Retirement Interest Only Mortgages (RIO) in 2025

As you approach retirement, it’s natural to feel concerned about your financial stability. One option to consider is a retirement mortgage, often called retirement interest only mortgages, which can provide financial flexibility while allowing you to remain in your home.

This comprehensive guide explores various retirement mortgage options, compares their features, and offers crucial advice to help you make informed decisions.

In the following sections, we’ll discuss types of retirement mortgages, eligibility criteria, borrowing limits, and affordability assessments. We’ll also explain the importance of seeking professional advice, comparing mortgage products, and protecting yourself from potential scams.

Short Summary

- Retirement mortgages are home loans specifically designed for older borrowers, including Retirement Interest Only Mortgages and Reverse Mortgages.

- Eligibility criteria typically include being over 55, owning a significant portion of the home’s equity, and having a stable income source to cover loan repayments.

- It is important to compare lenders for the best deal and consider the costs associated with retirement mortgages before making an informed decision.

Access Rates Similar To Those Offered By Prime Banks To Younger People. Discover Lenders That Understand The Needs Of Senior Borrowers

Retirement Mortgage Decision In Principle Enquiry

RIO Mortgages For Over 55’s, 60’s, 70’s and 80’s With The Following Benefits:

- Interest rates similar to conventional prime mortgage lenders

- Flexible approach to loan-to-value

- A small valuation fee

- Use your own solicitor

- Lenders not available on price comparison websites

- No early repayment charges

- No product fees

- Make capital repayments or just pay interest

Understanding Retirement Mortgages Without Age Restrictions

Retirement mortgages are home loans designed for older borrowers, typically aged 55 and above. These types of mortgages provide financial flexibility when considering options for retirement income.

The main types of retirement mortgages are retirement interest-only (RIO) mortgages and reverse mortgages, both secured against your home.

RIO mortgages are akin to standard interest-only mortgages but with a key distinction: the loan is usually repaid when the borrower passes away, moves into long-term care, or sells the house.

Conversely, reverse mortgages enable borrowers to access the equity in their homes without requiring monthly payments.

In the next section, we’ll delve deeper into these two types of retirement mortgages.

Types of Fixed Term Retirement Mortgages With A Fixed End Date

Retirement mortgages come in two primary forms: Retirement Interest Only (RIO) mortgages and Reverse Mortgages. Both of these mortgage products are secured against your home, with RIO mortgages requiring monthly interest payments and reverse mortgages providing access to your home’s equity without monthly payments.

To better understand these options, let’s examine each type in more detail:

Retirement Interest-Only (RIO) Mortgages And Later Life Mortgages

RIO mortgages are a popular choice for older borrowers, as they require only monthly interest payments, allowing you to maintain your current lifestyle without worrying about capital repayments.

The loan is repaid upon the sale of the property or when the borrower passes away or moves into long-term care.

RIO mortgages are generally available to individuals aged between 55 and 80. The lender’s affordability assessment considers your income, ensuring the monthly interest payments are manageable.

Some lenders, such as building societies, offer RIO mortgages with competitive interest rates and flexible lending criteria. We offer a RIO Mortgage decision in principle that won’t affect your credit score from a select panel of UK lenders.

Reverse Mortgages To Repay Your Outstanding Loan

Reverse mortgages, available to homeowners aged 55 and above, enable borrowers to access the equity in their homes without needing monthly payments.

Instead, the lender provides a lump sum or regular payments, and the loan is repaid upon the borrower’s death or relocation from the property.

Although reverse mortgages can be a convenient way to supplement retirement income, it’s essential to understand the potential risks, such as the debt increasing over time and leaving less equity remaining in the home.

As with any financial decision, seeking professional advice before considering a reverse mortgage is crucial to ensure it’s the right choice for your needs.

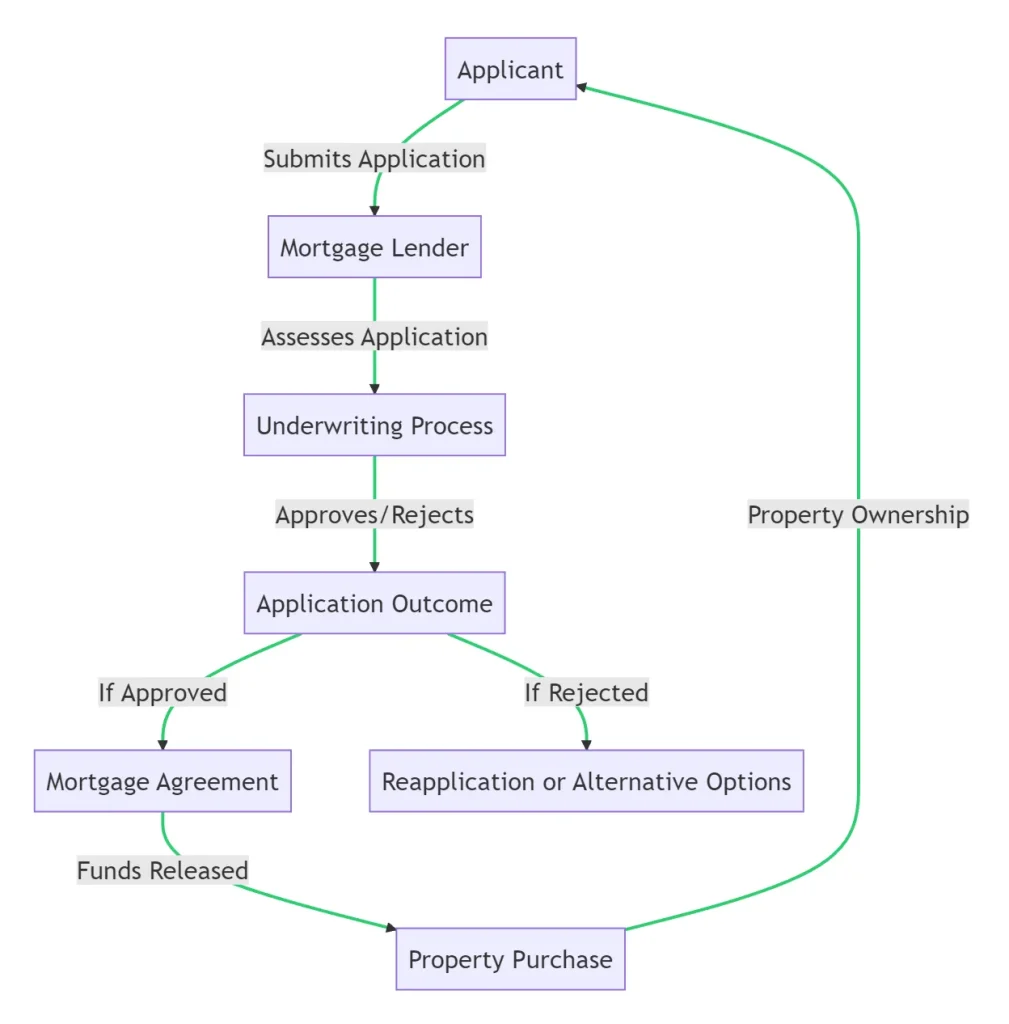

Retirement Mortgage Process Chart Based On Independent Advice

- The process starts with the applicant applying to the mortgage lender.

- The mortgage lender then assesses the application through an underwriting process.

- The outcome of the application is either approval or rejection.

- A mortgage agreement is formed if the application is approved and the funds are released for the property purchase.

- The applicant then becomes the owner of the property.

- The applicant can reapply or explore alternative options if the application is rejected.

Eligibility Criteria for Retirement Mortgages

Each lender may have different eligibility criteria for retirement mortgages.

In general, you must be over 55 years of age, own a significant portion of your home’s equity (usually at least 55%), and have a stable income source, such as pension income, to cover the loan repayments.

Moreover, lenders will consider your credit history and assess whether you can afford the loan based on your income and expenses. Maintaining a good credit score and demonstrating financial responsibility is essential to improving your chances of approval.

Borrowing Limits and Affordability Assessments

When applying for a retirement mortgage, lenders will assess your income, expenditures, and home value to determine how much loan amount you can borrow. Generally, the maximum loan-to-value (LTV) ratio for retirement mortgages is 60%.

Remember that each lender may have different methods for assessing affordability and determining borrowing limits. Therefore, shopping around and comparing various lenders is essential to find the best deal that suits your financial situation and needs.

Comparing Retirement Mortgage Products

Comparing different retirement mortgage products is vital to finding the best deal for your unique circumstances. Factors to consider include interest rates, fees, eligibility requirements, and whether the mortgage is interest-only or an equity release product.

Consider working with a fee-free mortgage broker such as 1st UK to help you navigate the complex process of comparing retirement mortgage products.

We have access to a wide range of retirement mortgage providers and deals and can provide tailored advice based on your financial situation. We can also assist you in negotiating the best agreement and ensuring that you choose the most suitable mortgage product for your needs.

Seeking Professional Advice From A Mortgage Adviser

It is highly recommended that you seek professional advice from an independent financial adviser or fee-free mortgage broker before deciding on retirement financing.

These experts can help you understand the various retirement mortgage options, explain their benefits and potential risks, and guide you in selecting the most suitable product for your individual circumstances.

When looking for a professional adviser, verify their qualifications, expertise, and any fees they may charge. Additionally, ensure that the adviser is independent and not affiliated with any specific lender.

Repaying Retirement Mortgages

The repayment structure of a retirement mortgage depends on the type of product. For RIO mortgages, you’ll make monthly payments to cover the full interest rate already accrued on the loan. At the same time, the capital is repaid upon the sale of the property, your passing, or moving into long-term care.

Understanding the repayment process and planning accordingly are essential to comfortably managing the monthly interest payments and maintaining your desired retirement lifestyle.

Moving House with a Retirement Mortgage – Need A Mortgage Adviser?

If you decide to move house while having a retirement mortgage, you’ll need to settle any outstanding loans from selling your previous property. This may involve fully discharging or transferring the loan to your new home.

Remember that if you decide to remortgage, you must undergo another affordability assessment to confirm that the new loan is financially feasible. Porting your mortgage to a new property might also incur early repayment charges from your existing lender.

Costs and Fees Associated with Retirement Mortgages and Lifetime Mortgages

Retirement mortgages can come with various costs and fees, such as arrangement fees, valuation fees, adviser fees, legal fees, and early repayment charges.

These costs can significantly impact the overall affordability of your retirement mortgage, so it’s essential to consider them when comparing different deals.

To ensure that you find the most suitable retirement mortgage for your needs, it’s crucial to compare different deals, considering the interest rates and associated costs and fees. This will help you make an informed decision and avoid potential financial pitfalls.

An Example Retirement Mortgage Offering To Release Equity

| Product Details | Rates And Other Factors |

|---|---|

| Borrower Age Range | 55 – 80 years old |

| Maximum Loan to Value (LTV) | 55% |

| No Minimum Equity Required | No minimum equity is required |

| Demonstrate Lifetime Affordability | The sale of the mortgaged property is the only repayment strategy accepted |

| Initial Fixed Rate | 5.65% |

| 2-Year Fixed Rate | 5.65% |

| 3-Year Fixed Rate | 7.24% |

| Remaining Term Variable Rate | Society’s current Standard Variable Rate (SVR) |

| Overall Cost for Comparison (APRC) | 7.7% |

| Product Fee | £0 |

| Maximum Loan Amount | £2,000,000 |

| Mortgage Completion Date | Assumes the 1st day of a calendar month |

| Mortgage Exit Fee | £199 |

| Interest Calculation | Interest is calculated daily |

| Repayment Strategy | Sale of the mortgaged property is the only repayment strategy accepted |

| Eligibility | Mortgages are subject to eligibility, status, and financial standing |

Protecting Yourself from Mortgage Scams For A Later Life Mortgage

As you explore retirement mortgage options, you must remain vigilant and safeguard yourself from scams. Mortgage fraud can involve paying advanced fees, transferring the title of your property, or signing documents with blank fields.

To protect yourself from scams, exercise caution and conduct thorough due diligence before entering into any agreements. Refrain from paying advanced fees or transferring the title of your property without professional advice.

Additionally, to ensure the security of your personal information, do not disclose it over the phone, email, or text messages unless you have initiated the contact or are certain of the recipient.

Alternative Financial Options for Retirees – Be Careful About Your Means Tested Benefits

In addition to retirement mortgages, retirees can consider other financial options to supplement their income.

Equity release loans, for example, allow borrowers to access the equity in their homes without selling them. Repayment is typically due upon the borrower’s passing or relocation to long-term care.

Other alternative financial options for retirees include investing in stocks and shares, property or other asset classes, deferred compensation plans, individual retirement accounts, dividend-paying stocks, variable life insurance, and retirement income funds.

It’s essential to explore all available options and seek professional advice to ensure you make the best financial decisions for your retirement.

Retirement Interest Only Mortgages To Repay Your Standard Interest-Only Mortgage

Retirement mortgages offer older borrowers a valuable financial tool to help maintain their desired lifestyle while remaining in their homes.

By understanding the different types of retirement mortgages, such as the RIO mortgage and reverse mortgages, and considering eligibility criteria, borrowing limits, and affordability assessments, you’ll be better equipped to make informed decisions about your retirement financing.

Seeking professional advice, comparing various mortgage products, and remaining vigilant against scams will help you choose the most suitable retirement mortgage.

By exploring all available options and carefully considering each decision, you can secure a comfortable and financially sound retirement. Remember, it’s never too late to take control of your financial future.

Retirement Mortgages Frequently Asked Questions On Interest Repayments

How does a retirement mortgage work?

A retirement mortgage is a loan specifically for those over the age of 55 that is secured against the borrower’s home.

This type of loan offers repayment options on an interest-only basis, allowing individuals to keep their monthly repayments very low while still enjoying the equity in their home.

The loan is typically only paid off later in life when the borrower passes away, enters long-term care or sells the property.

How much can you borrow on a retirement mortgage?

The amount you can borrow depends on your individual circumstances, but typically you can borrow up to 60% of the value of your property.

This is based on affordability calculations that consider income from employment and retirement.

Do you have to be retired to get a Rio mortgage?

You don’t have to be retired to get a Retirement Interest Only (RIO) mortgage.

While RIO mortgages are designed with retirees in mind, they are available to individuals over a certain age, typically 55 or 60, depending on the lender.

RIO mortgages offer flexible repayment options and can be suitable for those approaching retirement or looking for alternative mortgage solutions.

Retirement interest only mortgage vs equity release, which is better?

When comparing retirement interest-only mortgage against equity release, the former allows older borrowers to repay only the interest monthly, with the principal repaid upon selling the property, moving into care, or death.

In contrast, equity release, such as a lifetime mortgage, enables homeowners to access the equity in their home without monthly repayments, with the loan and accumulated interest repaid upon death or moving into long-term care.

Retirement Interest Only Mortgage Rates 2025 VS A Repayment Mortgage

For 2025, the outlook for Santander retirement interest only mortgage rates is good if you want to explore the cheapest house prices in London and make a good purchase.