Best Equity Release Companies – Top Providers List For 2025

Do you want to find the right equity release provider for your needs? With so many companies offering tailor-made plans and rates, it can be difficult to determine which is the best fit.

Accessing the equity in your home can offer an enhanced retirement lifestyle and a needed financial buffer for unexpected expenses. You can take the money you release as a lump sum, in several smaller amounts or as a combination.

However, you can make a well-informed decision with research and careful consideration of all factors. Here are some tips to help you research the best equity release companies in the UK.

Low Rate Equity Release Plans For 2025 – Free Valuation

- Remove tax-free cash from your home with age flexibility

- 4.37% APR for equity release with our selected provider

- Zero lender fees and hidden extras

- Free property valuation

- No product fees with our equity release companies

- Choice to get a mortgage to purchase another home

- Make a monthly payment if you so choose

- Help out a member of your family in buying their own home with a small mortgage

- Retain 100% ownership of your home while continuing to live there

How much money can you release from your property?

You can access 65% of your home’s valuation. So, if your house is worth £340,000, you can borrow £221,000.

Looking For The Best Equity Release Companies? Release Tax-Free Cash. Get Your Quote Below

Key features of borrowing money in retirement:

- The initial loan can often be increased over time, subject to valuation and valuation fee

- The equity release cost can include legal fees and home valuation charges

- Some of the best plans involve regular interest payments and a fixed rate of interest

- The rates on equity release are slightly higher than on standard mortgages for younger people with provable income

- Also similar to standard interest only mortgages, equity release rates work by considering the risk to the lender and the loan to value

- With an equity release loan secured on your home, variable interest rates are less common, fixed rates are usually offered

- Due to regulation penalty free payments on the plan is common, but different lenders have different rules

- A good rule of thumb is to look at the monthly equivalent rate mer

- You should consider your means tested benefits

- The different equity release products have very different overall cost so you should always look for a better deal. You should also consider the solicitor’s fees and other factors like legal paperwork

- Without interest repayments, the interest accrues over time and the loan balance will increase

What You Need to Look for in an Equity Release Provider

Are you looking for an equity release provider? If so, finding one that meets your needs and complies with industry regulations is important.

Here are some key elements to consider when searching:

- Being part of the Equity Release Council (ERC) ensures the provider is reputable and offers competitive plans.

- Make sure they are regulated by the Financial Conduct Authority (FCA) and only charges market average fees and offers free initial advice.

- Look for a provider who guarantees no negative equity.

- Consider fixed or capped interest rates that fit within your budget.

- Ensure you have the right to remain on your property for life or move to another, should you choose, if it meets the requirements.

- Check for low early repayment charges, voluntary repayment options, market-related interest rates, low administration fees and flexible plans with no hidden costs.

- Customer satisfaction ratings offer insights into the experiences of other homeowners who have taken out equity release plans.

Are you aged 55 or over? If so, you have a unique opportunity to bring more financial stability and security to yourself and your family. Many people use equity release schemes to unlock the money in their properties. With over 300 plans available, there are competitive rates, high loan-to-value ratios and safeguards for the future.

Also, you can protect part of your estate by using inheritance protection, which ensures a percentage of your property’s value will be passed on.

Fill out the short form above and get a free, no-obligation quote today. Our online form is secure, simple and only takes a few minutes to complete. So make the most of this chance now and get the peace of mind that comes with having a reliable financial plan in place.

Benefits Of Our Services:

- Release equity from your home as a cash sum or via regular payments

- Exclusive rates and offerings from the top equity release providers

- Release money for repairs or home improvements like a new kitchen or bathroom.

- Help a family member purchase their first home.

- Pay off all your credit cards and loans and have zero monthly payments.

- Switch to a better lifestyle, change your car or have a well-deserved holiday.

- 100% independent, securing you quotes from the UK’s leading equity release companies.

Types of Equity Release Schemes: Lifetime Mortgages and Home Reversion Plans

Lifetime Mortgages are the most common form of equity release in the UK. These allow you to take out a mortgage secured on your home, which remains yours, and you can ring-fence some of the value of your property as an inheritance for your family.

Being on our equity release providers list for these products, companies often ensure that you’ll never have to pay back more than the value of your home.

Alternatively, Home Reversion Plans involve selling a portion of your home to a company in return for a lump sum or regular payments while retaining the right to live there rent-free. When addressing questions like “what is the best equity release company?” or exploring the “best equity release mortgages”, weighing the pros and cons of each plan type is critical.

The 1st UK team have extensively researched the equity release companies in the UK to provide you with an updated equity release providers UK list.

Here’s an overview of the two Equity Release types:

| Equity Release Scheme | Product Features | Suitable For |

|---|---|---|

| Lifetime Mortgage | No need to move out. Interest rolls up over time. There is an option to ring-fence inheritance. Varied interest rates can be fixed or capped. | Those looking to utilise the property value while living in their home. |

| Home Reversion Plan | Sell part or all your property in exchange for a lump sum or regular income, and live rent-free. | Those preferring certainty of funds over property ownership. |

A List Of Equity Release Providers (UK)

The equity release providers list below summarises the main insurance companies and retirement finance houses currently providing equity release and the general conditions required by each provider.

Just Retirement

Just Retirement provides three types of equity release products. Drawdown, Lumpsum Lite, and Lumpsum Plus. All plans have a minimum age requirement of 60 years of age.

The minimum you can borrow is £10,000, and the maximum is £600,000 for homeowners in England and £250,000 elsewhere in the UK, including Northern Ireland.

However, only the Drawdown option covers Northern Ireland. All three plans are available to homeowners in England, Scotland, and Wales, subject to a minimum property valuation of £70,000. It is often cited as one of the best equity release companies with a very approachable team of advisors.

Responsible Lending

Responsible Lending is a newer entrant to the UK equity release market after gaining regulatory approval in 2017. The company was headed by the prior Managing Director of the Just Retirement Group and Prudential before that.

The minimum age for Responsible Lending’s Equity Release products is 55 years of age. The lifetime mortgages offered are targeted towards those who feel trapped in the wrong mortgage product and those on interest-only mortgages due to end.

Retirement Plus

Retirement Plus is currently only catering to existing customers; however, they are approved by the Equity Release Council and may accept new customers in the future. They have a minimum age requirement of 65 years of age and specialise in home reversion plans, not lifetime mortgages.

The Retirement Plus Limited Group is the trading name responsible for administering home reversion plans through Milton Homes. If you’re interested in Home Reversion Plans for equity release, see further down our equity release providers list for the Bridgewater Group, which is the largest provider of this type of equity release finance.

Pure Retirement best equity release interest rates

Pure Retirement focuses entirely on equity release, providing finance from £10,000 up to a maximum of £100,000 to any homeowner over 55 years of age. Suppose the amount you take is below the maximum you can borrow. In that case, a cash reserve is available, letting you use drawdown to release a minimum of £2,000 at any time in the future without additional fees.

Hodge Lifetime lowest equity release rates

Hodge Lifetime caters exclusively to retirement finance and has four types of equity release products, each lifetime mortgages. The Flexible Lifetime Mortgage has variable repayment fees or fixed early repayment charges, a lump sum lifetime mortgage with variable early repayment charges, and indexed lifetime mortgages with fixed early repayment fees.

All products have a no negative equity guarantee and are exclusively available through select partners. Requirements for eligibility are a minimum age of 55 with an upper age limit of 85 years of age.

Your home must be mortgage-free, or the money released must be used to clear your mortgage balance. Properties must be freehold (house, maisonette, or flat); alternatively, if your property is a leasehold, there must be over 90 years left.

The minimum property valuation is £100,000, and properties must be in Scotland, England or Wales and built of standard construction that hasn’t been recently affected by flooding or structural issues.

The minimum you can borrow with Hodge is £20,000, or £15,000 using the Index-Linked Lifetime Mortgage. If using drawdown, the minimum transaction is £1,000. The maximum loan amounts range from 15% to 50% of your property valuation.

Aviva best equity release deal

Aviva provides two equity release products. The Lifestyle Lump Sum Max and the Aviva Flexible Plan. The lump-sum max lets you borrow a minimum of £15,000 as a tax-free lump sum, and the Flexible Plan is Aviva’s drawdown option, letting homeowners over the age of 55 release an initial lump sum of £10,000, leaving at least £5,000 in a cash reserve to use in the future.

The minimum age for each plan is 55, and the minimum property valuation is £75,000. Properties must be located in Scotland, England, or Wales and cannot have any recent issues with subsiding, structural damage, or flooding.

Aviva does consider equity release on leasehold properties, but there need to be at least 160 years remaining. There is also an option to voluntarily repay up to 10% of your loan amount each year after your first year. Although this is voluntary and not a requirement, it can help reduce the overall interest fees at the end of the loan term.

Retirement Bridge Group best drawdown equity release

The Retirement Bridge Group is the UK’s largest administrator of home reversion plans. Currently, there are dozens of home reversion companies in the UK. Still, most have their plans administered by the Retirement Bridge Group, the largest of which is Bridgewater Equity Release, which provides three types of home reversion plans.

Rent-free, fixed rent and an escalating rent plan let homeowners sell equity in their homes and keep some control over future finances for inheritance purposes. You could apply to over 60 home reversion companies or cut the process short by applying directly to the policy administrators.

Nationwide Building Society best equity release schemes

Nationwide is the only major lender to offer lifetime mortgage products. Most high street banks have tried and failed in the equity release market, causing all but Nationwide to exit the market and leave this type of lending to the specialist finance houses. Nationwide launched its latest lifetime mortgage in 2021 with some straightforward eligibility requirements.

Those being a minimum age of 55 to a maximum age limit of 85 years of age. The minimum loan amount is £10,000 with an upper limit of £460,000, subject to a maximum of 55% LTV, meaning you can’t borrow more than 55% of your property’s market valuation.

A big differentiator with Nationwide Equity Release is the repayment options, which the fees reduce the longer you have the lifetime mortgage. If you repay within the first five years, a 6% early repayment fee is applied.

That drops to a 3% early repayment charge if you repay the entire amount between 5 and 10 years, after which you’ll only pay 1% if you repay in full after ten years.

Alternatively, a downsizing guarantee lets you repay the entire loan amount without penalty when you sell your property to move to a smaller home after five years. Most equity release providers offering downsizing protection do so with a higher interest rate to add the feature to your policy.

LV= Liverpool Victoria best equity release rates uk

LV= is one of the UK’s largest insurance, investment, and retirement finance companies, serving millions of customers. They offer two types of equity release plans, both lifetime mortgages. A lump sum plan and a drawdown option. Both are suitable for homeowners with a property valuation of at least £70,000 and who are over 60 years of age.

The upper age limit for the LV= equity release plan is 95 years of age. The minimum loan amount is £10,000 on a lump sum plan, and on the flexible lifetime mortgage, LV= will release an initial minimum of £10,000, leaving the rest in a cash reserve to use at your leisure.

The only requirement for future withdrawals is that the minimum transaction needs to be £2,000, and the funds need to be used within 15 years from the approval date. The amount you could be approved for ranges from 20% to 50% of your property valuation.

Overview Of Equity Release Interest Rates 2025

| Aspect | Detail |

|---|---|

| Lowest Interest Rate | 4.37% (AER) fixed for life |

| Highest Interest Rate | 8.98% (AER) |

| Average Interest Rate | 5.21% (From Market Report by the Equity Release Council) |

| General Rule | 5% excellent, 6% average, 7%+ for substantial borrowing with more product features |

| Factors Affecting Rates | Loan to Value, Credit History, Product Features, Lending Criteria, Age, Marital Status |

| AER vs MER | AER (Annual Equivalent Rate), MER (Monthly Equivalent Rate) |

| Fixed vs Variable Rates | The majority are fixed; variable rates are typically linked to the Consumer Price Index (CPI) |

| Interest Rate Trends | Lifetime mortgage interest rates are at an all-time low; lower rates have continued to fall |

Legal and General Home Finance with flexible repayment options and great customer feedback

Legal and General Home Finance dominate the equity release market with over 30% market share. They’re a reputable company with a long-standing history of entering markets after carefully analysing what works for competitors and then entering the market with an improved offering.

With L & G equity release, the minimum you can borrow is £10,000, and you can choose from a lump-sum payment or use a drawdown. If you use drawdown, you can request a minimum of £2,000 per transaction, and there are no withdrawal fees.

The rate of interest applied will be based on the interest rate at the time of withdrawal and not the time your upper limit was approved, letting you benefit from possible interest rate reductions, but it’s also possible interest rates could be higher in the future.

On the Flexible Plan from Legal and General Equity release, the maximum amount you could be approved is £250,000, subject to your age at the time of application, health conditions, and the valuation of your property.

The minimum age is 55, and the minimum property valuation is £100,000 unless your home is an ex-council property, subject to a minimum valuation of £150,000. A Premier Flexible Lifetime Mortgage is available for homeowners over 55 who want to release over £250,000 from their property wealth.

One Family Lifetime Mortgages LTD financial solutions

OneFamily is a mutual society formed in 2015 following the merger of Engage Mutual and the Family Assurance Friendly Society Limited. After the merger, One Family was formed, and today serves over 2.6 million customers.

OneFamily provides three types of equity release products, all lifetime mortgages.

- An interest roll-up option, as it sounds, has no repayments payable. Instead, interest rolls up and is repaid at the end of the loan term from the proceeds from the sale of your home.

- The Voluntary Repayment Lifetime Mortgages let you repay up to 10% of your loan amount each year, fee-free either in full or with partial payments throughout the year.

- The Interest Payment Lifetime Mortgage lets you repay some or all of the interest each month, preventing interest from rolling up into bills that could affect your family’s inheritance. Eligibility requirements are to own property worth at least £70,000 and be aged 55+.

More2Life with the best equity release process

More2life provides four types of lifetime mortgages: Capital Choice, Maximum Choice, Tailored Choice, and Flexi Choice. The Capital Choice and Maximum

Choice plans are suitable for those between 55 and 95 years of age. Tailored Choice is ideal for anyone over 55, and the Flexi Choice is only suitable for those between the ages of 55 and 84.

The Capital Choice plan pays a lump sum from £15,000 up to a maximum of £1.5M, subject to LTVs, which range from 19% to 55% of your property valuation. You can repay up to 10% each year, fee-free.

The Maximum Choice plan lets you borrow from £10,000 to £750,000 with LTVs ranging from 24% to 53% and enables you to repay a higher amount of 12% each year without any early repayment fees.

The Tailored Choice is More2Life’s equity release product for those with medical conditions. It is subject to a health questionnaire and provides between £10,000 and £600,000 based on LTVs of 20.9% to 54.5%, which can be used for drawdown.

The Flexi Choice plans let you benefit from an initial lump sum payment, then use drawdown for future payments up to your maximum pre-approved limit. Up to 10% can be repaid each year without early repayment charges and the LTVs available range from 5% to 44%. The minimum amount you borrow is £10,000, and the maximum is £1.85M on the Flexi Choice Lifetime Mortgage.

Many equity release services suggest you should seek professional advice and work out the cash lump sum you need for your outstanding mortgage balance so monthly interest does not impact your financial future, even with competitive interest rates.

Costs And Repayment Of The Top Equity Release Companies

| Aspect | Details |

|---|---|

| Cost Components | Includes advice fees, repayment fees, application fees, and tax considerations. |

| Advice Fees | Essential for the process can be a fixed amount or a percentage of the released amount. |

| Repayment Fees | Consider potential early repayment charges. |

| Tax Implications | There is no tax on released equity, but implications for how the money is used (e.g., Inheritance Tax). |

| Application Fees | This may include valuation, solicitor’s, and lender’s fees. |

| Repayment Options | Interest can be repaid in full or partially, monthly or in lump sums, without penalty. |

| Equity Release Suitability | Advisers help compare options and ensure the plan suits individual needs. |

Canada life – one of the top equity release providers

Canada Life provides various types of lifetime mortgages, some of which let you release equity from a second home. You can choose from interest roll-up or repayment lifetime mortgages to limit the interest repayable amount at the loan term’s end. Interest roll-up is available on the lifestyle and prestige plan.

The lifestyle option lets you borrow from £10,000 up to a maximum of £1M, either released as a lump sum or through a drawdown. The Prestige option is similar but is suitable for a higher amount of £250,000 minimum amount being released based on property valuations of £500,000 minimum to a maximum valuation of £6M. Both plans have an inheritance guarantee option available.

Repayment lifetime mortgages from Canada Life are suitable for homeowners over the age of 55 borrowing a minimum of £10,000. The Interest Select plan lets you repay either half of the interest accrued or all of it for five years or the life of the loan term.

A few missed payments are allowed, but if three payments sequentially fail, the plan will revert to interest roll-up, so while you can choose to repay interest, it is still voluntary because if you don’t pay, you won’t be forced to. It’ll just revert to interest roll-up rather than repayment.

On the other hand, the Voluntary Select plan allows for 15% capital repayment per year without an early repayment charge applying. The only requirement is that each payment needs to be a minimum of £50.

All equity release plans from Canada Life have a no negative equity guarantee, allow for additional borrowing subject to property valuation, a cash reserve for drawdown, and an inheritance guarantee.

If you have a second home for which you’re interested in using and equity release service, Canada Life offers second home finance options.

Standard Life/Age Partnership Calculator Equity Release

Another company that you may think offers equity release mortgage is Standard Life, which relaunched into the equity release market in 2019. They don’t directly offer the products but are partnered with Age Partnership.

They are an equity release broker service for which Standard Life uses the referral service, earning referral fees and using marketing tools such as the equity release calculator used by Age Partnership and other mortgage broker advisors for marketing purposes.

A whole of market equity release broker service will compare all companies for a list of best UK equity release providers, which are those listed above, and return to you the best deals available, providing written information on each and a Key Facts Illustration document demonstrating everything you need to know before proceeding.

Which UK Equity Release Companies Are Members Of The Equity Release Council?

Several equity release lenders, such as Nationwide, Scottish Widows, and Canada Life, are members of the Equity Release Council. Various other companies also meet the standards set out by this organisation.

The complete list is as follows, including the top 10 equity release companies:

- Just Mortgages and the just group with a qualified equity release adviser with greater flexibility

- LV= for an excellent initial lump sum

- OneFamily Lifetime Mortgages one of the leading equity release providers

- Santander mortgages for over 70’s that offer two lifetime mortgages and other tailored solutions

- More2Life one of the flexible equity release lenders

- Pure Retirement equity release brokers with a money back guarantee

- Responsible Lending for the later life mortgage market and greater flexibility

- Crown equity release working with a qualified equity release adviser

- Aviva equity release services with excellent customer service and compound interest

- Legal & General Home Finance – one of the top equity release providers

- Canada Life lifetime mortgage lender home finance to repay existing debts

- Retirement Bridge Group has various equity release mortgages and retirement services

- Nationwide Building Society – one of the top equity release companies

- Standard Life Home Finance for Later Life Borrowers with no monthly income

- Scottish Widows for the best equity release journey with flexible repayment options

- Hodge Bank with low early repayment charges and with a good lump sum upfront

- Key Retirement to find the best equity release provider for people with financial goals

Do UK Banks Offer Equity Release At Present?

While many banks may offer equity release, they generally don’t do so directly. Instead, institutions like Lloyds Bank, Bank of Scotland and Halifax point consumers interested in this loan product to Scottish Widows. This Edinburgh-based life insurance and pensions company is a subsidiary of Lloyds Banking Group.

It can be easy to assume that all banks offer equity release due to its nature as a loan product, yet most high street providers have yet to enter the market, with only a few exceptions.

An overview of the best companies for equity release – find the leading companies and an accredited broker

Whether you’re considering equity release, ready to jump in and release the cash tied up in property wealth, or interested in switching equity release providers, it’s imperative to do your due diligence by investigating what’s on offer from a list of equity release providers.

Equity release is available to all UK homeowners over 55. However, meeting the age requirement doesn’t necessarily make this type of finance suitable. It is a specialist product, highly regulated, and requires careful consideration before arranging a Lifetime Mortgage, whether to release a lump sum or use it as an income drawdown for additional capital in retirement years.

Know your options for the best company for equity release

Option 1: The Lifetime Mortgage

When searching for the best equity release companies, you need a basic understanding of lifetime mortgages. A lifetime mortgage is as it sounds – a mortgage you take out on your principal place of residence that stays in place for the rest of your life. Various repayment options are available, depending on your equity release provider.

Some will allow you to ring-fence some of your property wealth to leave for inheritance. Others let you make partial repayments, which can leave more capital for the beneficiaries of your estate.

Others apply interest roll-up across the entire loan, requiring no repayments, instead of taking capital plus interest from the sale of your home when you (or both people living in the property) die, after which the finance company sells the property to recoup the capital they loaned with interest.

Best Equity Release Companies UK for 2025

The best equity release companies or abandoned houses for sale London are the ones that offer a free valuation.

Things to know about Lifetime Mortgages:

- The minimum age is 55

- The maximum percentage you can borrow is 60% (most equity release providers are 50% max; however, 60% LTV is available from some specialist lenders through a medically underwritten lifetime mortgage)

- Interest rates need to be fixed, or if it’s a variable rate, there must be a cap representing the upper limit that the amount repaid can’t go above. The cap needs to be there to prevent more being owed than your property’s worth. This is called a no negative equity guarantee; all reputable providers offer this as standard.

- Despite the lifetime mortgage being for life, you can move property if you wish, provided the new property fits the security requirements of the equity release provider.

- While some equity release companies will let you repay some of the interest on a lifetime mortgage, the amount you can repay may be restricted as you need to prove you can afford the repayments.

- Interest roll-up is only applied to funds released as they’re released. For this reason, it will cost more interest fees to take out a lump sum payment than to take out smaller amounts at frequencies that suit your lifestyle.

Option 2: The Home Reversion Plan – how much equity do you have?

With a home reversion plan, you would sell some or all of your property to an equity release provider, who’d provide you with a lump-sum payment or regular payments at intervals of your choosing, which can be used to supplement your retirement income. Like a lifetime mortgage, where you can set some cash aside for inheritance purposes, you can do the same with a home reversion plan.

The key difference between a lifetime mortgage and a home reversion plan is that a lifetime mortgage lets you borrow from the equity you own in your home. In contrast, with a home reversion plan, you’d be selling your equity rather than borrowing against it, but you do retain the right to live in your property rent-free.

Things to know about Home Reversion Plans:

- Home reversion providers generally require a higher minimum age, usually 60 or 65 years of age

- Reversion companies will typically only provide between 20% and 60% of your properties market value

- The older you are at the time of application, the higher the percentage the finance company will pay

- Home reversion companies promise you the right to live in the property without paying rent, but you still have to pay maintenance fees, such as ground rent.

When people are searching for who is the best equity release company, it is common they decide all the equity release firms have better products than the best home reversion plan providers.

Find Out How Equity Release Loan Could Help You. Stay In Your Own Home. Quick Quote Form

More detailed equity release guides for the top equity release companies uk:

- Pros and Cons with Various Equity Release Plans with interest payments

- For 90 Years And Above for releasing equity near the end of life

- Equity Release For Under 55 with two equity release options with equity release interest payments

Best Equity Release Companies for 2025 for leasehold properties and free equity release advice

Ultimately, deciding which equity release provider to use is far from straightforward. With various banks, building societies and mortgage providers offering different types of plans, it can be difficult to decide what the best equity release companies are and which option best suits your needs.

It’s wise to consult a qualified financial advisor or broker, such as 1st UK Money, to make the right choice. We can assess your personal circumstances and help you find an appropriate plan that meets your financial objectives.

Given how complicated and essential the process can be for selecting the best equity release company, you must get expert advice before making any decisions.

The Best Equity Release Providers List Plus Questions And Answers

Does Lloyds do equity release or variable rate lifetime mortgages?

If you have been on the fence or wondering whether should you consider equity release, and what the best equity release companies are the Q and A’s below could be of further interest to you.

Yes, Lloyds equity release is ideal for many homeowners, including freehold flats. Some people think it has some of the best equity release rates. It’s commonly used for care home fees. Some products have fixed interest rates and low monthly repayments.

Does RBS offer equity release to repay an existing mortgage?

Yes, RBS equity release is particularly good for postcodes where the property is inexpensive. You can repay equity release early. It’s common for it to be used to gift money to the family. The financial adviser does not charge completion fees or other costs. They are part of the responsible equity release scheme. Your poor credit history does not matter.

Does Santander do equity release?

Yes, Santander equity release has a low rate and has no early repayment charges. It’s a great option for the over 70s. They recommend independent financial advice that may involve an advice fee.

Does HSBC offer equity release?

Yes, HSBC equity release has excellent interest rates and no fees. Some people think they are the best equity release provider and is popular with people who want to pay for school fees. When you die or move into long term care, your home is sold and the loan is repaid without a early repayment charge.

Does Royal Bank of Scotland offer equity release?

Yes, the Royal Bank of Scotland equity release plan has a very low rate and a free property valuation. Sometimes known as the cheapest equity release with repayment option. It’s ideal for the 60+.

Does Saga have good reviews for equity release?

Yes, Saga equity release reviews are generally very good, especially for people over 80 and pensioners. The Saga equity release interest rates are very competitive. With some plans you have to pay interest.

Does Sunlife do lifetime mortgages?

Yes, Sunlife lifetime mortgages have some very low rates. It’s a common choice for people looking to buy another property. Over 55 equity release plans are, of course, available upon request. The loan to value ratio is 60%.

Does Nationwide Currently Offer An Equity Release Plan In the UK?

Nationwide offers three types of equity release products: a lifetime mortgage, a retirement interest-only (RIO) mortgage, and a retirement capital and interest mortgage. The Financial Conduct Authority regulates all three products and offers different benefits depending on your individual circumstances.

Does Leeds Building Society Have Any Equity Release Products For UK People?

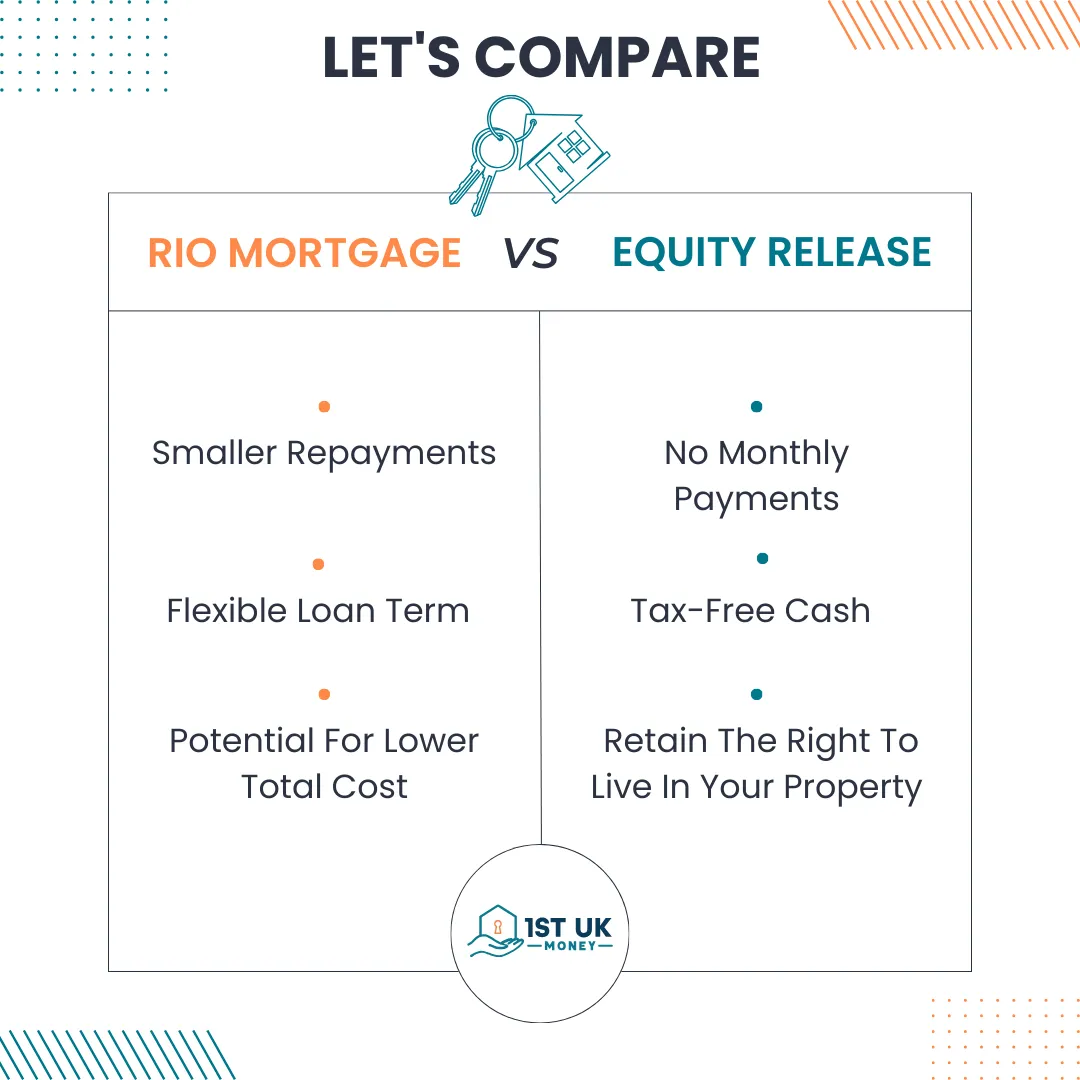

Leeds Building Society does not offer equity release plans but has RIO mortgages as alternatives to equity release. RIO mortgages are Retirement Interest Only (RIO) mortgages, which allow homeowners aged 55 and over to access the equity in their homes without moving.

With a RIO mortgage from Leeds Building Society, you can release equity, protect the remaining equity and leave an inheritance for loved ones. The maximum loan to value (LTV) is 55%, with no minimum equity required. There are also no charges to repay early and no lender fees.

What Are The Latest And Best Equity Release Rates In The UK?

According to various sources, the latest and best equity release rates in the UK vary depending on the provider and the type of plan. As of 2025, the lowest equity release interest rate is 5.65% (AER), fixed for life, while the highest is 8.31% (AER)

[1]. The Equity Release Council indicated in its Spring 2025 Market Report that average equity release interest rates were 3.95%

[2]. However, the average interest rates for equity release was 5.74%, according to the Autumn 2023 Market Report by the Equity Release Council