The Uses Of A Secured Loan – From 6.8% No Broker Fees

Did you know secured loans can let you borrow up to £1000,000? This illustrates the significant impact that a form of borrowing can have on homeowners. We’ll examine the various ways secured loans can assist property owners in the UK and explore the numerous applications of a secured loan.

Secured or home equity loans let you use your property as collateral. They’re great for borrowing small to large amounts. If you want to improve your home, pay off debts, or make a significant purchase, a secured loan could be a helpful option.

A positive aspect of secured loans is that they often have lower interest rates than unsecured loans. This means you could save money over time, especially with longer repayment plans.

A very wide specialised lender panel with 100’s of secured loan products & high rates of acceptance!

- Match the term of your loan to remaining term of your mortgage

- Excellent for clearing other loans/credit cards/existing car credit

- New lenders for 2026 now available

- High loan-to-value (LTV) with many lenders

- Same day decisions. Fast & simple

- Retain your existing mortgage with no stress

- Soft footprint credit search that won’t impact your credit score

- Rates from just 6.8%

- Borrow up to 100% of the value of your home (subject to status)

- No pressure to proceed

Pre-Decision In-Principle Application Form. Sympathetic To Historic Credit Issues: All Forms Of Credit Considered

Some Important Points To Consider:

- Secured loans can offer borrowing amounts up to £1,000,000

- Homeowner loans typically feature lower interest rates than unsecured options

- Typical uses include home improvements, debt consolidation, and major purchases

- Longer repayment terms can make monthly payments more manageable

- Secured loans can potentially improve credit scores with regular, on-time repayments

Uses Of A Secured Loan

Secured loans allow homeowners to finance various projects and needs. We’ll examine the main uses of secured loans and what you can do with them.

Home Improvements and Renovations

Many homeowners choose secured loans for home improvements. These loans are great for big projects like:

- Kitchen or bathroom upgrades

- Loft conversions

- Home extensions

- Urgent repairs

A secured loan allows you to borrow between £ 10,000 and £ 1000,000, depending on your property’s value and your situation. This is ideal for extensive renovations that can significantly boost your property’s value.

Debt Consolidation

Debt consolidation loans are a common choice for secured borrowing. They help combine multiple debts into a single loan, potentially lowering your interest rate and monthly payments. However, it’s essential to understand the risks associated with switching from unsecured to secured debt first.

Financing Major Purchases

Secured loans can fund larger purchases such as:

- Vehicles

- Weddings

- Luxury holidays

They often have lower interest rates than unsecured loans, making them a cheaper way to pay for these big expenses.

Complete Our Quick & Simple Form. New Rates For 2026. Soft-Search Technology

Secured Loans for Business Purposes

Secured loans for businesses are a strong way to obtain capital for various needs. They allow companies to use their assets to secure funding, thereby opening up numerous funding opportunities.

Asset-backed financing for companies

Asset-backed financing allows businesses to use their assets as collateral, which can result in better rates than those offered for unsecured loans. It’s great for new companies or those with less-than-great credit. Lenders typically offer 50-70% of the asset’s value, but in some cases, they may provide up to 100% coverage.

Expanding business operations

Secured loans, ranging from £5,000 to £5 million, can help businesses expand. These loans typically have lower interest rates, usually ranging from 8% or less. They also have longer repayment times of up to 240 months. This makes them ideal for significant investments, such as hiring staff, purchasing equipment, or covering payroll.

Purchasing commercial property

Secured loans are an excellent option for companies looking to purchase or refinance commercial property. They give access to a significant pool of money, up to 75% of the property’s value. This type of financing offers stability with fixed interest rates and flexible terms that fit the business’s needs.

For many UK businesses, secured loans are a viable option for securing the capital they need for growth and development.

So entrepreneurs and business owners can use secured loans for business goals, such as:

- Expanding operations

- Purchasing equipment

- Investing in additional properties for buy-to-let

When considering a secured loan for your business, ensure you can afford it and understand the fees involved.

| Loan Purpose | Average Loan Amount | Typical Repayment Term |

|---|---|---|

| Home Improvements | £40,000 | 8-16 years |

| Debt Consolidation | £62,000 | 15 years |

| Major Purchases | £25,000 | 5-10 years |

| Business Investments | £100,000+ | 10-25 years |

Understanding Secured Loans: An Overview

Secured loans are a common way for people in the UK to borrow varying amounts of money. We will explore what secured loans are, how they differ from unsecured loans, and the critical role of collateral.

Definition and Basic Concepts

A secured loan means you borrow money and give something valuable as collateral, usually a property. This makes lenders offer better terms because they can repossess the asset if you default. These loans are also known as home equity loans or second-charge mortgages.

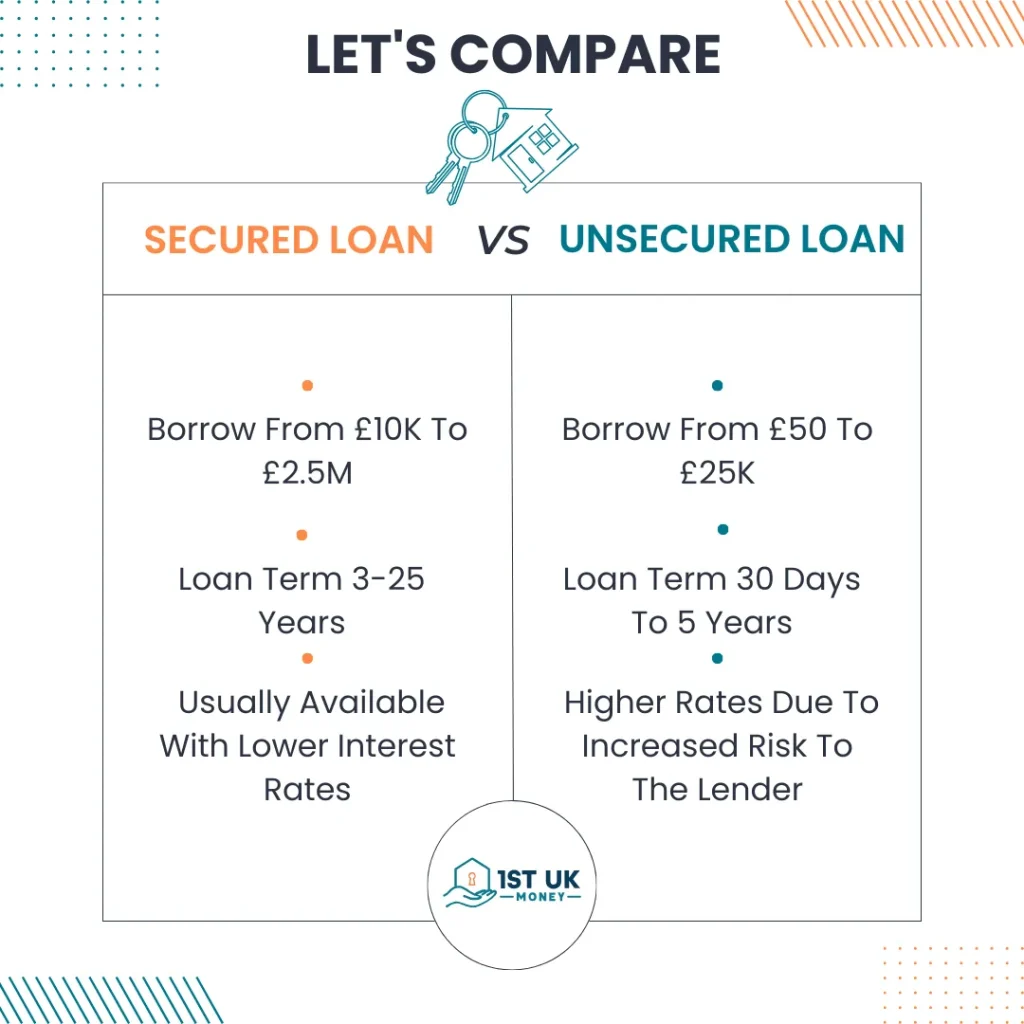

How Secured Loans Differ from Unsecured Loans

Secured and unsecured loans are different because secured loans need collateral. This affects many parts of the loan:

- Loan amounts: Secured loans can be up to £ 1,000,000; unsecured loans usually don’t exceed £25,000.

- Interest rates: Secured loans have lower rates because they’re less risky for lenders.

- Repayment terms: Secured loans can last up to 30 years, while unsecured loans typically last 5-7 years.

- Approval process: Secured loans might be easier to get, even if your credit is not great.

Advantages of Choosing a Secured Loan

Secured loans offer numerous benefits, making them a suitable choice for many individuals in the UK. Let’s look at some key advantages that set them apart.

Access to Larger Loan Amounts

Secured loans let you borrow a lot of money. You can get up to 80% of your property’s value. For example, home loans let you borrow about 80% of your home value. This provides you with sufficient funds for major purchases or investments.

Lower Interest Rates

Secured loans usually have lower interest rates than unsecured ones. This is because they are less risky for lenders, as they have collateral. Home loans, for example, often have some of the lowest interest rates.

Longer Repayment Terms

Secured loans also offer longer repayment periods. Home loans can last from 15 to 30 years. This makes monthly payments more manageable for borrowers.

Potential for Improving Credit Score

Secured loans can help improve your credit score. Paying back your loan on time demonstrates your financial responsibility. This can help raise your credit score over time.

| Loan Type | Typical Loan-to-Value Ratio | Interest Rate Comparison |

|---|---|---|

| Home/Secured Loans | Up to 80% | Lower than unsecured loans |

| Vehicle Loan | Up to 90% | Lower than personal loans |

| Gold Loan | Up to 75% | Lower than credit cards |

The Application Process for Secured Loans

Applying for a secured loan may seem daunting, but understanding the steps can make it easier. It typically takes three to four weeks, but some lenders can complete the process in as little as one week.

We start by collecting important documents for our loan application. These include:

- Three months of bank statements

- Recent mortgage statements

- Payslips or tax returns

- Credit card statements

- Proof of identity and address

After gathering these documents, the lender will carefully review them. They check the property’s value, income, and credit score. A higher credit score can mean better interest rates.

Lenders will also assess the value of our property during the application process. This might be done quickly or take longer. They check whether we own the property legally and determine its market value.

Comparing Secured Loan Options

Knowing what affects your borrowing is key when considering your secured loan options. We’ll examine the key factors to consider when comparing secured loans.

Fixed vs. Variable Interest Rates

Secured loans have two main interest rate types: fixed and variable. Fixed rates, usually around 6.5%, stay the same for 60 months. Variable rates, starting at 4.95% above the Bank of England Base Rate after 60 months, are subject to market fluctuations.

Loan Terms and Repayment Periods

Secured loans can be repaid over up to 35 years. Longer terms mean smaller monthly payments but more interest over time.

Fees and Associated Costs

When comparing secured loans, consider the additional costs. Fees can range from £3,345 to £3,745, and the total price can reach 12.5% APRC. Some lenders offer loans as small as £10,000, while others offer loans up to £ 1,000,000.

| Loan Feature | Range/Value |

|---|---|

| Loan Amount | £10,000 – £1000,000 |

| Repayment Period | Up to 35 years |

| Associated Fees | £3,345 – £3,745 |

| APRC | Up to 12.5% |

At least 51% of customers get the representative APR. Your credit score significantly affects loan terms, and defaults can make it harder to get approved. Always compare different secured loans to find the best one for you.

Impact of Secured Loans on Remortgaging

Secured loans and remortgaging are closely linked in the property finance sector. Many ask, ‘Does a secured loan affect remortgaging?’ Yes, it can impact your options.

Secured loans add a second charge to your property, making remortgaging harder. Lenders consider this debt when you apply, which might limit your choices.

- Equity: A secured loan reduces your property’s equity, which in turn affects your loan-to-value ratio.

- Affordability: Lenders consider your secured loan repayments when checking what you can afford.

- Complications: Some lenders might not offer a remortgage with an existing secured loan.

Remortgaging with a secured loan isn’t impossible. It requires careful planning. Some use remortgaging deals to clear their secured loan, possibly saving money by getting a lower interest rate.

| Aspect | Impact on Remortgaging |

|---|---|

| Equity | Reduced, affecting LTV ratio |

| Affordability | Loan repayments considered |

| Process | It may be longer and more complex |

| Legal Fees | Additional £200-£300 possible |

If you’re considering a secured loan, consider your future property plans. Getting advice from a mortgage broker, such as 1st UK, can help you find the best solution.

Managing and Repaying Your Secured Loan

Managing your secured loan effectively is crucial to protecting your assets. It’s vital to stay on top of your financial duties. Let’s examine some practical ways to manage secured loans.

Direct debits are a great way to ensure timely payments. This method helps maintain a healthy credit score and prevents the loss of assets. Remember, failing to pay on time can negatively impact your credit score.

Don’t hesitate to contact your lender if financial difficulties arise. Many lenders can offer temporary assistance to help you stay afloat. Talking openly can also prevent legal action and protect your home or other assets.

| Repayment Strategy | Benefits |

|---|---|

| Overpayments | Reduce overall interest, shorten loan term |

| Regular reviews | Optimise loan terms, consider refinancing |

| Budgeting | Prioritise payments to avoid falling behind |

If you can, try making overpayments. This can reduce the interest and shorten your loan term. But always check for early repayment fees first.

Potential Risks and Considerations

Secured loans offer numerous benefits, but understanding the associated risks is crucial. We’ll review the key factors to consider before making a decision.

The most significant risk is losing your collateral, usually your home in the UK. If you can’t repay the loan, you could lose your property. This shows the importance of planning your finances well before taking out a secured loan.

Another thing to consider is the long-term cost. Secured loans may offer lower interest rates and longer repayment terms, but this can result in paying more interest over time. Ensure that you calculate the total cost of borrowing, including not just the monthly payments.

Early repayment charges are another consideration. You may incur additional fees if you pay off your loan early. These fees can increase the cost of your loan, so review the terms carefully and regularly.

| Consideration | Impact |

|---|---|

| Missed Payments | Risk of property repossession |

| Long-term Borrowing | Higher total interest costs |

| Early Repayment | Potential fees and charges |

| Credit Score | Negative impact if payments are missed |

Eligibility Criteria for Secured Loans

Understanding what you need for a secured loan is key. We’ll review the key factors lenders consider when determining if you qualify for one.

Property Ownership Requirements

You must own a property to use as collateral for a secured loan. The property’s value and your share in it affect how much you can borrow. Lenders use different ways to value the property based on when you bought it.

Credit Score Considerations

A good credit score is helpful, but it’s not always a requirement for secured loans. Lenders primarily consider whether you can afford the loan and the value of your property. This makes secured loans a better option for those with not-so-great credit.

Income and Affordability Assessments

Lenders check your income to see if you can afford the loan. You’ll need to show recent payslips or a P60 if you work. If you’re self-employed, you must provide 12 months of business history and proof of income, such as SA302 forms.

| Eligibility Factor | Requirement |

|---|---|

| Age | 18-85 years old |

| Residency | UK resident with three years of address history |

| Property | Owned property with sufficient equity |

| Income Multiple | 6-7 times gross annual income |

| Employment | Stable job or 12+ months self-employed |

Meeting these requirements doesn’t mean you’ll get a loan. But it helps. Lenders carefully review each application, considering multiple factors to determine if you’re eligible for a secured loan.

Uses of Secured Loans, which are popular in 2026

We’ve examined how secured loans help homeowners access funds. Secured loans typically offer lower interest rates than unsecured ones, making them a suitable option for home improvements or debt repayment.

Having your property as collateral means you can borrow more and pay back over time. For example, a £10,000 secured loan at 5% interest over ten years would result in monthly payments of approximately £106.07. This can be helpful, but remember that your home could be at risk if you’re unable to make your payments.

Before taking out a secured loan, consider your finances. These loans can help improve your credit score if used wisely, but they also carry risks, such as losing your assets or ending up with negative equity. Always review the loan’s terms and conditions, including any additional fees, to ensure it aligns with your financial plans.

Purpose Of A Secured Loan FAQ’s

What is a secured loan?

A secured loan lets you use your property as collateral. This means your property is at risk if you are unable to repay the loan. It’s also known as a homeowner loan or second-charge mortgage.

What are the advantages of a secured loan?

Secured loans have significant benefits. You can borrow more money, often up to £100,000. They usually have lower interest rates because the lender has less risk. You can also repay over a more extended period, up to 25-30 years. Making timely payments can also help improve your credit score.

What can a secured loan be used for?

You can use a secured loan for many things. This includes improving your home, paying off debts, purchasing large items such as cars or wedding dresses, or investing in a business. They’re ideal for large projects or high-value items.

What are the eligibility requirements for a secured loan?

To get a secured loan, you must own property with enough equity. Lenders look at your credit score, income, and how well you can afford the loan. They want to ensure that you can repay what you owe.

How does the application process for a secured loan work?

Applying for a secured loan starts with an initial enquiry. Then, your property is valued, and credit and affordability checks are conducted. You’ll need to show proof of income, property documents, and details of your current debts.

How does a secured loan impact remortgaging options?

Getting a secured loan can affect your future remortgaging options. It might reduce the equity in your property, which could change how much you can borrow later. Some lenders might not offer remortgaging if you already have a secured loan.

Can businesses use secured loans?

Yes, businesses can use secured loans for big projects. They can get more capital to expand, buy commercial property, or for working capital. Using company assets as collateral makes it easier to get a loan.

What are the potential risks of a secured loan?

The main risk is losing your secured asset, usually your home if you don’t repay the loan. Longer repayment times can lower monthly payments, but you might pay more interest overall. There could also be fees for paying off the loan early.

How can I effectively manage and repay a secured loan?

To manage a secured loan well, pay on time to avoid losing your asset. Use direct debits, contact lenders if you’re experiencing trouble, and pay extra when possible. Review the loan terms and consider refinancing to secure the best deal.