Best Secured Loan Broker Cheapest Rates Guaranteed For 2025

Access to a very broad specialist lender panel with 100’s of secured loan products & high rates of acceptance!

- Our secured loan brokers match the term of the loan to remaining term of your mortgage

- Great for clearing other loans/credit cards/existing car credit

- New lenders for 2025 now available

- High loan-to-value (LTV) with many lenders

- Same day decisions. Quick & simple

- Keep your existing mortgage with no hassles

- Soft footprint credit search that won’t affect your credit rating

- We Offer Homeowner Loans From The UK’s Top Lenders . Flexible Repayments. Exclusive Rates – Secured Loan Brokers

- Rates from just 7.49%

- Borrow up to 100% of the value of your home (subject to status)

- No obligation to proceed

- We have broker only lenders that are not featured on the far from impartial comparison engine sites.

Pre-Decision In Principle Application Form. Sympathetic To Past Credit Problems: All Forms Of Credit. Prime, Light, & Heavy Adverse Considered.

Credit Problems Are No Barrier To Accessing Any Financial Product With A Secured Loan Broker.

Following the start of the cost of living crisis, the demand for homeowner loan bad credit applications has increased significantly. It is more and more commonly accepted that pledging your home as collateral for a loan will allow the borrower to access the best secured loan rates available.

They are only for bigger chain lenders automating processes because it’s cheaper to say no than approve. In recent years there have been huge regulatory changes in response to the FCA’s Mortgage Market Review. Execution-only mortgages (where you manage the entire process yourself) are only available in very restricted circumstances.

You would need to know the following:

- The exact type of 2nd mortgage you want (which would need you to know if it’s a suitable product; otherwise, the application will be rejected).

- The property you want to buy (including freehold, leasehold details and anything that affects the property valuation).

- How much you can borrow, based on your income and the types of income that count towards the criteria for the lender you’re applying for.

- The interest rate details include how much you’ll borrow for an introductory rate and the renewal rate after any promotional offers come to an end. Interest rates affect your affordability test, which is a legal requirement.

- That’s why execution-only mortgages fall by the wayside and are very difficult to obtain.

Enter Some Details In Our Quick & Simple Form. Newly Updated Rates For 2025. Brokerage Loans With Soft-Search Technology

Go Direct or Have Your Second Charge Mortgage or Secured Loan Brokered

To get your mortgage or secured loan application approved, those are the only options you have (direct lenders or brokered) regardless of your credit file because of the restrictive nature of execution-only deals.

The direct route would need you to compare the interest rates, application fees, secured loan completion fees, and home valuation fees and total up all the associated costs, both upfront costs in the short term and the total interest payable over the longevity of the secured loan.

The broker for loans route requires you to work closely and trust a broker to act on your behalf. You would submit your application to the broker, supply supporting documentation, and talk over your income details, including total household income, expenditure, and the type of income you have, such as state benefits only, pensions, and any investments you have that could be used to support your affordability test.

Specialist adverse credit secured loan brokers have a high success rate because they cherry-pick direct lenders based on risk levels they’re comfortable with.

Armed with your data, a secured loan broker can work with the most appropriate lenders. They would be able to look over your credit report and see that CCJ has been issued within the past year, so they would know that Precise Mortgages could be an option as they consider secured loans for CCJs as recent as 3 months ago.

However, Pepper Home Loans wouldn’t because they only accept applications with CCJs older than a year. This is why you need the best secured loans advice.

If a Debt Management Plan were in place, The Mortgage Lender could be an option, provided the DMP had been consistently maintained with no missed payments and no CCJs within the past 12 months for more than £1,500.

Pre-Decision In Principle Application Form for the best homeowner loans.

Secured Loan Brokers: Do What The Banks Can’t – Lower Rate Secured Loans For People With Bad Credit

Getting an appointment with a secured loan advisor with a main street lender is difficult at the best of times, and many main street lenders don’t offer the best secured loan rates anyway.

If you can get an appointment, it would likely require a couple of hours sitting down and going through the paperwork, and then you would only be able to get information on that lender’s in-house products, not the best secured loan rates.

They won’t sell you a competitor’s secured loan product because they need the long-term interest for profitability, not the arrangement fees.

Lenders profit over the long term. Brokers work in the short term, putting speed in their best interest. A good broker for secured loan products will actively chase your case with lenders and, in some cases, have the technology to give you real-time case tracking or contact you with case updates. It’s not unusual for a broker to make ten calls per application to keep the process rolling.

That’s what customers are after, and the banks can do neither speed nor whole of market secured loan advice. A secured loan brokerage service is aligned more with customer demand, which drives the rise of secured loan broker services.

This year, the Intermediary Mortgage Survey 2025 showed that 75% of UK mortgages are brokered.

That’s because a broker is more active. The service will…

- Give you tailored advice, including the types of income different lenders accept as part of their acceptance criteria.

- Compare the whole of market secured loan products.

- Assess your suitability for each product.

- Route your application to the most appropriate lender suited to your circumstances.

- Access broker-only/intermediary-only secured loan deals with their network of lenders.

It all boils down to the cost of processing secured loans. These days, all lenders are tailoring their distribution channels with an emphasis on including brokers and in a lot of cases, making strong broker-only offerings that cannot be found on comparison websites.

Customers have long chosen to use a secured loan broker because of the tailored approach to assist customers best. Lenders cottoned on and opened their distribution channels to make more bespoke offerings by working with intermediaries – who do their heavy lifting for them. It saves them money, so it’s the obvious choice for lenders to work with brokers more.

Brokers are the knowledgeable bridge between the tight-with-their-cash lenders and the smart-with-their-money borrowers.

A good broker will have many questions because the more data they have, the better a match they’ll find. And you’ll be kept in the loop throughout the process.

They’ll assist in form completion, advising on the whole of market secured loan products, the overall cost of each option suited to your circumstances, and advise on the most suitable product with both upfront costs and long-term costs so you can make an informed decision on the lender to have your application routed to.

For bad credit secured loan applications, an adverse credit broker specialist is your best choice because they have an established working relationship with lenders. In some cases, they can bypass the usual application channels to get your application directly to the loan underwriting department, which is ultimately where it’s decided if you’re approved or not.

Bad Credit Secured Loan Brokers have Exponentially Better Tech On Their Side

And that’s to your advantage. Everyone uses technology, and the best businesses invest in superior technology. A great secured loan broker service can invest thousands or even tens of thousands into improving their infrastructure to compare the whole of market products.

For a chain lender, the investment for the same (or even any) technology upgrades would cost millions because it would need streamlining to work with multiple branches and departments within those.

While customers can certainly use search engines and comparison sites to find the top 10 secured loan deals for bad credit and the like, secured loan brokers can tap exclusive lender deals, compare overall costs, filter by terms, approval percentages by the lender, weed out those who don’t accept self-employed income customers and even filter down to those as narrow as specialist lenders for retirees.

Secured loan brokers can do all of the above and get a secured home loan approved for applicants with bad credit.

That’s one thing we can do because we know the market, our panel of lenders have a vast amount of knowledge on each lender criteria, and know the secured loan market off the back of our hands.

Put us to the test or compare us against the rest and see how we can help get your secured loan approved at the best rate.

What is best for me – do I need brokers loans?

There is a massive demand for no broker fee loans as people don’t want a fee added to their loans. However, some of the best secured loans UK only work with brokers.

This is why they should look for the best secured loan rates and best homeowner loans from a broker that only charges a very small fee, that can do the secured loan comparison for you and tell you what secured loan lenders you will qualify for.

There are no such thing as best secured loans UK as it’s very likely the best-secured loan offer you will not qualify for – but you likely will qualify with other secured loan lenders.

The cheapest secured loans are generally available to people with very small existing mortgages at a very low loan to value. What is a loan broker? Many people ask this.

Well, the best-secured loans broker is an expert on many of the best homeowner loans. So, after a few questions about your home and your income and outgoings, they will have an excellent idea of the cheapest secured loans for you. The best brokers can do a secured loan comparison in their heads without the need for a computer!

There is massive search traffic and interest in loan lenders, not brokers in the UK, because some people do not trust brokers or think they don’t offer any value. In general, the opposite is true.

Key Secured Loan Terms

| Term | Description |

|---|---|

| Second Charge Mortgages | Often synonymous with secured loans, these allow borrowers to use their home as collateral for additional funding. |

| Debt Management Plan (DMP) | A formal agreement between a debtor and their creditors to repay debts. Secured loans can be considered by those in a DMP (Debt Management Plan). |

| County Court Judgments (CCJs) | Legal decisions handed down for unpaid debts. Some secured loan providers consider applicants with recent CCJs. |

| Loan-to-Value (LTV) | The ratio of a loan to the value of the property offered as security. Higher LTVs might be riskier but are available through some brokers. |

Key Features of Secured Loan Providers

| Provider | LTV Range | Interest Rate Options | Key Features |

|---|---|---|---|

| Pepper Money | Up to 100% | Fixed, Variable | Low minimum loan amounts, suitable for self-employed. |

| United Trust Bank | High | Fixed, Tracker | Requirement of a 12-month minimum mortgage history and offers high loan amounts. |

| Norton Home Loans | Varies | Fixed, Variable | They ask for a 12-month minimum mortgage history and offers high loan amounts. |

| West One | Up to 85% | Fixed, Variable | Available for lower credit scores and flexible term limits. |

Risk Considerations and Advantages

| Risk Factor | Description | Mitigation Strategy |

|---|---|---|

| Home Repossession | Failing to meet loan repayments can lead to losing one’s home. | Ensure realistic repayment plans, consider fixed-rate options for predictable repayments. |

| Interest Rates | Rates can vary significantly based on the borrower’s credit profile and loan terms. | Compare offers from multiple brokers to secure the best rates. |

| Loan Terms | Longer terms can mean more interest paid over time. | Assess financial stability to handle long-term debt responsibly. |

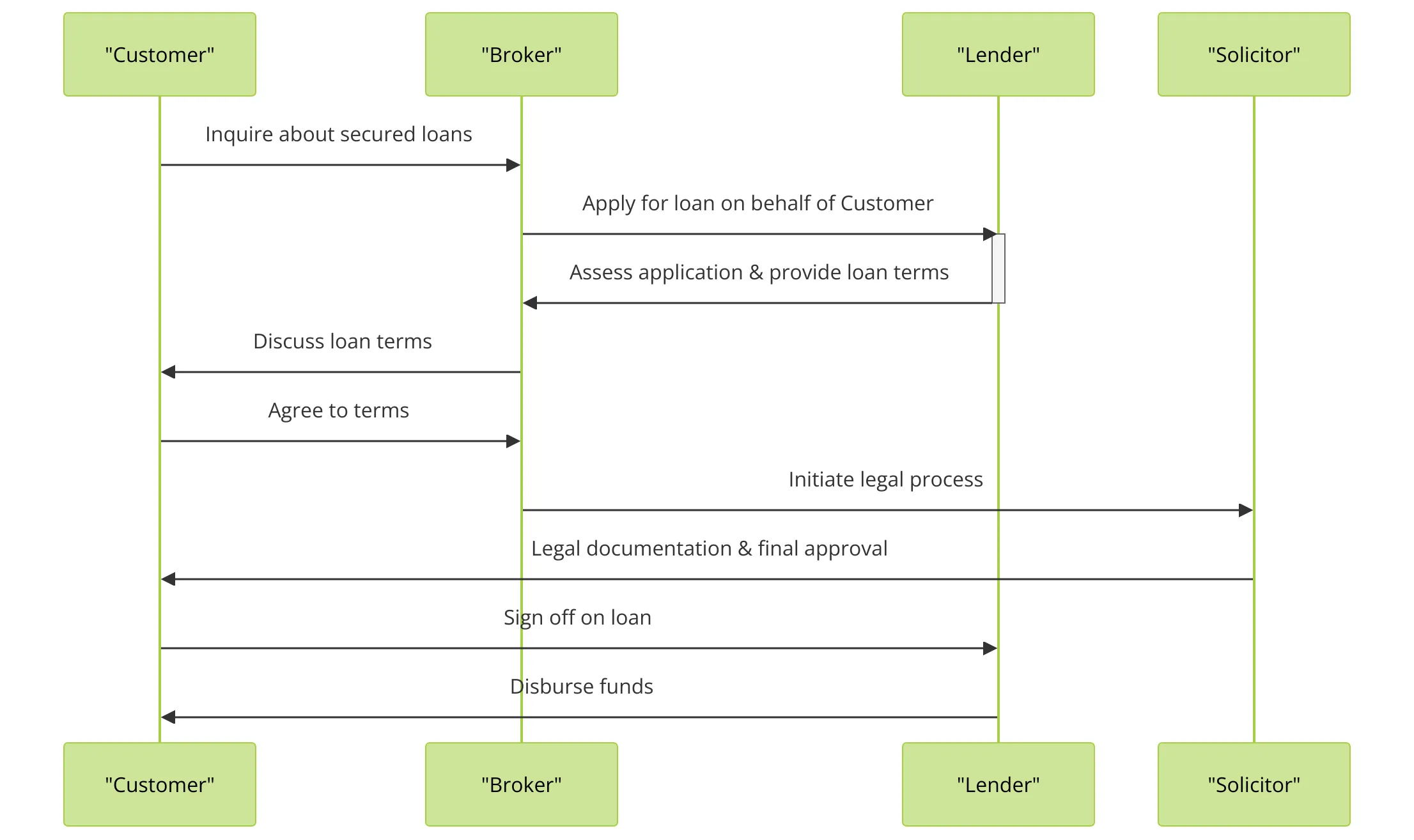

Flow chart illustrating the secured loan broker process

Common questions from people who are looking for secured loans for people with bad credit without the need for a personal loan broker UK:

What are some common uses for secured loans in the UK?

In the UK, secured loans are frequently used for many reasons. Homeowners often utilise them for property improvements or renovations, such as adding extensions or upgrading kitchens and bathrooms, which can enhance property value.

Secured loans are also employed to consolidate existing debts into a single, manageable payment, often at a lower interest rate. They are also used for major purchases, such as buying a new car, financing higher education, or funding large-scale events like weddings.

The collateral requirement, typically a property, enables borrowers to access larger amounts of credit than would be available through unsecured loans.

Do Lloyds bank loans offer secured loans?

Yes, Lloyds secured loans are good for many people looking to release equity from their homes. They always quote the maximum APR. They are much pickier about your current circumstances than a lender like Masthaven Bank.

Does HSBC loans do homeowner loans?

Yes, HSBC secured loans can be very competitive with other lenders. A high-street lender like HSBC is likely to be very cautious about the application process than a lender like Spring Loans.

Do the Royal Bank of Scotland loans do secured loans?

Yes, RBS secured loans have great rates but require a recent home valuation. They do not offer Secured Loans With Bad Credit as they are a prime lender. They also offer bridging loans and deals on your main mortgage. If you have some adverse credit you should look for brokers for personal loans.

Do TSB loans offer cheap secured loans with no brokers?

UK homeowners can get a TSB secured loan subject to their loan-to-value percentage. They have a repayment plan using variable interest rates and let you pay back your loan early if you can. Pepper Home Loans have much higher rates, but they are far less fussy about your credit score.

Do Santander loans do the best secured loans?

Yes, you can apply for a Santander secured loan even if you’re not an existing Santander account holder. They could even offer you a Santander home improvement personal loan too. The lender’s standard variable rate of interest is very competitive in the long run. If you have some adverse credit you might be better off with loan brokers UK.

Does Nationwide loans offer the cheapest secured loans?

Yes, Nationwide Building Society secured loans are ideal for people looking for a low fixed rate. The minimum term and maximum term make the lending product very flexible, and you can use the money for any legal purpose. If the Nationwide Building Society decline your application, you could try Norton Home Loans as an alternative.

Nationwide do offer home improvement loans that are not available on the comparison engine websites.

Is it hard to qualify for a 10000 loan with bad credit?

No, it’s easy, subject to having enough income and home equity. Ideal lenders are Paragon Bank, Secured Debt Consolidation Loans for bad credit, or 1st Stop Loans Now Oplo.

Can I get a UK secured loan over 10 years with the best secured loan rates UK?

Yes, a secured loan over 10 years allows you to borrow a larger sum of money than unsecured loans. The value of your home may influence the amount you can borrow.

Does Barclays Loans do an online secured loan?

Yes, Barclays Bank secured loans are considered some of the best secured loans. If you want to raise funds using your home equity or one of your buy-to-let properties over a much more extended period, you might be better off with a lender like Optimum Credit. Barclays Bank is not a lender to apply to if you have a default or a CCJ. If you have poor credit, you are better off with a personal loans broker.

How do you get a loan with a low-interest rate with poor credit?

Easy. You look for a broker that offers bad credit loans with security.

Do NatWest loans do homeowners loans?

Yes, NatWest offers joint secured loans. You need a home valuation. Natwest home improvement loans are also very popular in 2025.

Is it hard to get a 25000 loan with bad credit?

No, as long as you have enough income and ample home equity, you can get a £25,000 homeowner loan at a fair rate.

What about my credit score – how will it affect my eligibility and repayment of no broker loans?

Some lenders, for example, United Trust Bank, Precise Mortgages or Together Money Loans (previously known as Blemain) are less fussy about your credit score as they deal with people with poor payment history. They care much more about if people can afford the monthly payment.

With unsecured loans, where you apply online, poor credit scores are typically not a way to finance home improvements or manage debt consolidation, as an unsecured loan requires a good credit history.

Bad credit secured loans, sometimes commonly known as 2nd charge mortgages, can have early repayment charges that you may need to pay if you refinance your home with a bad credit history remortgage.

The best deal for monthly repayments from secured lenders is likely a deal you will fail on eligibility, as the low-interest rates will not cover the risk of arrears and defaults for the lender.

Poor credit history secured loan rates are exceptionally high if you want to borrow money at a high-risk loan to value. However, even these repayment terms can be better than struggling with high-rate other forms of credit like credit cards, store cards, catalogues and personal loans – consolidating debts can simplify your life.

To get the best annual interest rate to cover outstanding debt, you may be better off paying a lender fee added to the loan amount.

Your financial history and personal circumstances are better disclosed early on because you can’t get an accurate representative example without all the bad credit issues being obvious. Larger amounts of equity in your property can be released as long as your income stacks up.

You could even get an unsecured personal loan to purchase houses under 20k as some boarded-up homes are very cheap.Have brokers for bad credit loans ever got in trouble with regulators?

Yes, brokers can get in trouble with the regulator if their fees are too high.

Why is there such a high demand for no broker bad credit loans in 2025?

Even if you have not paid your water or electricity bill on time (which is very common) you can end up with some adverse credit quite easily, and people hate to pay a broker a big fee. People want the cheapest secured loans not to pay fees for people’s overheads.