Pensioner Mortgages For 60, 65, 70, Or 80-Year-Olds

A growing number of pensioners are looking for a mortgage over 60 because they have an existing mortgage they have been unable to pay during their working life.

1st UK Money specialises in helping these homeowners secure their home for their retirement with affordable monthly payments, easily serviceable from pension income.

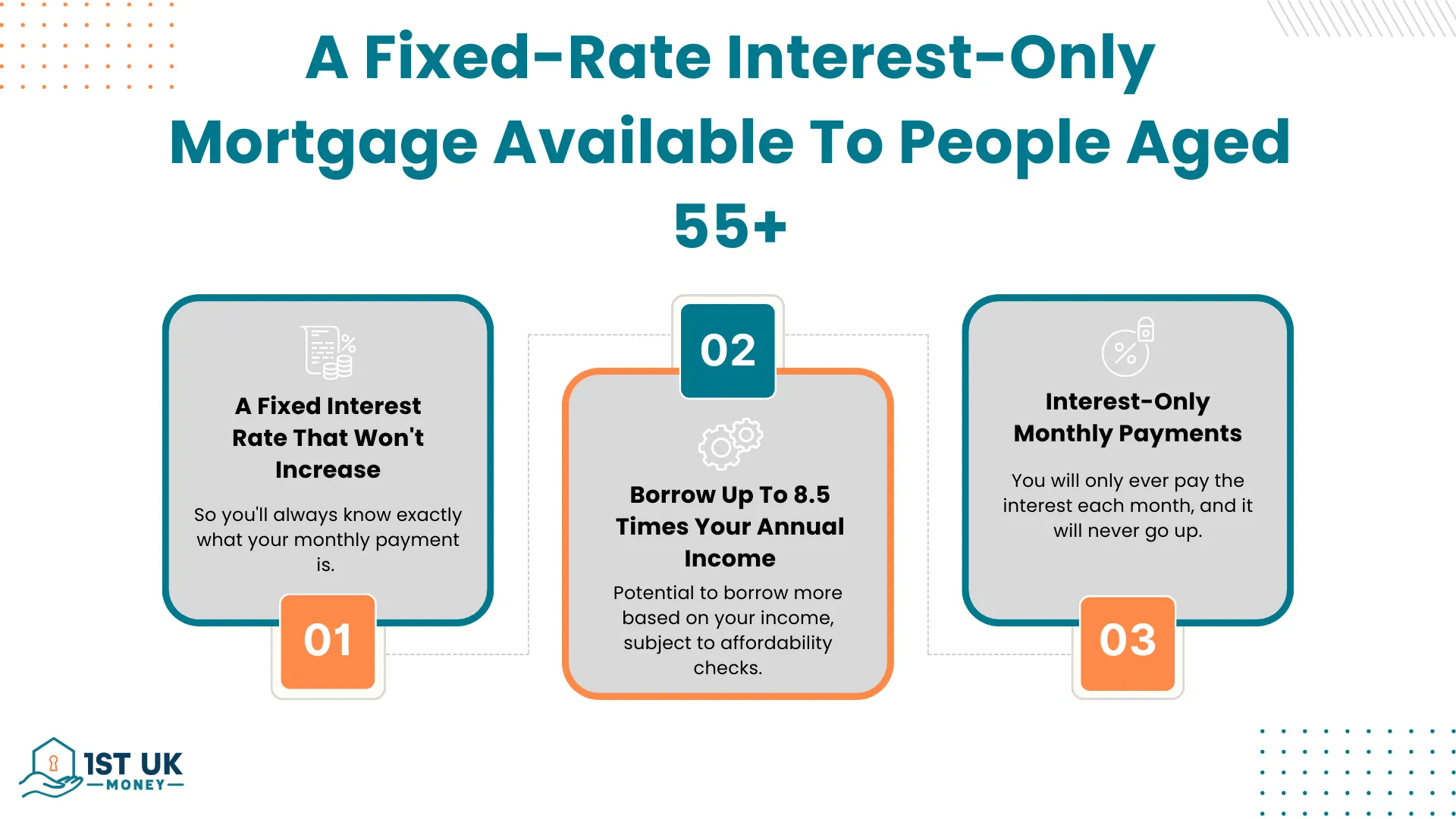

These mortgages are called RIO or retirement interest only mortgages.

1st UK Money has two lenders that do not feature on the comparison websites that specialise in mortgages for older borrowers, with interest rates and terms similar to mortgages for younger people.

Lender 1: Up to 55% loan to value

- Free no obligation home valuation

- 4.89% Fixed for life

- Interest only payments

- Up to two penalty free payment holidays a year

- No lender, broker, or advisor fees

- All applicants must be over 55 years old at the time of application

- Full open market value applied to flats and other leasehold properties

- No upper age limit

Lender 2: Up to 65% loan to value

- 5.12% Fixed for life

- Free no obligation home valuation

- Interest only payments

- Up to two penalty free payment holidays a year

- No lender, broker, or advisor fees with this lender

- All applicants must be over 55 years old at the time of application

- No upper age limit restrictions

Access Rates Similar To Those Offered By Prime Banks To Younger People. Discover Lenders That Understand The Needs Of Senior Borrowers

Mortgages For Over 60’s, 70’s and 80’s With The Following Benefits:

- Interest rates similar to conventional prime mortgage lenders

- Flexible approach to loan-to-value

- A small valuation fee

- Use your own solicitor

- Lenders not available on price comparison websites

- Make capital repayments or just pay interest

Pensioner Mortgages. Compare Today’s Deals With No-Obligation – Quick Quote Form

Pensioner Mortgages FAQ’s

Can pensioners get a mortgage?

Yes, they can, and the good news is in 2024, the rates and terms can be as good as for younger people. The reality is that pensioner income is unlikely ever to change. Pensioners get good deals because they are the lowest risk.

Mortgages for pensioners are strictly regulated, so you are protected from taking on an unsuitable product. The income of all owners is considered when you look at mortgages for pensioners, so even if one person dies, you can be sure that the remaining person will be OK.

A mortgage for pensioners, a good deal?

Very likely, yes, as the rates are very low and can be fixed for the life of the mortgage. Some of the best deals are from the big lenders – products called Nationwide mortgages for over 70s, Halifax mortgage for over 70s, Nationwide mortgages for over 60s and Saga mortgages for over 60s.

Mortgages for retirees are likely interest only with some options with no monthly payments at all.

Loans for the over 75’s?

A couple of lenders from 1st UK Money see the over 75’s are a great sweet spot for risk where the borrower can get a great deal, and the lender is subject to minimal downside.

Mortgages In Retirement

Most mortgages for pensioners over 70 will be restricted to repayment only, so interest-only mortgages for over 65’s will be extremely difficult to find.

What pensioner mortgages lenders will assess is your ability to repay over the terms you are asking for. The vast majority will refuse if you’re over 60 years of age and asking for a 25-year fixed-term mortgage.

Most lenders have an upper age limit for applications that they’ll consider. There are lenders currently increasing the upper age limits that they accept borrowers to be at the age of maturity (when the mortgage is fully paid).

Nationwide are among the first high street lender to raise its upper age limit to 85 years old at the age of the mortgage maturity.

Halifax pensioner mortgages will only extend to the age of 80 years old, and retirement mortgages from Barclays will only extend to the age of 70 years old.

This may increase as more lenders understand that more people are still active in their senior years. Some are still working beyond state retirement age, and many are still earning into retirement through BTL investments, pensions, savings, ISAs, and/or they have a second property for which some equity can be released through a home equity loan.

About Interest Only Retirement Mortgages

The interest-only pensioner mortgages available years ago were linked to endowment policies. Many of those policies didn’t perform as expected, leaving older borrowers unable to repay the capital on the home loan. If you find yourself in this situation, see Dealing with an Endowment Shortfall.

This year has seen a couple of banks go head to head in a criteria war, with Santander leading the way to let older borrowers borrow through an interest-only mortgage for over 65’s by raising their upper age cap for this type of mortgage to 70 years old, the main reason being that many people are still working to the age of 70.

Barclays will now accept interest-only mortgages for over 65s, up to the age of 70 at maturity. Some mortgages for people over 50 are also available.

Nationwide Mortgages For Over 60 & 70s

Nationwide mortgages now extend their residential mortgage to older people with an age of maturity of 85 years old. So at the age of 60, you could still take out a residential mortgage over a 25-year term.

Naturally, that’s subject to you being able to meet all other lending criteria, such as affordability. Other key differences exist between the nationwide offer and what you may need from other lenders.

However, Nationwide also has a buy-to-let specialist lender branch – The Mortgage Works. Nationwide’s The Mortgage Works will accept Buy to Let applicants up to the age of 70 years old, with the repayment terms extending from 5 years up to 35-year terms.

Therefore, if you’re looking for mortgages for pensioners, they pay off at 105. The only current option is not in the residential mortgage sector but in the commercial mortgage market through the Mortgage Works.

Should you be a landlord with equity in other properties, that could be an option to consider should you need to raise capital for any reason. The maximum LTV is 75% for this type of product. The more equity you have, the more favourable your application is likely to be viewed due to the lower risk level.

Many people are pleased to see that nationwide mortgages for over 60s are now available. The 1st UK Money team is happy to include Nationwide older person mortgage products in any research we do on your behalf.

That being said, a report by the Telegraph listed six specialist lenders that don’t apply upper-age limits to residential mortgage applicants.

Those include:

- National Counties Building Society over 65 mortgages

- Harpenden Building Society interest only mortgages for the over 70s

- Bath BS mortgage for over 60

- Metro Bank mortgages over 65

- Dudley Building Society mortgages for pensioners over 60

- The Cambridge Building Society with a mortgage maximum age 85

- Halifax mortgage for over 70s

Should you be looking for a residential mortgage, such as nationwide mortgages for over 70s, and you don’t intend on entering the commercial market, those lenders may be worth considering.

To get mortgage advice on which lender is best for which type of mortgage product, it would be best to work with a mortgage broker, as they’ll be aware of each lender’s criteria and help you find the best deal.

Some people get in trouble with credit cards, and after five years of struggling, a retirement interest-only mortgage can be a great option to pay them off. Also, you pay the interest each month, so the interest does not pile up.

Interest Only Mortgages For All Ages Require A Thorough Repayment Strategy

To be approved for interest only mortgages for over 60s, every lender will ask you to provide a repayment plan. Speculation doesn’t count for this.

You can’t approach a mortgage for pensioners lender asking for an interest-only mortgage basing your reasoning for affordability being that you fully intend to downsize when your kids fly the nest.

That would mean speculating on future house prices; as you’ll know, those can flat line. Lenders will need to see evidence that you have a future-proof repayment plan or as close to sure that your investment plans will materialise with enough capital to repay the mortgage at the end of the term.

What you need are repayment vehicles such as:

- Stocks and Shares

- Unit Trusts

- Investment Bonds

- Pensions

- Savings, including regular savings plans

- Other properties and assets you hold

You won’t need all of those listed, but enough of any to prove to lenders that you have a sound investment plan that will pay enough to repay the loan. Different lenders have different repayment vehicles they’ll accept.

As an example, this document from Scottish Widows shows what they’d consider acceptable for a repayment plan and the evidence you’d need to present them with to prove your ability to repay the capital of the loan. Find out more about mortgages for 65 and over here.

It’s important to note that when you have an interest-only mortgage, lenders can ask you at any time to review and provide evidence that your repayment plan is still on track. If they feel it’s not going to be sufficient to cover the loan amount, they can ask you to change your mortgage from interest-only to another type of mortgage product that will repay the capital plus interest.

Are you a pensioner on a low income?

If you are like many asset-rich and cash-poor pensioners, a good option for you could be equity release.

With rates in many cases very close to conventional repayment mortgages, you can release equity tied up in your home as a lump sum or an agreed flexible drawdown. Put simply; you can use your home to provide additional monthly income.

The team at 1st UK Money are here to answer any questions or concerns you might have regarding pensioner mortgages, so please feel free to contact us today.

Interest only mortgages for over 65 year olds

Because mortgage for pensioners interest rates are so low, it is even possible for someone over 65 to sell their existing home a buy a new home.

Some interest-only mortgages for over 65 year olds have monthly payments lower than that property’s council tax bill.

As the mortgages are interest only and the principal is never paid down, the payments are very low. If you are smart enough to pick a property in a good area with house price growth, your house price appreciation could easily swamp the small monthly payment.

And it’s not just people over 65. A mortgage over 70 UK is quite possible as retirement income is very stable, and lenders have a high degree of confidence in the UK residential property market.

Halifax mortgages for over 70s and mortgages for over 80s

The Halifax Building Society has some very low-cost interest only mortgages for pensioners options. Interest rates are close to those offered to much younger people.

Nationwide mortgage for over 70s

You don’t need to be a Nationwide account holder to get a Nationwide mortgage for over 70s, and coupled with the trust that people have in the Nationwide brand, these mortgages, or indeed remortgages from the Nationwide can be ideal for pensioners with stable personal income.

Nationwide mortgages for over 60s

There is an even better offering from the nationwide for people over 60.

Interest only mortgages for over 65s

A retirement interest only mortgage is very easy for the over 65s to qualify for as long as they have ample funds for the monthly interest payments.

A comprehensive affordability assessment and independent advice will be needed to assess your workplace pension, pension statement and state benefits. Your pension income is key for Rio mortgages.

An interest only retirement mortgage can help you pay your outstanding mortgage accounts that have a maximum age.

Even if you still have a substantial balance on your current interest only mortgage a Rio mortgage without maximum age limits at a low-interest rate can be much better than other equity release options before you die or move into long term care.

Also, retirement interest only mortgages can be ideal for helping a family member or loved one to buy their first home or to avoid downsizing when you may prefer to keep a bigger stake in the property market in later life.

If your current home has had all the issues fixed, an independent mortgage broker may suggest you don’t take the risk of downsizing.

Building societies’ standard interest only mortgages have mortgage payments similar to the Family Building Society retirement mortgage. Look for issues like minimum property value, early repayment charge, minimum loan amounts, minimum income, and main residence requirements.

You will need to get all your financial information together before deciding on the mortgage type and maximum loan you can get based on credit crunch-modelled monthly repayments.

Many people prefer a standard interest-only mortgage that they understand, as the principal never rises with this type of mortgage. With lifetime mortgages, the amount you owe grows over time, and you end up paying interest on the interest – compound interest.

A mortgage for the over 70s in 2024

As there is a much bigger emphasis on IHT, the demand for mortgage for the over 70s is likely to be strong in 2024.

Pensioner mortgages can be a great option for UK residents looking to purchase or refinance their home

With pensioner mortgages, retirees can access the equity in their homes and enjoy lower interest rates than traditional mortgages.

Pensioner mortgages also provide flexibility regarding repayment terms, allowing retirees to tailor their loan to their specific needs. With a pensioner mortgage, retirees can enjoy the security of owning their own home without worrying about making payments they cannot afford.

Are pensioner mortgages a good deal? The answer is YES! 1st UK has some excellent products for pensioners or more mature borrowers. Including interest-only mortgages for over 65-year-olds.

How Can Pensioners Access Such Low Rates – A Mortgage Over 70?

A pensioner is considered very low risk because of the stability of a pensioner’s monthly income to a lender. This is coupled with the relative stability of the UK residential property market.

New Santander Mortgages For Over 70s for 2024

Santander has a new range of mortgages coming out in early 2024 according to a recent press release.

What If I Don’t Want To Make A Monthly Payment – Mortgages For Older People Options?

Some excellent deals are available if you want to free up money from your home.

Mortgages For Pensioners FAQs

Can you get a mortgage if you are a pensioner?

Yes, many mainstream lenders offer pensioner mortgages, and the best mortgages for over 60s have rates very similar to those offered to younger people. Mortgages for the over 70s can be great for estate planning.

Can you get a mortgage at 70 years of age?

Yes, the Halifax mortgage for over 70s is a retirement interest only fixed rate product with a free valuation and no lender fees.

What is a retirement mortgage?

It is a mortgage for retired people with very similar terms to mortgages for younger people. You still have to prove income, and the rates will be higher if you have poor credit.

Can I get a 100% mortgage at 60?

Yes, if you have another property or additional security to pledge as collateral. Also, some mortgages have a part mortgage, part unsecured personal loan.

What mortgages can a pensioner get?

They can get mortgages at low rates, very similar to younger people, and in a very similar way, pensioners have to prove personal income for the rest of their life.

Is it easy for a pensioner to get a mortgage?

Yes, as long as the retired person has sufficient income to support the monthly interest payments. You can refinance your existing home or get a new pensioner mortgage to buy a new home.

Who offers the best mortgages for over 75s?

Lloyds Bank has some of the lowest rate mortgages for over 75s, with no lender fees and a free home valuation new for 2024. A mortgage for older people is going to be a big conversation topic in 2024.

Do banks in the UK give mortgages to pensioners?

Many banks in the UK are now offering mortgages to pensioners, including over 70 mortgages. Pensioners can take advantage of competitive rates and flexible repayment options, depending on their loan type.

Potential borrowers need to consider their circumstances to ensure they are getting the right mortgage.

What is the maximum age for a Santander mortgage in the UK?

The maximum age for a Santander mortgage in the UK is 85 at the end of the term. This means that if you are already over 75, you may still be able to apply as long as you can prove that you will be able to keep up with your mortgage payments until you reach 85.

Can a pensioner get a mortgage?

Yes, pensioners with income can get a mortgage. Interest only mortgages for over 70s were very common even in 2021, as were mortgages up to age 85.

Many people have contacted us asking can a pensioner get a mortgage? Many lenders have upper age limits. For those over 65, getting a mortgage is likely to mean taking it out over a shorter term such as 15-years or a 10-year deal.

With a shorter repayment time, the monthly premiums rise, leaving many in their golden years struggling to raise finance to buy a home or refinance on an existing home loan.

The exception is the Lifetime Mortgage option, which can affect what you leave to your loved ones as an inheritance since the lender will want to sell the property to repay the loan. It’s a popular type of equity release, but that doesn’t mean it is a suitable choice for everyone. A mortgage for 70 year old can have interest rates very similar to rates offered to younger people.

In many cases, the best option is to use a traditional mortgage product rather than an equity release.

A Mortgage For Older Person or loans for over 80s?

You might want to pay your existing mortgage early if your mortgage term is about to expire. Existing customers can still have their mortgage options cut off – getting the right advice about the term ending at a certain age is wise.

New Nationwide Mortgages For Over 70s for 2024

The new nationwide mortgages for over 70s predicted for 2024, have much lower rates, including for the purchase of cheap houses for sale in Kent and Cambridgeshire. Another popular product is likely to be Halifax mortgages for over 60s.