Secured Debt Consolidation Loans For Bad Credit UK Direct Lender

There is a rush to lend as interest rates are declining, and lenders are even gambling on lower rates. UK wages are often strong, and there is very little unemployment.

1st UK has a new direct lender, Fund Fortress, for secured debt consolidation loans, not featured on the comparison sites with funds from Hong Kong investors to lend.

If you want to borrow money to improve your home for a loft conversion or extension, you can access the assumed home valuation when the works have been completed.

Here Are Some Of The Key Features On Offer:

- Ideal for debt consolidation

- Overall loan to value up to 90%

- No lender, broker or adviser fees

- Fixed for life rate of 6.76% APR

- No upper or lower age limit

- Up to one penalty-free payment holiday a year

- Free no obligation home valuation

- No penalty for flats or other leasehold properties

- Open minded view on affordability and credit score

- No early repayment charges/redemption penalties

Enter Some Details In Our Quick & Simple Form. Soft-Search Technology

Why should I consolidate my debts in 2025?

Simplicity

A secured debt consolidation loan will be debited from your bank account once a month and can be debited just after your payday. This makes your life and budgeting very simple.

If you had a personal loan, a store card, two credit cards, and a consumer credit agreement for a sofa all coming out at different times of the month, your affairs could be messy.

These circumstances make you more likely to get forgotten or defaulted payments, with the related damage to your credit score. Not everyone is good at budgeting, so a secured loan enforces discipline.

Dealing with debt and paying it down for good

Having credit cards and being trapped into paying the minimum each month is hard to get out of. Paying down cards a bit and then running them back up again through the month makes your debts into something that more resembles an interest-only loan.

This issue worsens because many credit and store cards have high interest rates.

Paying off your credit cards and store cards with a debt consolidation secured loan will force you to not only service the debt but also pay down the principal each month, so eventually, the debt will go away, which is what you should want.

Being in debt for many years could eventually impact your standard of life in retirement!

Getting a better rate

With a secured loan, the rate is probably much lower than that on your credit cards and other unsecured credit.

While it is true that a loan requires paying down the principal, and the payment reflects that, secured loans typically have a much longer term, so the principal is paid down over time.

Service debt with a lower overall monthly cost

The main benefit of a homeowner debt consolidation loan is the lower overall monthly cost. This can help you have more money to pay for household utility bills, unforeseen home repair bills, or even holidays.

A good secured loans broker will have personal experience of lifting a messy and unsustainable debt burden from people.

Does the NatWest bad credit consolidation loan UK require a charge on your home?

Yes, NatWest’s debt consolidation options, specifically those that involve consolidating your debts onto your mortgage, would require securing the loan against your home. This means your property would be at risk if you could not keep up with mortgage repayments.

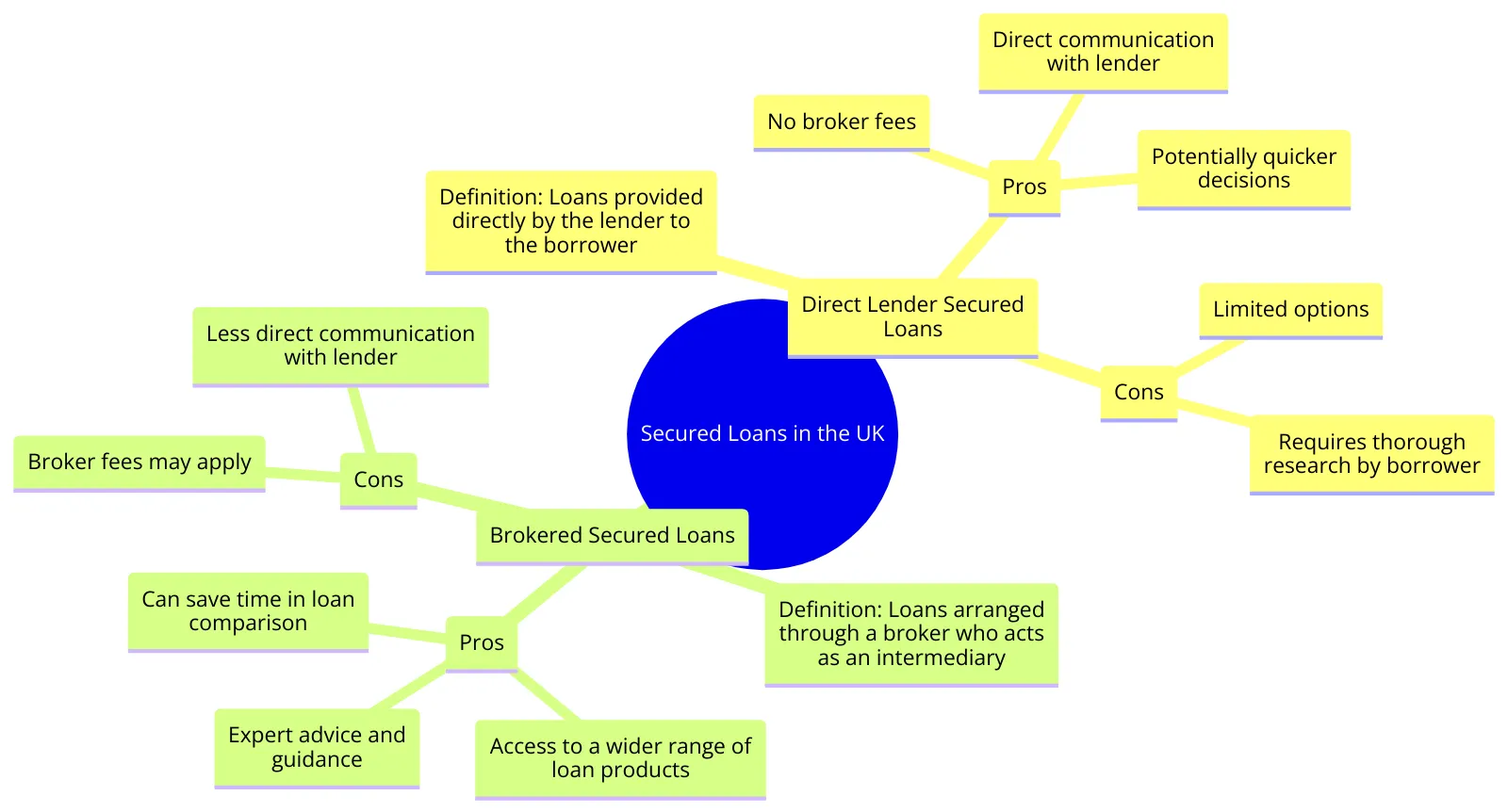

It’s essential to weigh the pros and cons of this move, as securing debts against your property can potentially reduce your monthly outgoings and offer lower interest rates compared to unsecured finance.

However, this comes with the caveat that repaying over a longer time could mean paying more interest and reducing the equity in your property. Therefore, it’s critical to consider these factors and ensure you can meet the new payment terms to avoid putting your home at risk.

Before applying for such a loan, you would need to be at least 18 years old and a resident in the UK with a NatWest current account that you’ve held for over three months. NatWest also stipulates that applicants should not have been declared bankrupt in the last six years and should not have completed a personal loan application with them in the previous 28 days. It is predicted that Natwest debt consolidation will be very popular in 2025.

It’s advisable to carefully review all the loan terms and conditions and consider speaking with a financial advisor to understand the full implications of consolidating debts in this way.

With Virgin Money bad credit consolidation loans UK, are the affordability criteria strict?

Virgin Money’s criteria for debt consolidation loans are pretty specific and factor in the borrower’s ability to afford the new loan payments. They include the monthly payments of debts consolidated in the affordability assessment, ensuring that the borrower can manage the consolidated loan alongside their other financial obligations.

This approach indicates carefully considering the borrower’s financial situation, which could be interpreted as a sign of strict affordability criteria.

Are Lloyds debt consolidation loans bad credit suitable for people over 60?

Lloyds Bank offers personal loans for debt consolidation, even for individuals with weak credit histories. While the bank does not specify age restrictions for these loans on its public web pages, personal loans are typically available to all individuals over 18 who meet the bank’s lending criteria.

This would include those over 60, provided they have a suitable credit history, a steady income, and meet other specific requirements set out by Lloyds.

It’s important to note that the terms offered, including the interest rate and the amount that can be borrowed, will depend on an individual’s financial circumstances, which include their credit rating and income. Lloyds assesses each loan application’s merits and offers rates based on this assessment.

An example of someone who can easily maintain monthly repayments is a pensioner who uses credit cards to pay for home repairs. Because the monthly payment drains the person’s bank account due to high rates, a one-monthly payment loan provider could be ideal.

The pensioner has £300 per month of spare disposable income, and the loan repayment was £220, so affordability is fine.

For a more personal insight into eligibility, particularly concerning debt consolidation loans for someone with bad credit and over 60, it would be best to contact Lloyds Bank directly or visit their website for detailed information.

Suppose you’re considering applying for a debt consolidation loan from Lloyds or any other bank. In that case, it’s crucial to understand that your credit history, income, and the loan amount you apply for will all play a role in determining your eligibility and loan terms. Always ensure you meet the repayment terms before proceeding with a loan application.

What is the maximum loan to value with Royal Bank of Scotland bad credit debt consolidation loans UK?

The Royal Bank of Scotland offers secured loans with a maximum loan-to-value (LTV) ratio of up to 90%. This means borrowers can potentially borrow up to 90% of their property’s value. This option could be suitable for homeowners looking to consolidate their debt, especially if they have equity in their property.

However, as with any secured loan, it’s important to remember that your home may be at risk if you cannot keep up with the repayments. Contacting RBS would provide the most accurate information for detailed product terms and conditions.

Is there a minimum loan amount with a Bank of Scotland bad credit loan debt consolidation?

The specific minimum loan amount for a Bank of Scotland debt consolidation loan tailored for individuals with bad credit is not explicitly stated in the public domain. Typically, banks have minimum thresholds for personal loan offerings, which could range from £10,000 upwards.

For accurate and current details regarding the minimum amount you can borrow under a bad credit debt consolidation loan with the Bank of Scotland, it would be best to directly contact the bank or check their official website, which provides the most up-to-date information on their loan products.

Can I use a buy-to-let property as security for Aldermore bad credit loans consolidation?

Aldermore Bank offers buy-to-let mortgages and typically lends to various limited companies, including Special Purpose Vehicles and trading companies. It caters to landlords looking to grow their portfolios and allows the combination of up to 30 properties on one application.

While they specialise in mortgages, the information available online does not clearly state whether a buy-to-let property can specifically be used as security for a bad credit loan consolidation product. For precise details on whether you can use a buy-to-let property for debt consolidation with bad credit, it would be best to contact Aldermore Bank directly or visit their website.

Are the Alpha Bank bad credit loans debt consolidation offered an attractive interest rate?

Alpha Bank offers a consolidation program called Alpha All in 1, which aims to provide solutions for those looking to combine their debts. While the details regarding interest rates for bad credit loans are not publicly disclosed, the bank offers consolidation for performing debts with preferential rates, suggesting that the terms could be competitive.

It’s advisable to contact Alpha Bank directly for the most accurate information on interest rates and to determine if their offerings align with your financial situation.

Does the Atom Bank bad credit consolidation loan offer a high loan to value?

Atom Bank has updated its mortgage lending criteria to cater to a broader range of customers, including those with less-than-perfect credit histories. This suggests a willingness to consider applications from those who may not meet traditional lending criteria. However, the public information does not detail their loan-to-value ratios for bad credit consolidation loans.

It is advisable to contact Atom Bank directly or through their intermediaries to get the most accurate and current details regarding their loan products and whether they offer high LTV options for debt consolidation purposes.

Are Axis Bank bad credit secured loans direct lender as competitive as Together Money loans?

Direct comparisons between Axis Bank and Together Money, especially regarding bad credit secured loans, can be challenging without specific details on the loan products offered by both institutions.

Generally, both banks may offer competitive rates for bad credit secured loans. Still, the attractiveness of these rates can vary based on several factors, including the loan-to-value (LTV) ratio, interest rates, fees, loan terms, and the borrower’s specific financial situation.

Axis Bank is known for catering to a wide range of financial needs, including those of customers with less-than-perfect credit. They offer various loan products that might suit individuals looking to consolidate debt. Similarly, Together Money provides secured loans that can be used for debt consolidation, often with flexible lending criteria tailored to meet the needs of individuals with varying credit histories.

When considering a bad credit secured loan, it’s essential to compare the total cost of the loan, including interest rates and any additional fees, as well as the lender’s reputation and the flexibility of the loan terms. Borrowers should conduct thorough research or consult a financial advisor to determine which lender offers the best solution for their circumstances.

How many defaults are acceptable for Bank of Ireland bad debt consolidation loans?

The Bank of Ireland’s website doesn’t provide specific details on the number of defaults acceptable for their bad debt consolidation loans. Lenders typically assess loan applications based on various factors, including credit history, income, and consolidated debt amount.

For precise information on the Bank of Ireland’s acceptance criteria for defaults on debt consolidation loans, it’s best to contact them directly or consult their loan products page.

Are Cater Allen best debt consolidation loans for bad credit strictly regulated?

Cater Allen, operating under the strict regulations set by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority, ensures that its banking services, potentially including bad credit debt consolidation loans, comply with stringent standards.

This regulatory framework guarantees that all offerings are closely monitored and adhere to the highest levels of financial conduct and customer security.

Poor Credit Homeowner Loans: Understanding Your Options

Obtaining a homeowner loan can seem daunting if you have a poor credit history. However, it is not impossible. A homeowner loan application is essential if you need to obtain credit despite having a low credit score. Understanding the process and what lenders look for can increase your chances of being approved.

Assessing Your Equity

When applying for a homeowner loan, the first thing to consider is how much equity you have in your property. Equity is the difference between the market value of your home and the amount you still owe on your mortgage. It’s worth noting that the more equity you have, the better your chances of obtaining a loan. Lenders will assess the available equity in your home to determine the loan size they can offer you.

Understanding Fees

When applying for a homeowner loan, be aware of the lender fee and the broker fee. These fees can add to the total amount you need to pay back. A good broker will help you find the best deals and ensure you understand all the costs involved. While these fees are necessary, make sure they are transparent and explained thoroughly by your lender or broker.

Representative Examples

Lenders often provide a representative example to give you an idea of the cost of borrowing. This example typically includes the interest rate, the loan term, and the total amount payable. While a representative example can help you understand the costs, your actual offer may vary depending on your credit score and your home’s equity.

Considering Your Other Debt

It’s crucial to consider any other debt you may have when applying for a homeowner loan. Lenders will assess your debt-to-income ratio to determine if you can afford another loan. If you have too much debt, it might be challenging to obtain a loan, or you may be offered less favourable terms. Make sure you fully understand your financial situation before applying.

The Importance of Equity

Having enough equity in your home is critical. Lenders prefer borrowers with significant equity as it reduces their risk. You are more likely to be accepted for a loan if you have substantial equity. To assess your situation, ask yourself how much equity you have and whether it’s sufficient to support the loan you need. Remember, the more equity you have, the more you are likely to be accepted by lenders.

Loan Size and Eligibility

The loan size you can obtain depends on several factors, including your equity, income, and credit score. Lenders will consider all these factors to determine the loan size for which you are eligible. It’s worth noting that having a good broker can significantly improve your chances of getting a larger loan.

Using Your Home as Collateral

One of the primary benefits of a homeowner loan is that you can use your own home as collateral. This means you can access larger loan amounts compared to unsecured loans. However, using your home as collateral also means that if you fail to repay the loan, your home could be at risk. Make sure you fully understand the risks before proceeding.

A Long-Term Commitment On a loan could help you lessen the negative impact of higher rate debt with lower rate debt

A homeowner loan is usually a long-term commitment. These loans often have repayment terms ranging from five to thirty years. While a long repayment period can make monthly payments more manageable, it also means you will be paying interest over a longer time. Carefully consider if this type of loan is the best option for your financial situation.

Finding the Best Deals Even On Bank Holidays

To get the best deals on a homeowner loan, it’s essential to shop around and compare different lenders. A good broker can help you navigate the market and find a loan that suits your needs. They can also provide valuable advice on how much you could borrow and the terms that will likely be offered to you.

Eligibility and Acceptance characteristics could help where you pay less interest with a personalised rate

Your eligibility for a homeowner loan will depend on several factors, including your credit score, income, and equity. While poor credit can make it more challenging, it doesn’t make it impossible. By working with a good broker, you can improve your chances of being accepted. They will help you understand the criteria and prepare a strong application.

Representative Example and Transparency

A representative example provides a clear picture of the cost of borrowing. It includes the interest rate, monthly payments, and the total amount payable. While it’s only an example, it helps you understand the potential costs. Always ask your lender for a representative example and ensure all fees are transparent before agreeing to the loan.

Using Equity to Improve Financial Health

Using your home equity can be a great option for managing and reducing financial burdens. Whether you need to consolidate other debts, finance home improvements, or cover unexpected expenses, a homeowner loan can provide the funds you need. Ensure you fully understand the terms and how much you could borrow based on your available equity.

Last Resort Considerations on how a loan should help you

While homeowner loans can be beneficial, they should be considered a last resort if you have poor credit. These loans are secured against your property, which means your home is at risk if you fail to repay. Before applying, explore other options and ensure this is the right decision for your financial situation.

Working with a Good Broker where you may be able to get secured homeowner loans with a poor credit score

A good broker can make a significant difference in your loan application process. They can help you find the best deals, explain the terms, and assist with the application. Having an expert can increase your chances of acceptance and ensure you get a loan that meets your needs.

You may find the best way, or the most helpful way, is to have all your debts in one place. You could get one lender to take all your debts.

Fully Understanding the Loan Terms for large amounts without using other assets

Before accepting a loan, fully understand all the terms and conditions. This includes the interest rate, repayment schedule, fees, and any penalties for early repayment. Understanding these details can help you avoid surprises and manage your finances effectively.

Making Informed Decisions

Making informed decisions is crucial when applying for a homeowner loan. Assess your financial situation, consider your equity, and understand the risks involved. By doing so, you can make a decision that supports your financial goals and helps you manage your finances responsibly.

Calculating Available Equity

To calculate your available equity, subtract the outstanding mortgage balance from your home’s current market value. This figure is essential when determining how much you could borrow. Lenders will use this information to assess your eligibility and the loan amount they can offer you.

Exploring Loan Options

Various loan options are available for homeowners with poor credit. Whether you need a small loan to cover immediate expenses or a larger loan for major financial needs, it’s important to explore all your options. Understanding the different types of loans and how they work can help you choose the best option.

Assessing Your Financial Situation

Before applying for a loan, assess your financial situation thoroughly. Consider your income, expenses, other debts, and home equity. This assessment will help you determine how much you need to borrow and whether you can afford the repayments.

The Importance of Equity in Loan Approval

Equity plays a crucial role in loan approval. The more equity you have, the lower the risk for the lender. This can increase your chances of acceptance and result in better loan terms. Ensure you have enough equity before applying to improve your approval odds.

Using Equity to Cover Unexpected Expenses

Unexpected expenses can arise anytime, and having enough equity in your home can provide a financial cushion. Whether it’s medical bills, home repairs, or other emergencies, a homeowner loan can offer the necessary funds. Ensure you fully understand the loan terms and how they fit into your financial plan.

Loan Size and Borrowing Limits

The loan size you can obtain depends on several factors, including your equity, income, and credit score. Lenders will consider these factors to determine how much you can borrow. Ensure you understand your borrowing limits and choose a loan size that you can comfortably repay.

Planning for Repayment

Repaying a homeowner loan requires careful planning. Consider your income, expenses, and other financial commitments. Make sure you can afford the monthly payments without compromising your financial stability. A well-planned repayment strategy will help you manage the loan effectively.

Exploring Alternatives to Homeowner Loans

If you have poor credit, a homeowner loan might not be your only option. Explore alternatives like personal loans, credit counselling, or debt management plans. These options might offer different terms and conditions that better suit your financial situation.

Using Equity to Achieve Financial Goals

Using your home equity can help you achieve various financial goals, from consolidating financial commitments to financing major purchases. Ensure you fully understand the terms and how much you could borrow based on your available equity. This will help you make informed decisions and achieve your goals responsibly.

Poor Credit Homeowner Loans

Poor credit homeowner loans can provide a viable solution for those looking to manage their finances more effectively. Understanding the process, assessing your equity, and working with a good broker can increase your chances of being accepted. Before proceeding, ensure you fully understand all the terms and conditions, and plan your repayment strategy carefully. With the right approach, a homeowner loan can help you achieve financial stability and meet your goals.

What security is acceptable for Close Brothers consolidate debt loans bad credit in 2025?

Depending on the loan type, asset finance companies like Close Brothers typically require tangible assets, such as vehicles, equipment, or property, as security for loans.

For precise information on what security is acceptable for Close Brothers’ debt consolidation loans, especially for those with bad credit, it’s recommended to contact Close Brothers directly or visit their official website for the most accurate and up-to-date information.

Does a Clydesdale Bank consolidate debt with bad credit allow me to use a car as security?

Lenders like Clydesdale Bank’s acceptance of security types can vary, and it’s common for banks to have different criteria for secured loans, including what assets can be used as collateral.

For accurate and detailed information regarding Clydesdale Bank’s security requirements for debt consolidation loans, particularly for those with bad credit, contacting the bank directly would provide the most reliable guidance.

Can I apply for The Co-operative Bank consolidate loans with bad credit in person in the branch?

The Co-operative Bank offers personal loans, including debt consolidation loans for individuals with bad credit.

For individuals interested in debt consolidation, the bank suggests exploring alternative borrowing options and provides resources for financial guidance through services like MoneyHelper.

Is a Marks & Spencer consolidation loan bad credit UK online application only?

Traditionally, loan applications, including those for personal loans at banks like M&S Bank, required in-person branch visits. However, the current trend, including at M&S Bank, leans heavily towards online applications for personal loans. This shift offers convenience and accessibility, allowing applicants to complete the process from anywhere.

For those specifically seeking consolidation loans with bad credit, it’s advisable to review M&S Bank’s online resources or contact them directly to understand the available application methods and specific product offerings.

Is a Masthaven Bank consolidation loan for bad credit uk safe?

Masthaven Bank announced it would exit the UK banking market, impacting its savings and mortgage customers, but the information available did not specifically mention consolidation loans for bad credit.

It’s crucial to note this development for those considering Masthaven Bank for debt consolidation or any other financial products. Customers with existing products are advised on how the bank’s exit will be managed, ensuring safety and regulatory compliance for their financial products.

For a Metro Bank consolidation loan for poor credit are the Trustpilot reviews good?

For accurate and up-to-date customer feedback on Metro Bank’s loan services, I recommend visiting Trustpilot’s website directly and searching for Metro Bank to view their current ratings and reviews.

This will give you insights into other customers’ experiences and help you gauge the bank’s service quality, especially concerning consolidation loans for those with bad credit.

Is a Monzo consolidation loan with bad credit suitable for a shared ownership homeowner?

Monzo offers personal loans that can be applied for through their app, with loan amounts ranging from £200 to £25,000. The process is designed to be quick and straightforward for Monzo customers. However, the available information does not explicitly address whether these loans suit shared ownership homeowners with bad credit.

For the most accurate and tailored information regarding your situation, it would be best to contact Monzo directly through their app or customer service.

If I owe management fees on my flat will this stop me qualifying for HSBC debt consolidation loans poor credit?

Owing management fees on your flat might not directly disqualify you from qualifying for an HSBC debt consolidation loan, even if you have poor credit. HSBC considers various factors, including your income, existing debts, and ability to manage repayments, rather than focusing solely on one aspect of your financial situation.

However, all loan applications are subject to status and HSBC’s assessment of your financial circumstances. Contacting HSBC would provide the most accurate advice regarding specific eligibility criteria and discussing your situation.

Are Paragon Bank consolidation loans bad credit UK suitable for someone with a 350 credit score?

Obtaining a Paragon Bank consolidation loan in the UK with a credit score 350 can be challenging. With such a low score, approval may be difficult, and the terms may not be favourable if approved. Traditional lenders like Paragon Bank often prioritize applicants with better credit histories. Exploring alternative lenders or improving your credit score before seeking a consolidation loan is advisable.

Are Sainsbury’s Bank consolidation loans for bad credit UK online only or can you get help at the local Sainsbury’s?

Sainsbury’s Bank offers consolidation loans for bad credit in the UK primarily through its online application process. While you can initiate and manage the loan application online, the bank may also provide limited support and assistance through its customer service channels, including phone support.

Sainsbury’s Bank doesn’t have physical branches or local offices where you can visit in person for assistance with loan applications. Therefore, the primary mode of interaction for its loan products is via its website or customer service hotline.

Suppose you have specific questions or need assistance with a Sainsbury’s Bank consolidation loan. In that case, it is recommended that you contact customer support through their online or phone channels for guidance and support throughout the application process.

If I am considering Scottish Widows Bank consolidation loans for poor credit, do I have to pay the valuation fee upfront?

When considering Scottish Widows Bank consolidation loans for poor credit, it’s important to note that the requirement for paying a valuation fee upfront can vary depending on the specific loan terms and your circumstances.

Valuation fees are typically associated with mortgage loans and are used to assess the value of the property being used as collateral. However, if you’re applying for an unsecured consolidation loan, it’s unlikely that you’ll need to pay a valuation fee upfront.

Nevertheless, it’s advisable to carefully review the loan offer terms and conditions and clarify any fees or charges with the lender to ensure full transparency before proceeding with the loan application.

Do Secure Trust Bank consolidation loans UK bad credit have affordable interest rates?

Secure Trust Bank consolidation loans in the UK for individuals with bad credit may have interest rates that are less competitive than those offered to borrowers with better credit histories. Lenders often adjust interest rates based on the level of risk associated with the applicant’s credit profile.

If you have bad credit, you’re considered a higher risk, and as a result, the interest rates on your consolidation loan may be higher. To determine the affordability of a Secure Trust Bank consolidation loan, it’s crucial to compare their interest rates and terms with other lenders and carefully assess whether the monthly payments fit comfortably within your budget.

Have Shawbrook Bank consolidation loans with bad credit uk got interest rates that are competitive with other lenders?

Shawbrook Bank consolidation loans in the UK for individuals with bad credit may not offer the most competitive interest rates compared to loans offered to borrowers with better credit scores. Lenders typically adjust interest rates based on the risk associated with the applicant’s credit history. Therefore, those with bad credit might face higher interest charges.

To determine if Shawbrook Bank’s rates are competitive, it’s essential to shop around and compare their loan terms with those of other lenders. Additionally, consider improving your creditworthiness over time to access more favourable loan options with lower interest rates.

Is Starling Bank debt consolidation for bad credit available if I don’t have a Starling Bank account?

Starling Bank typically requires applicants to have an account to access its financial products and services, including debt consolidation loans.

While they may offer competitive loan options, having an existing account with them is often a prerequisite. However, policies and offerings can change over time, so it’s advisable to contact Starling Bank directly or visit their website for the most up-to-date information on their eligibility requirements and loan offerings, especially if you’re interested in debt consolidation with bad credit.

Is a Tesco debt consolidation loan bad credit direct lender for Tesco Clubcard holders only?

Tesco Bank does offer debt consolidation loans for individuals, including those with bad credit, and they are not limited exclusively to Tesco Clubcard holders. While being a Clubcard holder may have specific benefits and potentially lead to more favourable loan terms, Tesco Bank extends its loan products to a broader customer base.

Eligibility for a debt consolidation loan with Tesco Bank is typically determined by factors such as your credit history, income, and financial circumstances rather than Clubcard membership alone. However, lending policies can change, so it’s advisable to check Tesco Bank’s current eligibility criteria for their debt consolidation loans.

Can you apply for a TSB debt consolidation loan bad credit online or in person in a branch?

You can apply for a TSB (TSB Bank) debt consolidation loan for bad credit primarily through their online application process. TSB Bank provides a digital platform that allows applicants to complete their loan applications online. This convenient online application process makes it accessible to many customers, including those with bad credit.

TSB Bank does not require borrowers to apply for debt consolidation loans in person at a branch. However, it’s essential to check TSB Bank’s current application procedures and policies, as they may have evolved since then. Generally, online applications are a convenient and efficient way to apply for such loans.

I live in London, can I get an Ulster Bank debt consolidation loan bad credit UK even though it’s a bank from Northern Ireland?

Yes, you can typically apply for an Ulster Bank debt consolidation loan in the UK, even if you live in London or anywhere else in the UK. Ulster Bank is a subsidiary of NatWest Group, which operates in Northern Ireland and the rest of the UK. They offer customers a range of financial products and services across the United Kingdom.

When considering a debt consolidation loan with bad credit, it’s essential to meet the eligibility criteria set by the bank, which may include factors like your credit history and financial stability. You can check their specific requirements and apply online or through their designated channels.

Some people say the rates on a Vanquis Bank debt consolidation loan direct lender are very high.

Yes, it’s accurate to say that Vanquis Bank debt consolidation loans, as offered by a direct lender, can come with relatively high-interest rates. These loans are often tailored for individuals with poor or limited credit histories, representing a higher risk level for the lender.

As a result, Vanquis Bank may charge higher interest rates to compensate for this risk. While they provide a borrowing option for those with bad credit, it’s essential to carefully assess the interest rates and terms to determine if they align with your financial goals. Comparing rates with other lenders and exploring ways to improve your credit can help you secure more favourable loan terms.

Do I need a Yorkshire Bank Bank account to look at Yorkshire Bank debt consolidation loan eligibility?

Yorkshire Bank typically requires applicants to have a Yorkshire Bank account to be eligible for debt consolidation loans. Having an existing account with the bank can be a prerequisite for accessing their financial products and services.

However, policies and requirements may change over time, so it’s advisable to contact Yorkshire Bank directly or visit their website to get the most up-to-date information on eligibility criteria for their debt consolidation loans. They can provide the specific details you need if you’re interested in their loan offerings.

Do Barclays Bank offer Barclays debt consolidation loans bad credit, or are they just a prime bank?

Barclays Bank primarily focuses on providing financial services to customers with good credit histories. While they offer debt consolidation loans, these products are typically geared towards individuals with better credit scores who meet their lending criteria.

If you have bad credit, you may find it more challenging to secure a debt consolidation loan directly from Barclays. However, they may have alternative financial products or services to help you improve your financial situation. It’s advisable to contact Barclays directly or visit their website to inquire about their current loan offerings and eligibility requirements, as policies may evolve.

Are Zopa Bank still offering a Zopa Bank debt consolidation loan for bad credit UK in Q2 2025?

Zopa Bank’s offerings, including debt consolidation loans, may change over time due to various factors.

To determine if Zopa Bank is still offering debt consolidation loans for bad credit in the UK in Q2 2025, I recommend visiting their official website, contacting customer service, or checking with relevant financial sources for the most current and accurate information regarding their loan products and eligibility criteria. This will ensure that you have the most up-to-date details on their offerings.

Is a Danske Bank debt consolidation loan poor credit available to people in England, Wales, Scotland and Northern Ireland?

Danske Bank typically operates in Northern Ireland and primarily serves customers in that region. While they may offer various financial products and services, including loans, it’s important to note that their availability to customers in England, Wales, and Scotland may be limited or subject to specific conditions.

Suppose you have poor credit and reside outside Northern Ireland and are seeking a Danske Bank debt consolidation loan. In that case, it’s advisable to contact Danske Bank directly or visit their official website to inquire about their current lending practices, eligibility criteria, and whether they extend their services to customers in other parts of the UK.

The Co-operative Bank debt consolidation loan uk bad credit; what proofs of address and identity are required and do they do 30 years?

The specific proofs of address and identity required for a Co-operative Bank debt consolidation loan in the UK, especially for individuals with bad credit, can vary depending on the bank’s policies and the nature of the loan application.

Generally, you can expect to provide documents such as a valid passport or driver’s license for identity verification and recent utility bills, bank statements, or government-issued letters with your name and current address as proof of residence.

It’s advisable to contact the Co-operative Bank directly or visit their website to obtain the most up-to-date and accurate information regarding their documentation requirements for debt consolidation loans, ensuring a smooth application process.

Are Metrobank debt consolidation loans bad credit available to non-Metrobank Bank account holders?

Metro Bank typically requires applicants to have an existing Metro Bank account to be eligible for its financial products and services, including debt consolidation loans. While it may have specific offerings for its account holders, extending these services to non-account holders is less common.

To confirm the most up-to-date information on eligibility criteria and whether Metro Bank offers debt consolidation loans to individuals who do not hold accounts with them, it’s recommended that you contact the bank directly or visit its official website. Their customer service representatives can provide accurate and current details on their loan offerings.

Can I apply for Bath Building Society debt consolidation loans bad credit direct lender in the branch, or is it just done via a regulated broker?

The application process for Bath Building Society debt consolidation loans, especially for individuals with bad credit, can vary. While they may offer loans through their branch network, they might also work with regulated brokers to facilitate the application process.

It’s advisable to contact Bath Building Society directly or visit their website to clarify the current options available for applying for their debt consolidation loans. They can provide specific details on whether you can apply directly through their branches or if utilizing a regulated broker is the preferred method for obtaining one of their loans.

What percentage of people who apply for Beverley Building Society debt consolidation loans for bad credit in the UK get rejected because their credit scores are too low?

I don’t have access to real-time statistics or specific data regarding the rejection rates for Beverley Building Society debt consolidation loans for individuals with bad credit in the UK.

The approval or rejection of loan applications is influenced by various factors, including an applicant’s credit score, financial history, income, and the lender’s specific lending criteria. It’s essential to remember that each applicant’s situation is unique, and rejection rates can vary over time.

To get accurate and up-to-date information on approval rates and eligibility criteria, it’s recommended that you contact Beverley Building Society directly or visit their official website. They can provide you with the most current statistics and guidance regarding their loan offerings.

Are Bristol and West Direct the only place where you can get Bristol & West debt consolidation loans direct lenders, or can you apply through an advisor?

Like many lenders, Bristol & West typically offers debt consolidation loans directly to customers through its channels. However, it may also work with independent financial advisors or brokers who can assist individuals in applying for their loans. Whether you apply directly or through an advisor may depend on your preference and circumstances.

To clarify the current options available for applying for Bristol & West debt consolidation loans and whether they collaborate with advisors, it’s advisable to contact the lender directly or visit their official website. They can provide detailed information on their application process and any potential involvement of advisors or intermediaries.

Is the Buckinghamshire Building Society debt consolidation loans eligibility stringent regarding affordability and loan to value?

The eligibility criteria for Buckinghamshire Building Society debt consolidation loans, including affordability and loan-to-value (LTV) ratios, can vary depending on the lender’s policies and the specific loan product. Typically, lenders assess affordability to ensure borrowers can comfortably manage loan repayments.

LTV ratios may also be considered when collateral, such as property, is involved.

The strictness of these criteria can vary from lender to lender, and it’s best to contact Buckinghamshire Building Society directly or visit their official website for the most up-to-date and detailed information on their eligibility requirements for debt consolidation loans. They can provide you with specific insights into their affordability and LTV criteria.

Do the Burnley Building Society ask a lot of questions about existing debt before you apply for Burnley Building Society debt consolidation loans for bad credit direct lender?

As with any lender, the extent of questions about existing debt when applying for Burnley Building Society debt consolidation loans for bad credit can vary. Typically, lenders inquire about your existing debts to assess your financial situation accurately and determine your ability to manage additional debt.

They may ask about the types and amounts of outstanding debts, monthly payments, and the purpose of the loan. The level of detail and the specific questions asked may depend on the lender’s underwriting process.

When applying for a larger debt consolidation loan, it’s advisable to be prepared to provide information about your current debt obligations, as this helps lenders make informed decisions about your loan application.

You should only borrow money you can comfortably afford so there is less risk to your current circumstances, and your loan application must be truthful.

Are the Post Office debt consolidation loans for bad credit direct lenders the best deal currently for people with a poor credit history?

Determining the “best” debt consolidation loan for individuals with poor credit history involves considering factors beyond just the lender, such as interest rates, loan terms, and individual financial circumstances. While the Post Office may offer debt consolidation loans, their terms and rates may not necessarily be the most competitive in the market.

It’s essential to shop around and compare loan offers from various lenders to find the one that best suits your needs. Additionally, improving your credit score over time can open up more favourable loan options. Therefore, the “best” deal can vary from person to person, depending on their unique financial situation and credit profile.

How strict are the Halifax on income when I apply for Halifax debt consolidation loans bad credit?

Halifax’s strictness on income requirements when applying for bad credit debt consolidation loans can vary based on individual financial circumstances and the specific loan product. Generally, lenders assess income to ensure borrowers have the means to meet their loan obligations.

While Halifax may have guidelines in place, the degree of strictness can differ from one applicant to another. It’s advisable to contact Halifax directly or visit their official website to understand their current income criteria and eligibility requirements for debt consolidation loans, as these policies may have evolved. They can provide the most accurate and up-to-date information tailored to your situation.

Is the Cambridge Building Society debt consolidation loans for bad credit UK direct lender the best deal in 2025?

Determining whether The Cambridge Building Society’s debt consolidation loans for bad credit in the UK, as a direct lender, are the best deal depends on various factors, including individual financial circumstances, loan terms, and interest rates. It’s essential to compare loan offers from multiple lenders to find the deal that aligns with your specific needs and credit situation.

While The Cambridge Building Society may offer competitive loan options, what constitutes the “best deal” varies from person to person. It’s advisable to shop around, consider various loan terms, and review the interest rates to make an informed decision that suits your financial goals.

Do Chorley Building Society debt consolidation loans for poor credit have a massive early repayment charge?

Chorley Building Society’s approach to early repayment charges on debt consolidation loans for poor credit may vary depending on the specific loan product and its terms. Generally, lenders include clauses for early repayment charges to offset potential losses in interest when borrowers pay off their loans ahead of schedule.

The extent of these charges can differ among lenders. To get precise and up-to-date information on Chorley Building Society’s early repayment policies, it is recommended that you contact the society directly or visit their official website. They can provide detailed information about any associated charges and how they may apply to their loan offerings.

Do I need an account with the Coventry BS to apply for Coventry Building Society debt consolidation loans no credit check?

Typically, Coventry Building Society may require applicants to have an account with them when applying for debt consolidation loans. However, whether a credit check is performed can vary among lenders and specific loan products.

While some lenders may offer loans without a credit check, it’s essential to directly contact Coventry Building Society or visit their official website for the most current and accurate information regarding their loan offerings, eligibility criteria, and whether they perform credit checks for debt consolidation loans. They can provide you with specific insights into their application process and requirements.

If my parents are with Cumberland BS, can they sign as a guarantor for a Cumberland Building Society debt consolidation loans UK bad credit for me?

The possibility of your parents acting as guarantors for a Cumberland Building Society debt consolidation loan in the UK, especially for individuals with bad credit, may depend on the lender’s specific policies and requirements. Some lenders allow family members to be guarantors, while others may have different criteria.

To determine if your parents can act as guarantors for such a loan, it is advisable to contact Cumberland Building Society directly or visit their official website. They can provide precise information regarding their guarantor policies and whether your parents would be eligible to assist you in securing the loan.

Is Darlington Building Society debt consolidation with bad credit a good idea, or am I better off with an IVA?

Deciding between a Darlington Building Society debt consolidation loan with bad credit and an Individual Voluntary Arrangement (IVA) depends on your specific financial situation. Both options have pros and cons.

Debt consolidation may help simplify payments, but interest rates can be higher. On the other hand, an IVA is a formal agreement with creditors that may reduce your overall debt but can impact your credit score significantly.

It’s crucial to consult a financial advisor or debt specialist to assess which option aligns better with your goals and circumstances. They can provide tailored advice to help you make an informed decision based on your unique financial challenges and objectives.

Will my existing mortgage lender consent to the 2nd charge if I want a Dudley Building Society debt loan consolidation bad credit?

Whether your existing mortgage lender will consent to a second charge when you seek a Dudley Building Society debt consolidation loan for bad credit can depend on various factors. Lenders typically assess the risk and terms individually. While some mortgage lenders may be open to second charges, others may have specific policies against them.

You must contact your mortgage lender directly to discuss your intentions and seek their consent. Additionally, when applying for a Dudley Building Society debt consolidation loan, they can guide you on navigating the process and ensure you meet all requirements, including any consent from your existing mortgage lender.

Will my Lloyds Bank mortgage department consent to a second charge for my Earl Shilton Building Society direct lender debt consolidation loan?

Obtaining consent for a second charge on your Lloyds Bank mortgage when applying for an Earl Shilton Building Society direct lender debt consolidation loan can vary based on your circumstances and Lloyds Bank’s policies. Many mortgage lenders have specific guidelines and criteria regarding second charges.

To determine whether Lloyds Bank will consent to such an arrangement, it’s advisable to contact their mortgage department directly. They can assess your situation, provide information on their policies, and guide you if a second charge is an option. Their expertise will ensure you have accurate and tailored information to make an informed decision.

Is the Ecology Building Society willing to lend against a non-standard construction property type for an Ecology Building Society loan debt consolidation bad credit?

The Ecology Building Society’s willingness to lend against a non-standard construction property type for a debt consolidation loan, especially for individuals with bad credit, may depend on its specific lending policies and the unique characteristics of the property in question. Non-standard construction properties can vary greatly, and some lenders may have restrictions or preferences regarding such properties.

To get precise information on whether Ecology Building Society is open to lending against your specific property type, it’s advisable to contact them directly or visit their official website. They can provide insights into their lending criteria and whether your property qualifies for a debt consolidation loan.

I have gambling on my bank statement, does this mean a Family Building Society loan for bad credit debt consolidation will be declined?

Gambling transactions on your bank statement may impact your eligibility for a Family Building Society loan for bad credit debt consolidation, but it doesn’t necessarily mean an automatic decline. Lenders typically assess various factors, including your financial behaviour and credit history.

Gambling transactions may raise concerns about your financial stability, so it’s essential to be transparent about your financial situation when applying for a loan.

A clear picture of your income and expenses and a plan for responsibly managing your debt can improve your approval chances. It’s advisable to contact the Family Building Society directly to discuss your specific circumstances and get personalized guidance on your loan application.

I have expensive haircuts, luxury holidays and other extravagancies on my bank statement. Will this make my application to Furness Building Society loan for debt consolidation bad credit UK fail?

Having expensive haircuts, luxury holidays, and other indulgences on your bank statement may not necessarily lead to an automatic failure of your Furness Building Society debt consolidation loan application, even if you have bad credit. While lenders assess your financial habits, they primarily focus on your overall financial stability and ability to repay the loan.

It’s crucial to be transparent about your expenses and demonstrate a clear plan for managing your debts responsibly. Furness Building Society may consider various factors in your application, so it’s advisable to discuss your specific situation with them. They can guide you in strengthening your application and increasing your chances of approval.

Are Hanley Economic Building Society long term loans bad credit direct lender available in branch in person only?

As a direct lender, Hanley Economic Building Society long-term loans for bad credit may be available in person at their branches and through other application channels. Lenders often offer multiple methods for applying for loans to accommodate different customer preferences.

To confirm the most up-to-date information on the availability of their long-term loans and application options, it’s advisable to contact Hanley Economic Building Society directly or visit their official website. They can provide precise details about their application process and where you can apply for their long-term loans, ensuring you have accurate information for your specific needs.

How do I contact the Harpenden BS about my Harpenden Building Society online debt consolidation loan application?

Contact them through their official website or customer service channels to inquire about your Harpenden Building Society online debt consolidation loan application. Visit their website and look for a “Contact Us” or “Customer Support” section, where you should find contact details, including phone numbers and email addresses.

Alternatively, you can contact them via their social media profiles if available. If you have an application reference number or account details, have them handy when you get in touch, as it will help their customer service team assist you more efficiently. They will be able to provide you with updates and address any questions or concerns you have about your application.

Will a Hinckley and Rugby Building Society poor credit consolidation loan homeowner loan application help or hurt my poor credit score in the short and long term?

A Hinckley and Rugby Building Society poor credit consolidation loan can potentially impact your credit score in the short and long term. In the short term, applying for the loan may temporarily dip your credit score due to the hard credit inquiry and the new debt account. However, managing the loan responsibly by making on-time payments can positively impact your credit score.

Consolidating existing debts into manageable payments can improve your credit utilization ratio and demonstrate responsible financial behaviour. In the long term, as you repay the loan, it can contribute to rebuilding your credit and potentially improving your creditworthiness. However, making payments consistently is crucial to see these positive effects.

Does a Santander consolidation loan have a hard credit search as part of the application?

Applying for a Santander consolidation loan may involve a hard credit search as part of the application process. Most lenders, including Santander, typically perform a hard credit inquiry to assess your creditworthiness and determine whether to approve your loan application. This inquiry may appear on your credit report and temporarily affect your credit score.

It’s essential to know that credit checks are standard when applying for loans, as they help lenders make informed lending decisions. However, it’s advisable to contact Santander or visit their official website for specific details about their application process and associated credit checks.

Does a Santander debt consolidation loan have a term you can extend?

In some cases, Santander debt consolidation loans may offer the option to extend the loan term. The availability of term extensions can depend on the specific loan product and the terms and conditions set by Santander at the time of your application. Extending the term can lower monthly payments but may increase overall interest costs.

Suppose you’re considering extending the term of your Santander debt consolidation loan. In that case, it’s advisable to contact Santander directly or refer to your loan agreement for details on whether this option is available and any associated terms and conditions. They can provide accurate and current information based on your loan agreement.

Do co op debt consolidation loans for poor credit have an early repayment charge?

Co-op debt consolidation loans for poor credit may or may not have an early repayment charge, depending on the specific loan product and terms you agree to when taking out the loan.

Early repayment charges are typically outlined in the loan agreement. To determine whether your Co-op debt consolidation loan has such charges, you must review the agreement or contact the Co-op directly.

If an early repayment charge applies, it’s typically a percentage of the outstanding loan balance. Understanding these terms in advance can help you make informed decisions about your loan and its potential cost implications.

Do Nationwide debt consolidation loans bad credit have an ERC throughout the entire term of the loan?

Nationwide debt consolidation loans for bad credit may or may not have an Early Repayment Charge (ERC) throughout the entire term of the loan. The presence and terms of an ERC can vary depending on the specific loan product and the agreement you enter into with Nationwide.

ERCs are typically more common in the early years of a loan, but they may be present throughout the entire term or only for a specific period. To get accurate information about whether your particular loan has an ERC and its terms, it’s essential to refer to your loan agreement or contact Nationwide directly. They can provide detailed insights into your loan’s terms and conditions.

What are the drawbacks of secured debt consolidation loans?

Secured debt consolidation loans have advantages, such as lower interest rates and the potential to consolidate multiple debts into a single manageable payment.

However, they also come with several drawbacks that borrowers should carefully consider:

- Risk of Asset Loss: Secured loans require collateral, often a home or other valuable asset. If you fail to make payments, you risk losing your property through repossession, which can be a significant downside.

- Higher Total Interest Costs: While secured loans offer lower interest rates than unsecured options, the longer loan terms can result in higher total interest costs over time.

- Limited Eligibility: Secured loans are not accessible to everyone. They require eligible collateral and a good credit history, which can exclude individuals with poor credit or those without valuable assets.

- Long-Term Commitment: Secured loans’ extended repayment periods mean a longer commitment, which may not be suitable for all borrowers.

- Potential for Over-Borrowing: Having access to significant amounts of money with a secured loan may tempt borrowers to take on more debt than they can handle, leading to financial stress.

- Impact on Credit Score: While making timely payments can positively affect your credit score, any missed payments or default can harm your credit and, in the worst case, lead to asset repossession.

- Difficulty in Refinancing: Refinancing a secured debt consolidation loan can be challenging, as it often requires finding another valuable asset to use as collateral.

While secured debt consolidation loans offer lower interest rates and the ability to manage debt, they carry substantial risks, especially regarding asset loss and higher total interest costs.

Borrowers should weigh these drawbacks against the potential benefits and consider their financial situation before securing a loan.

If you have too much debt, you could consider Step Change.

Can you get a secured loan for debt consolidation?

Yes, it’s easy to get a secured loan for debt consolidation as long as you have the income to support it.

Is a secured loan a good idea for debt consolidation – make debt easier?

It can be an excellent idea as it can save you money each month.

Do debt consolidation loans hurt your credit?

No, in many cases, quite the opposite, as they help you pay debt down.

How hard is it to get a debt consolidation loan?

Getting a debt consolidation loan is easy if you can prove your income to the lender at the right level.

Secured Debt Consolidation Secured Loans for Homeowners with Bad Credit

For homeowners with bad credit, securing a debt consolidation loan can be a lifeline to manage existing debts into one manageable payment. Debt consolidation loans work by having one monthly repayment, simplifying your financial commitments and potentially offering a lower interest rate. This comprehensive guide will help you understand how to effectively manage your debt, improve your financial future, and choose the right consolidation loan for your needs.

Understanding Debt Consolidation Secured Loans on the path to being debt free

A debt consolidation loan allows you to combine all your debts into a single loan with one monthly repayment. This approach can make managing your debts more straightforward. Using a debt consolidation loan calculator can help you determine how much you need to borrow and what your monthly repayments will be.

It’s important to note that a debt consolidation loan lets you have one monthly payment, which can simplify your financial management. For those with multiple lenders, this can reduce the stress and complexity of keeping track of various payment dates and amounts.

Types of Debt Consolidation Homeowner Loans – Representative APR applies

There are different types of debt consolidation loans available:

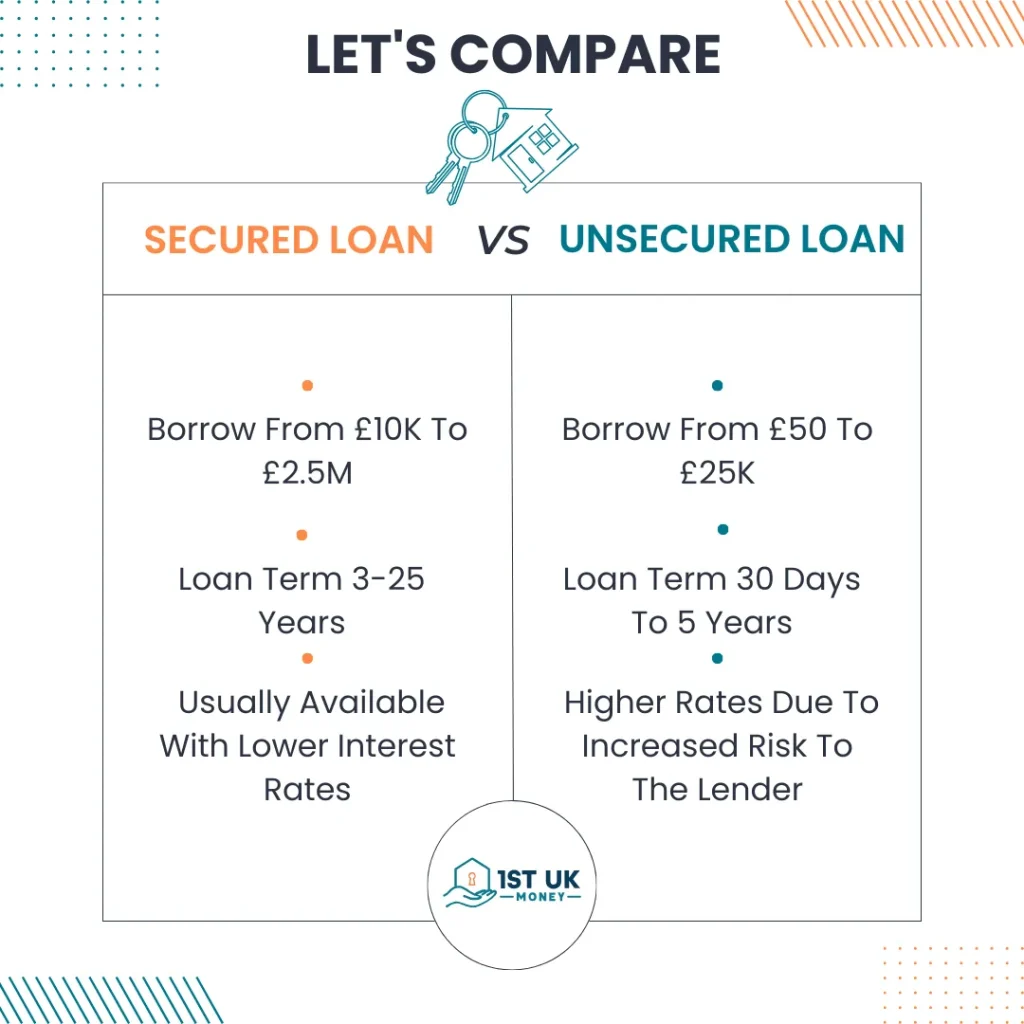

- Unsecured debt consolidation loan: This type of loan doesn’t require collateral but may have higher interest rates.

- Secured debt consolidation loan: This loan uses your home as collateral, potentially offering lower interest rates but posing a risk of losing your home if you default on payments.

Benefits of Debt Consolidation Loans – how much interest?

Debt consolidation loans offer several benefits:

- Combining existing debts into one can provide a clearer view of your financial obligations.

- A single loan with one monthly repayment can be easier to manage.

- Potentially lower interest rates compared to other borrowing.

- Fixed monthly payments can help with budgeting.

- Improved financial management can positively impact your credit score over time.

- A secured loan for bad credit with a joint application could be key to fixing your financial problems.

Before you apply for a debt consolidation loan, it’s essential to look at your credit file. Understanding your credit history can help you know what to expect regarding loan offers and interest rates. For UK residents, consolidating existing borrowing into an agreement online can be a convenient way to manage debts.

Applying for a Debt Consolidation Loan or other loans

To apply for a debt consolidation loan, follow these steps:

- Check your credit file to understand your credit score and history.

- Use a debt consolidation loan calculator to determine how much you need to borrow.

- Compare loans from various lenders to find the best deal for your current financial situation.

- Submit a loan application online or through a financial institution.

- Review the loan agreement carefully, including the interest rate, repayment term, and fees.

- Ensure there are no early repayment fees for your existing debts to avoid additional costs.

- Once approved, use the loan funds to pay off old debts and consolidate your financial obligations into one loan.

Consolidating Debt with a Fixed Monthly Payment and no early repayment fee

Consolidating debt with a fixed monthly payment can make it easier to manage your finances. A fixed rate debt may suit some people with many different lenders, providing consistency and predictability in your monthly budget.

Comparing Loan Offers – a consolidation loan to pay loans, credit cards, store cards and catalogues

When comparing loan offers, it’s essential to consider the following:

- Interest rates for secured homeowner loans: Look for loans with lower rates to save money over the long run.

- Repayment terms: Choose a term that fits your financial situation and ability to repay.

- Fees and charges for bad credit history: Be aware of any application fees, early repayment fees, or other costs associated with the loan.

- Unsecured Loan amount: Ensure the loan covers all your existing debts and any additional borrowing needs.

Using a loan calculator for repaying credit card debt can help you understand the impact of different rates and terms on your monthly payments and overall cost. Some people want to borrow money to pay off a debt management plan, making a debt consolidation loan attractive.

Managing Your Debt After Consolidation based on your personal circumstances

After consolidating your debts, managing your finances effectively is crucial to avoid falling back into debt. Here are some tips:

- Set up a budget to track your income and expenses so you can support you homeowner loan.

- Make all your loan repayments on time to avoid late fees and negative impacts on your credit score.

- Consider setting up a direct debit to ensure timely payments.

- Avoid taking on new debt while repaying your consolidation loan.

- Seek financial advice if you encounter any issues managing your debt.

- Avoid a county court judgment.

For those with bad credit, it’s important to note that you won’t have a good credit score without a county court judgment. Improving your credit score can help you qualify for better loan offers.

Alternatives to Debt Consolidation Loans could involve debt advice and a better interest rate with adverse credit

Before deciding on a debt consolidation loan, consider these alternatives:

- Debt management plans: These plans help you pay off your debts through a structured repayment plan.

- Balance transfer credit cards: Transfer your existing credit card balances to a card with a lower interest rate.

- Negotiating with creditors: Some creditors may be willing to negotiate lower interest rates or payment plans.

- Insolvency practitioners: For severe debt issues, an insolvency practitioner can help you explore options like individual voluntary arrangements (IVAs) or bankruptcy.

- Bad credit homeowner loans are ideal for larger amounts of money repaid over a longer term. A qualified mortgage advisor should process a secured homeowner loan or any debt secured on a home that may involve an arrangement fee.

- Do not forget about the risk of repossession.

Impact on Your Financial Future with the Borrowed Money regardless of property value

Choosing the right debt consolidation loan can positively impact your financial future. By consolidating your debts into one loan with a lower interest rate and fixed monthly payments, you can reduce your overall debt burden and improve your credit score. This can lead to better interest rates and loan offers in the future.

Single Monthly Repayment Frequently Asked Questions when borrowing money with a less than perfect credit history

If you have sufficient collateral in the form of a home and ample personal income, you should be able to make a single monthly payment to clear your debits.

How Do Debt Consolidation Loans Work for a UK resident – what about high street lenders?

Debt consolidation loans work by having one monthly repayment that covers all your existing debts. This simplifies your financial obligations and can often lower overall interest rates.

Can I Apply for a Debt Consolidation Loan if I Owe Money to Multiple Lenders and have existing loans?

You can apply for a debt consolidation loan if you owe money to multiple lenders. This type of loan allows you to combine your debts into one manageable payment, reducing the stress of managing numerous creditors.

What Should I Consider Before Applying for a Debt Consolidation Loan?

Before you apply for a loan, you should look at your credit file and compare loans to repay your overdraft debt or other debts. It’s also essential to ensure that your existing debts don’t have early repayment fees, which could add to your costs. You could also use the loan for home improvements. When you consolidate your debt you are looking to make

Is there a Debt Consolidation Loan Calculator I can use for my residential status?

Yes, many online tools are available, such as a debt consolidation loan calculator, that can help you calculate your monthly payments and overall cost based on different loan amounts and interest rates.

Are There Alternatives to Debt Consolidation Loans to make debt easier?

Several alternatives to consider include debt management plans, balance transfer credit cards, and negotiating directly with creditors. Each option has pros and cons, so it’s important to choose the right one for your financial situation.

How Will a Debt Consolidation Secured Loan Affect My Credit Score?

Taking out a debt consolidation loan can positively and negatively impact your credit score. Initially, applying for new credit may cause a slight dip in your score. However, if you make your payments on time and reduce your overall debt, your credit score can improve over time.

Can I Get a Debt Consolidation Loan with Bad Credit over 5 years?

Yes, there are options available for those with bad credit. Secured debt consolidation loans, which use your home as collateral, may offer more favourable terms than unsecured loans. It’s essential to shop around and compare different lenders to find the best deal.

What are the risks of debt consolidation for home owner loans?

The primary risk of a debt consolidation loan, especially a secured loan, is the potential to lose your home if you default on the loan. Additionally, if the loan term is extended significantly, you may pay more in interest over the long run, even with a lower interest rate.

Another common question is, does debt consolidation hurt your credit file like some short-term loans do? The answer is likely no, as lenders like to see all your lending agreements managed properly.

How Can I Ensure I Choose the Right Debt Consolidation Loan?

To choose the right debt consolidation loan, compare different loan offers, consider the interest rates, repayment terms, and any associated fees, and use a loan calculator to understand the impact of different loan options on your monthly payments and overall cost. Seek professional advice if needed to make an informed decision.

Suppose you can make regular payments on three credit cards at higher rates. In that case, you may be able to get a lower apr promotional period longer repayment term loan from a credit union, where higher rates do not exist even in the small print.

What Are the Benefits of Using a Debt Consolidation Loan?

A debt consolidation secured loan can simplify your financial management by combining multiple debts into one payment, potentially lowering your interest rate, and improving your credit score. It’s a practical solution for those struggling with managing multiple creditors and high-interest debt.

By understanding how debt consolidation loans work and carefully considering your options, you can take control of your finances and work towards a more stable financial future. Always ensure you read and understand the terms of any loan agreement before signing and seek professional advice if you have any doubts or concerns.

For more information on managing debt and financial planning, consider visiting advice pages from reputable sources like Money Saving Expert, Martin Lewis equity release advice, and other financial advisory websites.

It could be wise to find a debt advisor and get some free debt advice before consolidating your debts with more credit, as this could make your situation worse.

An administration order or bankruptcy may be necessary to permanently delete your current debts, missing payments, and other higher-interest-rate debt.