Best Retirement Interest Only Mortgage Rates 2026

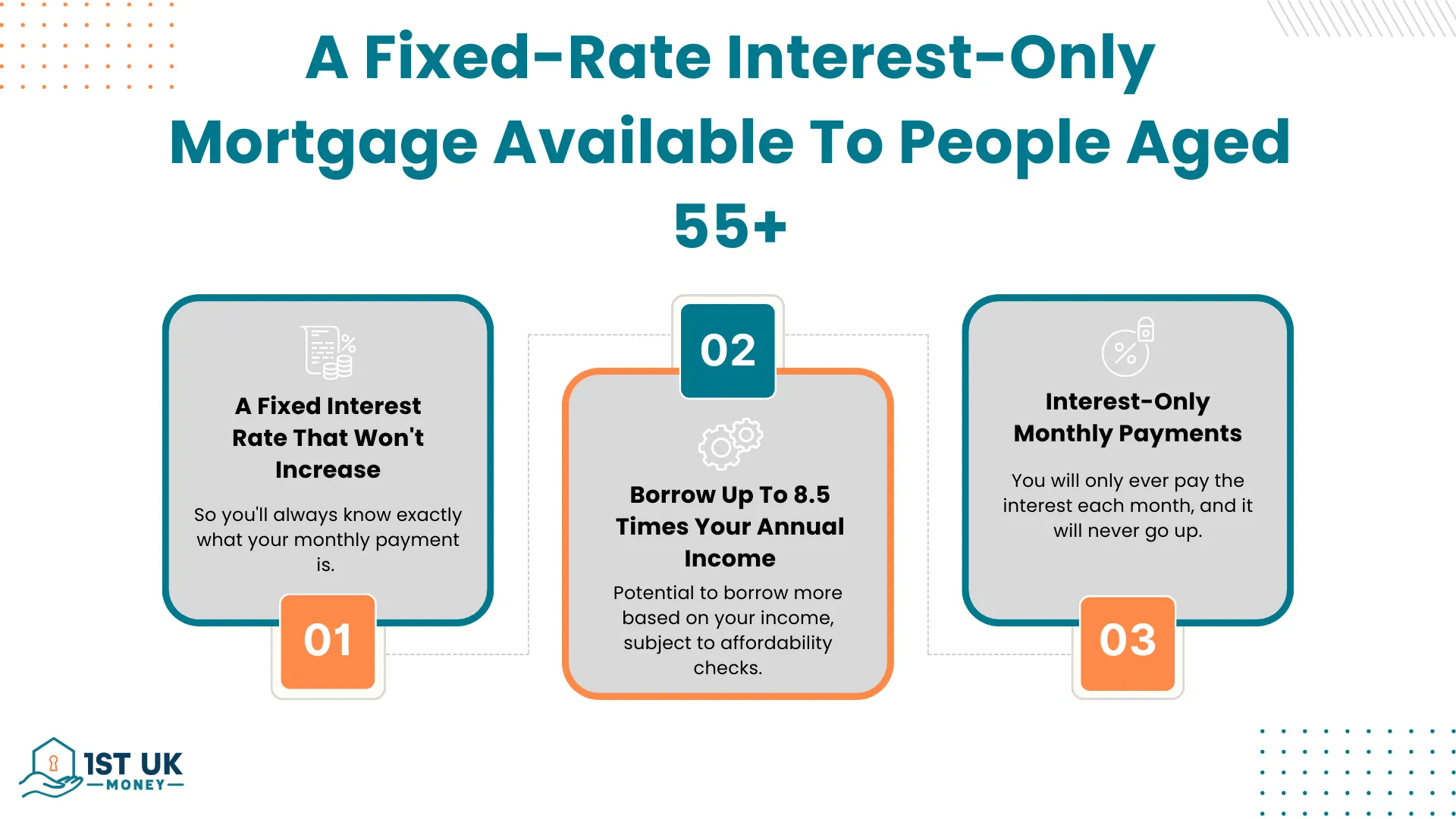

Retirement Interest-Only Mortgages (RIOs) are a popular option for homeowners aged 55 and above to unlock tax-free cash from their property while paying only monthly interest for life. Discover Lenders That Understand The Needs Of Senior Borrowers

Who Offers Retirement Interest-Only Mortgages?

1st UK Money has two preferred lenders with some of the best retirement interest-only mortgage rates in the UK.

Our Preferred RIO Mortgage Lenders:

Lender 1: With Very Competitive RIO Mortgage Rates

- Loan to value up to 65%

- 4.89% Fixed for life

- Free valuation

- No upper age limit

- No lender fees or broker fees

- Free no obligation home valuation

- No valuation penalty for flats and other leaseholds

- Over 55’s only

- No fixed term

Lender 2: Interest-Only Mortgages For Over 60s

- Loan to value up to 70%

- 5.11% Fixed for life

- No upper age limit

- No lender fees or broker fees

- Free no obligation home valuation

- No valuation penalty for flats, apartments and other leasehold types

- Over 60’s only

- No fixed term

RIO Mortgages For Over 55’s, 60’s, 70’s and 80’s With The Following Benefits:

- Interest rates similar to conventional prime mortgage lenders usually only accesible by younger people

- Flexible approach to loan-to-value

- A free home valuation

- Option to use your own family solicitor

- 1st UK has Lenders not available on price comparison websites

- No early repayment charges

- No product fees

- Make capital repayments or just pay interest

- No broker or advisor fees

- Some lenders require no-mandatory monthly payments

- Can be used for estate planning

- Ideal to pay off an old mortgage at the end of its term

- Decision in principle with no hard credit searches

- Remortgage or mortgage a new home purchase

Some Great Reasons To Consider A RIO Mortgage From 1st UK

- Qualification: Prove capability for monthly interest payments.

- Budget-Friendly: Lower payments with no set repayment deadline.

- Cost Efficiency: Unlike some equity release plans, interest doesn’t compound, making RIOs often more economical.

- Tapping Into Home Equity: Access extra funds for retirement or gifting.

- Legacy: Regular interest payments increase the chances of leaving an inheritance.

What Is A Retirement Interest-Only Mortgage (RIO)?

A Retirement Interest-Only Mortgage (RIO) is a specific type of mortgage designed for homeowners aged 55 and above. It allows retirees to unlock tax-free cash from their property without making capital repayments during their lifetime.

The primary purpose of RIO mortgages is to offer financial flexibility in retirement by providing an accessible means for meeting day-to-day expenses or other needs that may arise later in life, such as home improvements or debt consolidation.

The borrowed amount is typically based on the Loan-to-Value (LTV) ratio between 50% and 65% of your property’s value.

Major providers of RIO mortgages include Halifax, Lloyds Bank, Santander, Age Partnership and Nationwide, among others – all offering bespoke deals with varying eligibility criteria and interest rates depending on individual circumstances. 1st UK currently offers a retirement mortgage decision in principle from a panel of lenders not typically seen on comparison websites.

How Does A Retirement Interest-Only Mortgage Work?

A Retirement Interest-Only Mortgage (RIO) is a unique financial product designed specifically for retired UK homeowners who want to release equity from their property while keeping monthly payments manageable.

To better understand how RIOs function, consider this example: A homeowner aged 60 has a property worth £300,000 with no outstanding mortgage balance. They apply for a RIO mortgage at a 50% Loan-to-Value (LTV) ratio.

The lender would then issue them £150,000 in tax-free cash secured against the property.

The amount borrowed remains constant over time since only interest payments are made. The outstanding capital balance is eventually paid off when the borrower passes away or moves into long-term care, either by selling the property or through other arrangements such as insurance policies or investments earmarked for repayment.

Eligibility And Affordability Criteria For RIO Mortgages Over 60

To be eligible for a RIO mortgage, borrowers must be aged 55 or over and meet the lender’s income requirements, while affordability is assessed based on the borrower’s ability to make monthly interest repayments.

Age Restrictions On Retirement Mortgages UK

Age restrictions are crucial in determining one’s eligibility for Retirement Interest-Only (RIO) mortgages. Typically, the minimum age requirement for these mortgage plans is 55, ensuring that borrowers are in or nearing retirement.

Every RIO mortgage provider sets specific age restrictions; some may allow applications from pensioners aged 50 or older, while others set higher age limits. For instance, Halifax and Lloyds have a minimum entry age of 55 for their RIO mortgages, while other providers might require a higher minimum entry age.

Income Requirements To Access The Best Retirement Interest-Only Mortgage Rates

To qualify for Retirement Interest-Only (RIO) mortgages, you must show proof of a stable and predictable retirement income. Lenders will assess your pension income, including state and private pensions, along with other sources, such as investments or annuities.

It’s important to note that affordability checks for RIO mortgages are strict to ensure borrowers can afford monthly payments throughout their lifetimes. This means lenders want evidence of your financial stability before approving your application.

Best Retirement Interest-Only Mortgage Providers In 2026

Discover the leading Retirement Interest-Only Mortgage providers in 2026, including Halifax, Lloyds, Leeds Building Society, and Santander – read on to find out which RIO mortgage options could be right for you.

Halifax – The Best Retirement Interest-Only Mortgages?

Halifax is considered one of the top providers of retirement interest-only mortgages in 2025, offering competitive rates and flexible repayment terms.

With the Halifax RIO mortgage, borrowers can access tax-free cash from their property while paying only the monthly interest during their lifetime.

The funds released can be used to purchase another property or pay off any outstanding mortgage. Additionally, Halifax offers a fixed interest rate of 4.14% for their RIO mortgages with no early repayment charges or arrangement fees, making it an attractive option for retired homeowners looking to supplement their income without financial burden.

Lloyds – The Best Retirement Interest-Only Mortgage Rates

Lloyds Bank is a reputable, experienced lender that offers competitive interest-only retirement mortgages to UK homeowners aged 55 or over. With interest rates of 4.59% and an overall APRC of 6.0% for over 70s, Lloyds Bank stands out as one of the best providers in the market for RIO mortgages in 2026.

In addition to its RIO mortgage products, Lloyds Bank provides other mortgage options such as lifetime mortgages, equity release plans, and pensioner mortgages with loan-to-value ratios ranging between 50% to 65%.

Leeds Building Society – The Best RIO Mortgage Rates UK?

Leeds Building Society is a leading provider of retirement interest-only mortgages in the UK. They offer a range of products with flexible eligibility and affordability criteria, allowing retired homeowners to access finance while retaining property ownership.

Their retirement interest-only mortgage has a maximum loan-to-value ratio of 55% and offers borrowers a fixed interest rate of 4.49%, making it an attractive option for those looking for stability and predictability in their repayments.

The costs associated with Leeds Building Society’s retirement interest-only mortgages typically range from £1,000 to £3,000, depending on the chosen product.

Keywords: Leeds Building Society; Retirement Interest-Only Mortgage; Loan-to-Value Ratio; Fixed Interest Rate; Repayment Options; Affordability Criteria

Santander – The Key To RIO Mortgage Rates

Santander is one of the leading providers of interest-only retirement mortgages in the UK. They offer a fixed interest rate of 3.93% AER variable for over 70s, making it an attractive option for retired homeowners looking to unlock tax-free cash from their property.

Santander retirement mortgages are very popular, and there are rumours that a new product is being planned for 2026. The RIO mortgages UK landscape is changing.

To be eligible for Santander’s RIO mortgages, applicants must demonstrate access to a stable retirement income and be at least 55 years old. Strict affordability checks are conducted during the application process to ensure borrowers can afford payments on their interest-only mortgages.

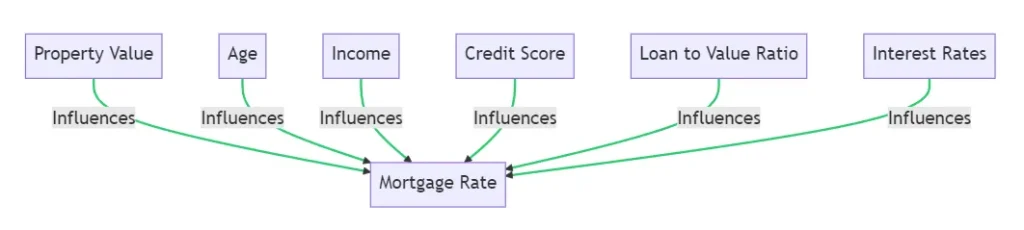

A diagram to illustrate the process of how UK Retirement Interest-Only Mortgage Rates are calculated

- Property Value: The value of the property you’re looking to mortgage plays a significant role in the calculation. The higher the property value, the higher the mortgage rate.

- Age: Your age at the time of the mortgage application is considered. The older you are, the higher the risk for the lender, which can increase the mortgage rate.

- Income: Your income (including pensions, investments, etc.) is assessed to determine your ability to make the interest payments. Higher income can lead to lower mortgage rates.

- Credit Score: Your credit history is checked to assess your reliability as a borrower. A good credit score can help you secure a lower mortgage rate.

- Loan to Value (LTV) Ratio: The loan amount’s ratio to the property’s value. A lower LTV often results in a lower mortgage rate.

- Interest Rates: The Bank of England’s base rate and the lender’s standard variable rate (SVR) influence the mortgage rate.

How Much Can You Borrow With A RIO Mortgage In 2026?

The amount you can borrow with a RIO mortgage in 2026 will depend on several factors, including your age, income, and the value of your property.

- Most RIO mortgages have a maximum loan-to-value (LTV) ratio of 50%, meaning you can borrow up to 50% of the value of your home.

- However, one provider offers an LTV ratio of up to 60% for certain borrowers.

- The minimum amount you can borrow with a RIO mortgage varies between providers, typically ranging from £10,000 to £25,000.

- Some lenders may apply affordability checks based on your retirement income and expenses when determining how much you can borrow.

- You may be able to increase the amount you can borrow by using equity release products such as home reversion plans or interest-only lifetime mortgages.

That said, it’s vital to approach borrowing cautiously and seek financial advice before committing to any mortgage product.

Benefits Of Retirement Interest-Only Mortgages

Pros of retirement interest-only mortgages include unlocking tax-free cash from your home, leaving a larger inheritance for your family, and allowing you to stay in the property until death or long-term care.

Retirement interest-only mortgages can offer several advantages for retired UK homeowners, including:

- Tax-free cash: Borrowers can unlock tax-free cash from the equity in their home, supplementing their retirement income without selling their property.

- Lower monthly payments: Interest-only mortgages tend to have lower monthly payments than repayment or lifetime mortgages, helping borrowers maintain their financial flexibility in later life.

- Limited debt accumulation: Interest on the loan doesn’t roll up and accrue, meaning the total debt won’t compound over time like other types of loans.

- Potentially higher LTV ratios: Loan-to-value (LTV) ratios can be higher for interest-only mortgages, enabling retired homeowners to release more equity from their property.

- Overpayment options: With some RIO mortgage providers, borrowers may be able to make overpayments on their loan to reduce overall debt.

- Flexibility for downsizing: If borrowers choose to downsize in the future or move into a care home, they can repay the loan by selling their property without any early repayment charges.

- Retain ownership of their home: Retirement interest-only mortgages allow borrowers to retain full ownership of their property, unlike other equity release options, such as home reversion plans, which sell off a portion of the property.

- Interest rate caps: Some RIO mortgage providers offer capped variable interest rates with upper limits, ensuring monthly payments don’t rise above a specified level even as interest rates climb.

Costs And Fees Associated With RIO Mortgages – Interest-Only Mortgages For Retired in 2026

Retirement Interest-Only Mortgages come with several costs and fees that homeowners must consider before applying. These include:

- Arrangement fee: Some lenders charge a one-off arrangement fee to set up the mortgage, ranging from zero to over £1,000.

- Valuation fee: Homeowners may need to pay for a property valuation, typically costing between £200 and £600.

- Legal fees: Borrowers must pay for legal services, such as conveyancing, which can cost between £500 and £1,500.

- Early repayment charge (ERC): Borrowers who decide to repay their mortgage early or switch to another provider may incur ERCs. The amount charged varies from lender to lender but is typically between 1% and 5% of the outstanding balance.

- Surveyor’s fee: In addition to valuation fees, surveyors may charge extra if they find any defects or issues with the property.

- Broker’s fee: Borrowers who use a mortgage broker may have to pay a broker’s fee, which can be either a flat rate or a percentage of the loan amount.

Retirees must consider these costs when deciding whether an RIO mortgage suits them. Comparing different deals and providers can help minimise the overall cost of taking out an RIO mortgage.

Best RIO Mortgage Rates UK In 2026

Discover the latest RIO mortgage rates for 2026 and choose from fixed, variable, or discounted rates with some of the top providers, including Halifax, Lloyds, Leeds Building Society, and Santander.

Retired Mortgages Interest-Only With Fixed Rates

Understanding the fixed rates offered by different mortgage providers is essential for retired UK homeowners considering retirement interest-only mortgages in 2026.

Fixed-rate mortgages provide the security of a fixed interest rate for a set period, ensuring that monthly payments do not change during the fixed rate term.

So, who offers retirement interest-only mortgages, and what are the best interest-only mortgage deals?

Here’s a table outlining the fixed rates from some of the top RIO mortgage providers in 2026:

| Provider | Fixed Rate Term | Interest Rate | APRC |

|---|---|---|---|

| Nationwide Building Society | 2-Year | 4.12% | 4.90% |

| Halifax | 3-Year | 4.28% | 5.10% |

| Lloyds Bank | 5-Year | 4.38% | 5.02% |

| Leeds Building Society | 10-Year | 4.47% | 6.23% |

| Santander | 5-Year | 4.57% | 6.09% |

It’s crucial to compare these fixed rates carefully, as they can significantly impact your monthly mortgage payments and the overall cost of the loan. Engaging with a specialist RIO mortgage broker can help you find the best fixed-rate mortgage for your unique financial requirements.

The Best Interest-Only Mortgages For Pensioners With Variable Rates

Variable rate RIO mortgages are an option for retired UK homeowners who want more flexibility in their retirement mortgage. These rates can change over the life of the mortgage based on market conditions and the Bank of England base rate.

Below is a table comparing different variable rate RIO mortgage options available in 2026:

| Lender | Initial Variable Rate | Follow-on Variable Rate | Minimum Income Requirement |

|---|---|---|---|

| Halifax | 2.61% | 3.77% | £16,000 |

| Lloyds | 2.52% | 3.91% | £14,000 |

| Leeds Building Society | 3.24% | 4.26% | £24,000 |

| Santander | 2.89% | 4.04% | £17,000 |

Remember that these rates can fluctuate, so it’s essential to research and compare different lenders to find the best deal. Your credit score and financial situation will also affect the rate you receive.

Consulting with a specialist RIO mortgage broker can help you navigate variable rates and decide on the best retirement mortgage product for your needs.

Retirement Interest-Only Mortgage Rates And Short-Term Discounted Rates

Retirement Interest-Only (RIO) Mortgage rates in 2026 offer various options for retired UK homeowners, including competitive discounted rates.

These discounted rates are available through specific lenders or brokers, so shopping around for the best mortgage deal is essential.

| Lender | Discounted Rate | Discount Period | Standard Variable Rate (SVR) |

|---|---|---|---|

| Halifax | 2.16% | 2 Years | 4.25% |

| Lloyds | 2.37% | 2 Years | 4.57% |

| Leeds Building Society | 2.49% | 3 Years | 4.81% |

| Santander | 2.99% | 2 Years | 4.64% |

These discounted rates offer retired homeowners a more affordable option for their RIO mortgage. It is critical to compare different deals and consult with a specialist RIO mortgage broker to secure the best mortgage rates in 2026.

Retirement Interest-Only Mortgage Rates FAQs:

What are retirement interest-only mortgage rates, and how do they work in 2026?

Retirement interest-only mortgages (RIOs) allow homeowners to borrow money against the equity in their property without making monthly repayments.

Instead, the loan is repaid when the property is sold or upon death, with interest added onto the initial borrowed amount. In 2026, these rates will be determined by market forces and other factors, including economic conditions and competition among lenders.

Who is eligible for a retirement interest-only mortgage?

Typically, RIOs are designed for older borrowers with significant equity built up in their homes but may not have sufficient pension income or savings to pay off an existing mortgage or release cash through traditional remortgages.

The exact eligibility criteria vary by lender, but usually require borrowers to be over a certain age (e.g., 55+), have a minimum level of equity in their home and pass affordability checks.

Are there any risks associated with getting a retirement interest-only mortgage?

Like any form of borrowing, taking out a RIO involves risks that should be carefully considered before deciding.

For instance, if house prices fall sharply or your financial circumstances change unexpectedly, you could owe more than your home is worth or struggle to keep up with ongoing repayments on other debts alongside your RIO loan.

How can I compare different retirement interest-only mortgage rates available in 2026?

Several factors must be considered to find the best deal on RIO loans from various lenders in 2026.

These include the overall cost of borrowing (interest rates plus fees), whether fixed-rate or variable-rate options are available, the repayment term length, eligibility requirements, customer service ratings/reviews from previous customers, etc.

What is the maximum age limit for RIO mortgages?

The maximum age limit for borrowers applying for RIO mortgages in 2026 is 100 years old.

What is the maximum loan-to-value (LTV) for RIO mortgages?

The maximum LTV for RIO mortgages in 2026 ranges from 50% to 60%.

Are there any early repayment charges associated with RIO mortgages?

Yes, some RIO mortgages in 2026 come with early repayment charges ranging from 2 years to 5 years.

Can I get an interest-only repayment option with a RIO mortgage?

Yes, all RIO mortgages in 2026 offer interest-only repayment options.

Which mortgage providers offer the best RIO mortgage deals in 2026?

Some of the best providers that offer retirement interest-only mortgage products include Halifax, Leeds Building Society, and Santander.

Do I need a stable retirement income to qualify for a RIO mortgage?

Yes, the eligibility criteria require proof of access to a reliable retirement income.

What are the costs and fees associated with taking out a RIO mortgage?

APRCs for retirement interest-only mortgages in 2026 range from 5.80% to 7.80%, and some lenders may charge arrangement fees or solicitor’s fees.

How do I apply for a RIO mortgage?

To apply for a Retirement Interest-Only Mortgage, you will need to gather necessary documents such as bank and pension statements, check your credit report, consult with a specialist broker, and provide affordability checks.

What are some alternative options to consider aside from Retirement Interest-Only Mortgages?

Alternative options include Lifetime Mortgages or Equity Release plans.

Will taking out a RIO mortgage impact my inheritance?

Yes, taking out a RIO mortgage may reduce your potential inheritance amount, as you will use some of your home equity to repay the loan.

What is the difference between a retirement interest-only mortgage and an equity release?

When evaluating retirement interest-only mortgage vs equity release, the former offers seniors the option to cover just the interest each month, settling the main loan when the property is sold or if they transition to care or pass away.

On the other hand, equity release methods, such as lifetime mortgages, allow homeowners to tap into their home’s equity without regular payments. The total amount and interest are settled upon their passing or relocation to a care facility.

Is an interest-only mortgage for over 60s worth considering?

An interest-only mortgage for over-60s in the UK can be worth considering, especially if one has a clear repayment strategy for the capital at the end of the term, such as selling the property or using savings.

It offers lower monthly payments since only the interest is paid. However, the total amount borrowed remains unchanged. It’s crucial to ensure that there’s a plan to repay the lump sum.

Additionally, some lenders may have age restrictions, so shopping around and seeking financial advice before deciding is essential.

What are the interest rates on retirement mortgages?

The interest rates are very similar to the rates offered to younger people, between 4 and 4.7%.

Are retirement interest-only mortgages a good idea?

They can be a good idea because they are specifically designed for older homeowners and have no set end date.

Can pensioners get an interest-only mortgage?

Yes, pensioners can easily get a mortgage, and the most common reason is to repay an existing interest-only mortgage.

At what age can you get a retirement interest-only mortgage?

In recent years, there has been more choice for most lenders, but generally, you need to be over 60 years old and have a good credit score.

Other things to consider:

- It is common for people to repay a standard interest-only mortgage with a later-life mortgage.

- The minimum property value and the mortgage affordability, as payments are required every month

- A standard residential mortgage affordability assessment could be easier than the lending criteria on a lifetime mortgage.

- You must get expert advice, as everyone who lives in the home must understand that the debt is secured against your home. All loved ones should be consulted.

Research Sources For Interest-Only Mortgages For Over 55s

- Financial Conduct Authority (FCA): Statistics on rio mortgages

- Money Advice Service: Equity release

- Age UK: Equity Release