don’t like that. That’s why BarclayCard, Capital One, GE Money, MBNA and likely more, tell each other you’re playing them by reporting to credit reference agencies, how much you pay each month.

The Best Thing You Can Do is Make Yourself More Attractive

What’s attraction got to do with your money? For finance, it’s not you, it’s your details that need to be attractive. Think of it as something like an online dating profile. It’s easy to upload a picture of a model to a dating site and make the claim that it’s representative of you. Morally wrong, but the principle applies to your credit too. If you appear attractable on screen, or paper, you’re more likely to be considered as investable and you do that by improving your credit-worthiness. That’s what attractable means to bankers.

On a Final Note…

One last piece of crucial advice: Never pay anyone else to fix your credit rating for you. It’s money down the drain. Instead, get proactive with good money management.

Resources that can help you get back on track:

- Money Aware (part of the Step Change Debt Charity)

- Pay Plan

- Debt Camel

- National Debt Line

A good start is having knowledge about good debt versus bad debt. Bad debt is when you spend what you don’t have, offering no return value over the medium to long-term.

At 1st UK Mortgage, we’re in the business of good debt. We help our customers get mortgages with bad credit. That’s good debt because in the long-term, it becomes a capital asset, and one you can use to ensure you get favourable credit terms in the future.

Further Reading:

- What We Do and Why

- How We Help Secure Mortgages for the Self-Employed

- A Guide To Notice Of Corrections

Understanding Credit Repair in the UK

A good credit score is essential for various financial transactions in the UK, from buying a home to securing loans at favourable rates. However, if you’ve found yourself with a less-than-desirable score, all hope is not lost. Credit repair UK services and strategies can guide you on how to build up your credit rating, even if your current score has seen better days.

A Dive into Credit Score Metrics

The UK has multiple credit score agencies, each with its scale. Let’s understand the major ones:

- Experian Score Range UK: Experian is one of the UK’s major credit reference agencies. Their score range is 0-999, with anything above 961 considered excellent.

- Clearscore Score Bands UK: Clearscore utilises Equifax data and ranks scores between 0 and 700. The higher you score within these clearscore bands, the better your financial health is perceived.

- Equifax Score Range UK: Ranging from 0 to 700, a score of 420 or above is considered good.

- Call Credit Score Range: This agency scores between 0 to 710, with higher numbers indicating better creditworthiness.

It’s essential to monitor your score from these agencies, and for that, you might consider the best credit report site UK options, such as Clearscore, Experian, or Noddle credit rating services.

Steps for Repairing Credit

- Understand Your Score: Start with a free credit report UK no sign up required to get an idea of where you stand. Recognise the factors causing your score to dip, such as late payments, outstanding debts, or a high credit utilisation ratio.

- Fix Errors on Your Report: It’s not uncommon for credit files UK to contain errors. Regularly check and rectify mistakes to improve your credit rating quickly. For inaccuracies, learn how to update your credit report quickly through respective agencies.

- Manage Debts: If you’re in a challenging situation like having a debt with Quick Quid, consider the debt camel Quick Quid solutions that offer advice on managing and repaying such payday loans. Also, note the impact of choices like a partial settlement on your credit file; while “partially settled” may not boost your score significantly, “settled” is viewed more favourably.

- Pay Bills on Time: Your repayment history plays a significant role in credit calculations. Ensure you’re consistent with payments, be it for utility bills, credit cards, or loans.

- Reduce Outstanding Debts: Minimising your credit card balances and paying off outstanding loans can help in repairing credit score.

- Credit Building Strategies: If you’re wondering how to raise your credit score UK style, consider using a credit card responsibly. Regular, full payments can show lenders you’re reliable, thus repairing credit score over time.

- Avoid Multiple Credit Applications: Each credit check can slightly lower your score. Only apply when necessary.

- CIFAS Protective Registration: If you’ve been a fraud victim, the CIFAS protective registration can shield you. However, it can also make obtaining credit slightly more challenging, so weigh the pros and cons.

- Stay Informed: Know the factors that can hurt your score. For instance, did you know you can be denied a job because of bad credit in the UK in some sectors? Or that having a 999 credit score but being refused a loan is possible due to other factors like unstable income?

Credit Repair Companies UK

Several credit repair companies UK-wide offer to improve your score for a fee. While some might be legitimate, be cautious. No company can erase bad credit overnight. If their promises sound too good to be true, they probably are. Instead of relying solely on a credit repair company UK, consider educating yourself and taking proactive steps.

Quick Fixes: Fact or Fiction?

Ads proclaiming “quickcreditscore” boosts or ways to “erase bad credit overnight” are tempting. However, genuine credit score repair is a steady process. It’s about building financial habits and rectifying past mistakes.

Things to Remember

- Settled vs Partially Settled: While settling an account is beneficial, remember that a settled default on a credit report still shows you had past struggles, even if they’re resolved now.

- Exclusivity of Lenders: Each lender evaluates differently. Just because one rejected doesn’t mean all will. Some might even focus on specific reports, like lenders who use Experian only in the UK.

- Long-Term Strategy: Improving your credit score UK-focused requires patience. How long does it take to improve credit score? It varies, but consistent efforts over months will yield results.

Tying it to Other Areas of Life

Improving credit score and financial health can positively impact other areas. For instance, if you’re looking into property built with autoclaved aerated concrete, a good credit score can help you secure a favourable mortgage. Learn more about autoclaved aerated concrete here.

Credit Repair Uk

With credit repair uk you could look to get a loan or mortgage for a home purchase. If you study Sunderland buy house uk cheap you might be able to get a bargain you can get with savings plus an unsecured personal loan.

Building Credit for the Future

Building a good credit history doesn’t stop once you’ve achieved a desirable score. It’s a continuous journey. Here are steps to ensure you remain on the right path:

- Diversify Credit: Having a mix of credit types can enhance your score, but only if managed well.

- Limit Unnecessary Credit: While it’s essential to have credit to build a score, unnecessary debts can backfire.

- Stay Updated: With the ever-evolving financial landscape, keeping abreast with the latest in credit scoring and financial management is crucial. Whether it’s understanding the clearscore range or the implications of having a CIFAS protective registration, being informed will always be your best asset.

Repairing credit in the UK is a marathon, not a sprint. It’s about understanding the system, acknowledging where you might have gone wrong, and making concerted efforts to fix those areas. It’s equally about patience, persistence, and developing sound financial habits that stand you in good stead for the future. Whether you’re trying to figure out how to build your credit rating from scratch or repair a credit score that’s taken a hit, every positive step taken is a step closer to your goal. Remember, the journey to a healthier financial future is always worth it.