Secured Debt Consolidation Loans For Bad Credit UK Direct Lender

There is a rush to lend as interest rates are declining, and lenders are even gambling on lower rates. UK wages are often strong, and unemployment is very low.

1st UK has a new direct lender, Fund Fortress, for secured debt consolidation loans, not featured on the comparison sites with funds from Hong Kong investors to lend.

If you want to borrow money to improve your home for a loft conversion or extension, you can access the assumed home valuation when the works have been completed.

Here Are Some Of The Key Features On Offer:

- Ideal for debt consolidation

- Overall loan-to-value up to 90%

- No lender, broker or adviser fees

- Fixed for life rate of 6.76% APR

- No upper or lower age limit

- Up to one penalty-free payment holiday a year

- Free no obligation home valuation

- No penalty for flats or other leasehold properties

- Open minded view on affordability and credit score

- No early repayment charges/redemption penalties

Enter Some Details In Our Quick & Simple Form. Soft-Search Technology

Why should I consolidate my debts in 2026?

Simplicity

A secured debt consolidation loan will be debited from your bank account once a month, and can be debited just after your payday. This makes your life and budgeting very simple.

If you had a personal loan, a store card, two credit cards, and a consumer credit agreement for a sofa, all coming out at different times of the month, your affairs could be messy.

These circumstances increase the likelihood of missed or late payments, which can damage your credit score. Not everyone is good at budgeting, so a secured loan enforces discipline.

Dealing with debt and paying it down for good

Having credit cards and being trapped into paying the minimum each month can be challenging to escape. Paying down cards a bit, then running them back up throughout the month, makes your debts resemble an interest-only loan.

This issue worsens because many credit and store cards have high interest rates.

Paying off your credit cards and store cards with a debt consolidation secured loan will force you to not only service the debt but also pay down the principal each month, so eventually, the debt will go away, which is what you should want.

Being in debt for many years could eventually impact your standard of life in retirement!

What are the drawbacks of secured debt consolidation loans?

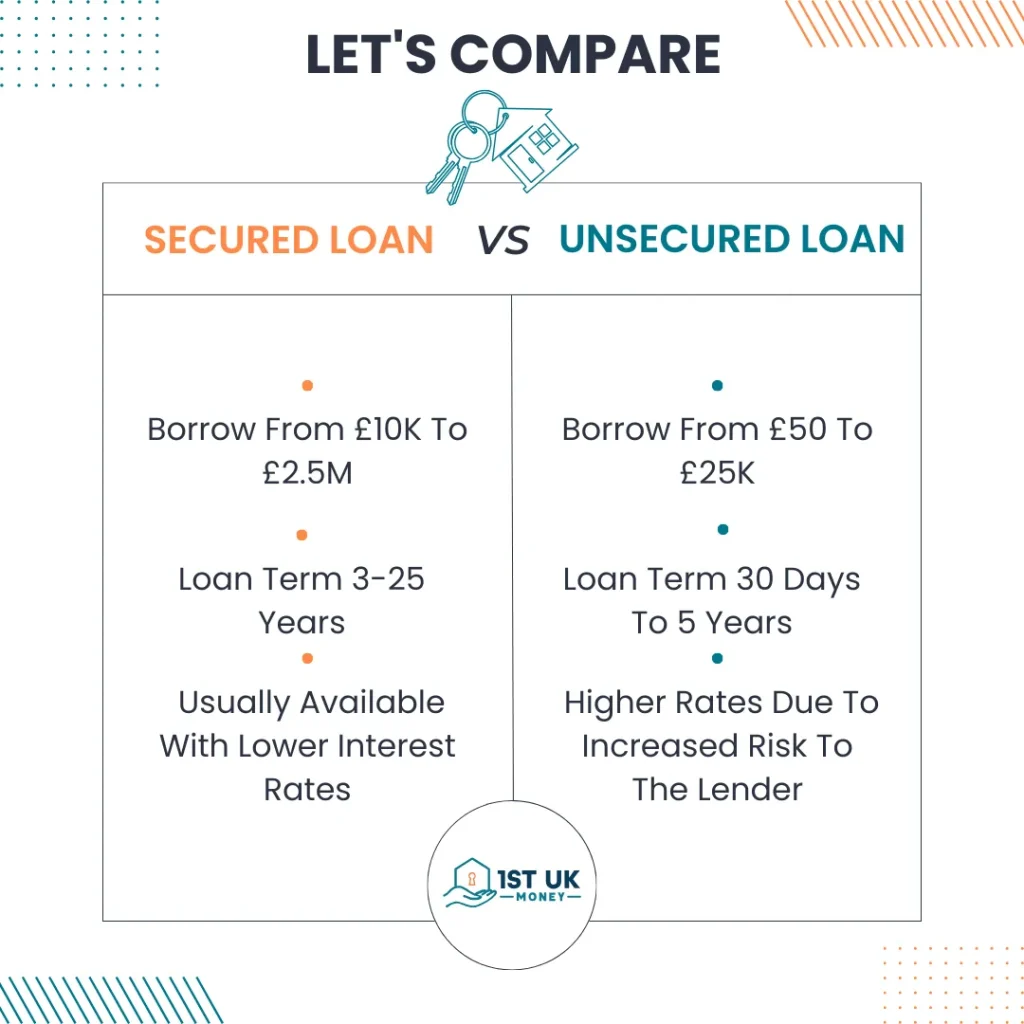

Secured debt consolidation loans offer advantages, including lower interest rates and the potential to consolidate multiple debts into a single, manageable payment.

However, they also come with several drawbacks that borrowers should carefully consider:

- Risk of Asset Loss: Secured loans typically require collateral, often in the form of a home or other valuable asset. If you fail to make payments, you risk losing your property through repossession, which can be a significant downside.

- Higher Total Interest Costs: Although secured loans typically offer lower interest rates than unsecured options, their longer loan terms can result in higher total interest costs over time.

- Limited Eligibility: Secured loans are not accessible to everyone. They require eligible collateral and a good credit history, which can exclude individuals with poor credit or those without valuable assets.

- Long-Term Commitment: Secured loans’ extended repayment periods mean a longer commitment, which may not be suitable for all borrowers.

- Potential for Over-Borrowing: Access to significant amounts of money through a secured loan may tempt borrowers to take on more debt than they can handle, leading to financial stress.

- Impact on Credit Score: Making timely payments can positively affect your credit score, while missed payments or defaults can harm it and, in the worst case, lead to asset repossession.

- Difficulty in Refinancing: Refinancing a secured debt consolidation loan can be challenging, as it often requires finding another valuable asset to use as collateral.

If you have too much debt, you may want to consider a Step Change.

Can you get a secured loan for debt consolidation?

Yes, it’s easy to get a secured loan for debt consolidation as long as you have the income to support it.

Is a secured loan a good idea for debt consolidation – to make debt easier?

It can be an excellent idea as it can save you money each month.

Do debt consolidation loans hurt your credit?

No, in many cases, quite the opposite, as they help you pay debt down.

How hard is it to get a debt consolidation loan?

Getting a debt consolidation loan is easy if you can prove your income to the lender at the right level.

Benefits of Debt Consolidation Loans – how much interest?

Debt consolidation loans offer several benefits:

- Combining existing debts into a single account can provide a clearer view of your financial obligations.

- A single loan with one monthly repayment can be easier to manage.

- Potentially lower interest rates compared to other borrowing.

- Fixed monthly payments can help with budgeting.

- Improved financial management can positively impact your credit score over time.

- A secured loan for bad credit with a joint application could be key to fixing your financial problems.