Retirement Interest Only Mortgage vs Equity Release 2024

If you are considering borrowing money and don’t know if you should pay the interest on the money you borrow (RIO mortgage) or let the interest roll up (lifetime mortgage/equity release plan), the considerations are complex.

One of the major factors is what happens to you later in life if you need a care home.

It’s common for a care home to charge £1200 per week. So, if you leave equity in your home ready for the local council to use to pay for your care, you could be making a severe planning mistake. Wouldn’t it be wise to offload the fee burden to the local authority for your later life care costs (and not your family)?

Also, if you have children who are paying interest on their own mortgage, would some borrowing on your home, where the interest does not need to be paid monthly, be appropriate to help keep their borrowing down?

You may feel happier leaving equity tied up in your home, but ultimately, you are leaving equity your local council can take from your children. The law entitles them to do this.

If you choose an RIO mortgage and pay the interest on the loan monthly, what impact will this have on your retirement quality of life? Wouldn’t you be better off gifting your disposable income to your children each month?

If you would like someone to help you do the maths around your circumstances, please complete the form below, and a brief fact find will help you determine which later-life lending product is right for you.

Are you over 55s and looking for an effective way to tap into your home equity? Retirement interest-only (RIO) mortgages and equity release are two popular options among older homeowners in the UK.

Our new retirement interest only mortgage vs equity release guide will clear up any confusion by exploring these financial options, detailing their pros and cons, and offering insights to help you make an informed decision.

Some Important Points To Consider:

- Retirement interest-only mortgages and equity release are popular options for accessing property wealth in retirement.

- Equity release allows homeowners to release cash from their property without repayment until they die or sell the house. At the same time, retirement interest-only mortgages require monthly interest payments and repayment when the house is sold, they die, or move into long-term care.

- Equity release does not require an affordability assessment. Still, it has higher interest rates and exit fees, while retirement interest-only mortgages offer lower interest rates and potential tax benefits but require affordability assessments and monthly payments.

- Retirement interest-only mortgages may be more suitable for those who can afford monthly payments and want to have something to pass on as an inheritance. At the same time, equity release may be preferable for those who need longer-term loans and are not concerned about higher interest costs or exit fees.

Get Rates Comparable To Top Banks For Younger Individuals. Find Lenders Aligned To Senior Borrower Needs

Retirement Mortgage Decision In Principle Form

RIO Mortgages For People Aged 55 To 90 Offer The Following Benefits:

- Interest rates close to conventional prime mortgage lenders

- Flexible and open minded approach to loan-to-value

- A small valuation fee

- Use your own solicitor or legal advisor

- Access to lenders not available on price comparison websites

- No restrictive early repayment charges

- No product fees

- Make capital repayments or just pay the interest

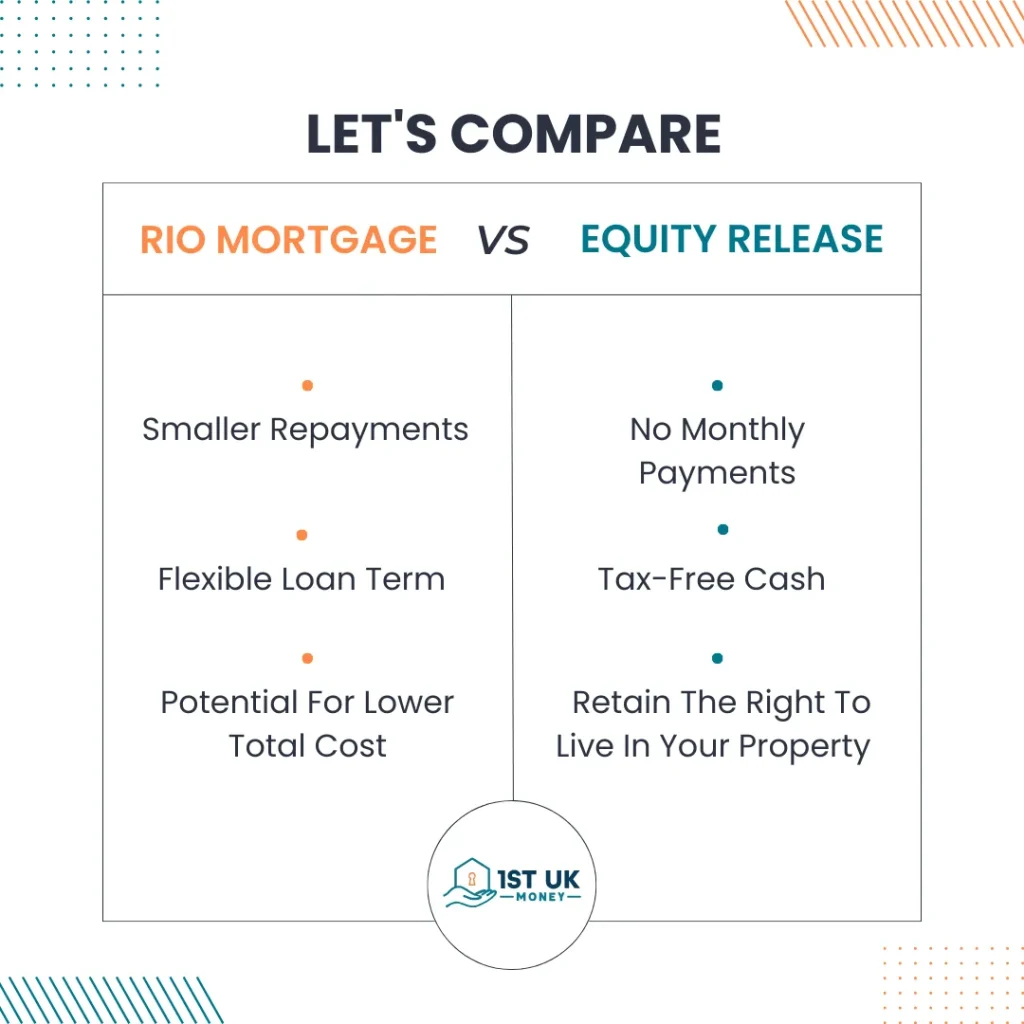

The Main Differences Between Retirement Interest Only Mortgage And Equity Release

Equity release and retirement interest-only mortgages are two options for homeowners looking to access the value of their property without selling it.

Equity release allows homeowners to release cash from their property without repayment until they die or sell the house, while retirement interest-only mortgages require borrowers to make monthly interest payments and repay the loan when the house is sold, they die, or move into long-term care.

Equity release loans, or lifetime mortgages, do not require borrowers to pass an affordability assessment. Instead, lenders consider the borrower’s age and the home’s value to determine the loan amount.

One drawback of equity release is the higher interest rate, which can lead to borrowers paying interest on interest over time. Exit fees for repayment before death can also be substantial.

On the other hand, retirement interest-only mortgages, introduced in 2018, offer lower interest rates compared to equity release. Borrowers are required to make monthly interest payments, and the loan does not increase in size.

These mortgages offer flexibility in terms of tenure, allowing borrowers to choose a 3-year term or the rest of their life. Another advantage of retirement interest-only mortgages is their potential tax benefits, such as starting the clock on the inheritance tax exemption rule.

Both options have their advantages and disadvantages. Retirement interest-only mortgages may be more suitable for those who can afford the monthly payments and want to have something to pass on as inheritance.

On the other hand, equity release may be preferable for borrowers who need a longer-term loan and are not concerned about higher interest costs or exit fees.

It is important to undergo an affordability assessment for both options to ensure the ability to repay the loan. Traditional mortgage lenders, including high street banks and building societies, offer retirement interest-only mortgages.

Remortgaging a retirement interest-only mortgage is possible, but it may require another affordability assessment. Seeking advice from an independent mortgage broker is recommended to explore the best options based on individual circumstances.

Understanding Equity Release

Equity release is a way of accessing cash from your property without selling it. It is typically aimed at homeowners over the age of 55 looking for a way to supplement their retirement income or fund home improvements.

There are two main types of equity release: a lifetime mortgage and a home reversion plan. The most common type of equity release is a lifetime mortgage, which involves taking out a loan secured against the value of your home.

You can receive the loan as a lump sum or regular payments, and the interest is added to the loan amount over time. The loan is typically repaid when the borrower dies or sells the property.

One of the main differences between equity release and a retirement interest-only mortgage (RIO) is that equity release loans do not require affordability assessments.

However, RIO mortgages allow borrowers to borrow into retirement and have lower interest rates than equity release.

With RIO mortgages, borrowers make monthly interest payments, and the loan amount doesn’t increase over time. RIO mortgages also offer more flexibility and potential tax benefits.

Considering the risks associated with equity release and RIO mortgages is important. The interest can roll up over time, reducing the amount of inheritance you can leave to your loved ones.

There is also a risk of repossession if repayments are not made. It is advisable to seek independent advice and carefully consider all options before deciding.

Pros And Cons Of Equity Release

Equity release providers offer a financial solution allowing homeowners to access the wealth tied up in their property without making monthly payments.

However, this option has its own advantages and drawbacks that you should consider:

| Pros | Cons |

|---|---|

| You can access property wealth without monthly repayments. | The interest on the loan compounds over time, leading to a larger total owed. |

| It allows you to continue living in your home. | It might affect your eligibility for state benefits and tax obligations. |

| It provides a lump sum, regular income, or both depending on the plan you choose. | As the loan is repaid when the property is sold, your estate will be reduced. |

| There are no monthly repayments. | It can limit your ability to move or downsize in the future because you’d need to repay the loan. |

| Some plans offer a ‘no negative equity guarantee’ which means you’ll never owe more than the value of your home. | Interest rates can be higher than other forms of borrowing. |

While equity release provides a way to access cash without selling your home, it has pros and cons. It is essential to weigh these factors before deciding whether it is the right option.

One of the significant advantages of equity release is that borrowers do not need to pass any affordability assessment. Instead, lenders consider the borrower’s age and the value of the home to determine the loan amount.

This can be helpful for retirees with limited income but significant home equity, as they can access funds they need for everyday expenses or one-off expenditures such as home improvements or medical expenses.

On the other hand, one of the drawbacks of equity release is that the interest rates are typically higher than those of traditional mortgages.

Moreover, the interest is often added to the loan amount rather than paid monthly, which means the debt grows over time. This can result in borrowers paying significantly more interest over the long term.

Considering factors such as affordability, potential inheritance, interest costs, and repayment options is crucial. Seeking professional advice from a mortgage broker or financial advisor such as 1st UK can help you make an informed decision and offer a retirement mortgage decision in principle via our no-obligation quote form.

While equity release can provide homeowners access to cash without selling their property, weighing the pros and cons is essential.

The interest costs and exit fees should be carefully considered before deciding whether it is the right option. Retirement interest-only mortgages offer lower interest rates and greater flexibility but require monthly interest payments.

Equity Release Providers Comparison Table

| Provider | Maximum LTV | Property Requirements | Borrowing |

|---|---|---|---|

| Legal & General | 64.50% | Minimum property value: £100,000 Maximum property value: £2m | Access to £2,700 as a monetary lump sum or monthly income |

| More2life | 60.00% | Minimum property value: £100,000 | Access to £10,200+ as a monetary lump sum |

| Just | 57.50% | Minimum property value: £100,000 Maximum property value: £1m | Access to £10,200 as a monetary lump sum |

| LV= | 55.50% | Minimum property value: £100,000 Maximum property value: £5m | Access to £10,200 as a monetary lump sum |

| Pure Retirement | 55.10% | Minimum property value: £70,000 Maximum property value: £2m | Access to £10,200 as a monetary lump sum |

Exploring Retirement Interest Only Mortgages

On the other hand, retirement interest only mortgages (RIO) provide an alternative to equity release. RIOs are a relatively new option for retirees to access the equity in their homes, offering a flexible and cost-effective way to finance their retirement years.

Unlike traditional mortgages, RIOs allow borrowers to continue making interest-only payments throughout their retirement years instead of having to repay the loan in full at the end of the mortgage term.

This can give retirees the peace of mind that they will not have to sell their home to repay the mortgage while allowing them to stay in their property for as long as they wish.

Retirement interest-only mortgages offer a range of benefits over equity release schemes. One of the main advantages is lower interest rates, meaning borrowers can potentially save thousands of pounds over the lifetime of the mortgage.

Additionally, RIOs offer more flexibility than equity release, as borrowers can make partial or full repayments at any time without incurring additional fees.

They can also opt for a shorter or longer mortgage term, depending on their individual circumstances.

To be eligible for a RIO, borrowers must typically be aged over 55 and have a stable pension or income source. They must also meet the lender’s affordability criteria and be able to afford the monthly interest payments.

It’s important to seek professional advice before applying for a RIO, as individual requirements may vary depending on the lender.

Overall, retirement interest-only mortgages offer a flexible and affordable way for retirees to access the equity in their homes without selling.

While they may not be suitable for everyone, they can be a viable option for those seeking an alternative to equity release schemes.

Advantages of Retirement Interest Only Mortgages

Retirement interest only mortgages (RIO) offer several advantages over equity release. RIOs allow individuals to borrow into retirement with lower interest rates than equity release.

This makes them a popular choice for those looking to release equity from their homes whilst keeping their interest payments manageable.

Unlike equity release, where interest rolls up over time, RIOs require borrowers to make monthly interest payments, preventing the buildup of interest.

This means that borrowers can retain more of the value of their property whilst, at the same time, reducing the potential interest costs.

RIOs also offer flexibility, with the option to choose a term or have the mortgage for life. This provides greater financial planning opportunities for retirees, allowing them to tailor their mortgage to their specific needs and circumstances.

Furthermore, RIOs may offer potential tax benefits, such as starting the clock on the inheritance tax exemption rule. Borrowers should consult a financial advisor to determine the tax implications of a RIO.

However, it is worth noting that borrowers must undergo affordability assessments and meet specific eligibility criteria to qualify for a RIO. Failure to keep up with repayments could result in repossession of their homes.

Overall, RIOs provide a new and ethical way of accessing funds from a property, offering significant benefits for those looking to borrow into retirement.

Borrowers should seek expert advice to determine the right mortgage option for their needs and circumstances.

Tax Benefits of Retirement Interest Only Mortgages

There are potential tax benefits to taking out a retirement interest only mortgage. As the interest payments are made monthly, the interest charge is not rolled up.

This means that the mortgage debt will not increase over time, and the amount of inheritance left to heirs will not be reduced.

In addition, taking out a retirement interest only mortgage can potentially start the clock on the seven-year potentially exempt transfer rule for inheritance tax.

It is important to note that to be eligible for a retirement interest-only mortgage homeowners need to pass an affordability check just like any other mortgage.

Failure to keep up with repayments can put the homeowner at risk of losing their home. Furthermore, requirements and criteria for these mortgages can vary among lenders, including high-street banks and building societies.

Eligibility and Requirements for Retirement Interest Only Mortgages

Retirement interest-only mortgages are typically aimed at older borrowers, such as those over 55 or 60, and pensioners who may find it easier to qualify for this type of mortgage compared to a traditional interest-only mortgage.

These RIO mortgages are a new way of ethically releasing money from your home, with the loan being paid off when you die, sell your house or move into long-term care.

The eligibility requirements for RIO mortgages are based on affordability, and you must demonstrate that you can afford to make the monthly interest payments.

Traditional mortgage lenders, such as high street banks and building societies, can offer retirement interest-only mortgages.

The main requirement is that the borrower can prove they have a stable pension or income source and can afford the monthly interest repayments. The amount you can borrow will be based on your affordability and the value of your property.

One of the key advantages of RIO mortgages is that you can avoid the issue of interest roll-up that is associated with some equity release schemes.

With RIO mortgages, you make monthly interest payments, and the outstanding capital is paid off when the house is sold, you die, or when you move into long-term care.

RIO mortgages come with flexibility, allowing you to choose a term of 3 years or for the rest of your life. There are also reduced exit fees compared to equity release loans, giving you the option to repay or downsize without large penalties.

There are potential tax benefits to taking out a RIO mortgage. By making monthly interest payments, you could potentially start the clock on the seven-year potentially exempt transfer rule on inheritance tax.

However, it is important to keep up with repayments, as the risk is that your home could be repossessed if you do not.

When considering retirement financing options, it is important to carefully assess your ability to afford the monthly interest repayments and the potential risks involved.

Seeking advice from a financial advisor or retirement mortgage specialist can help you determine the best option for your individual circumstances.

We hope you found our retirement interest only mortgage vs equity release guide helpful. Both equity release and retirement interest-only mortgages offer options for releasing cash from your property in retirement.

While equity release plans offer the possibility of releasing a large sum of money in one go, they come with higher interest rates and exit fees which could significantly reduce the value of your estate.

A retirement interest-only mortgage, on the other hand, allows borrowers to pay only the monthly interest on their loan, with the capital being repaid when the house is sold, the borrower dies, or they move into long-term care.

This type of mortgage offers advantages such as the possibility of leaving an inheritance and avoiding the interest roll-up associated with lifetime mortgages.

However, it requires passing affordability checks and carries the risk of losing one’s home if repayments are not maintained. Traditional mortgage lenders, including high street banks and building societies, offer retirement interest-only mortgages.

It is also possible to remortgage a Santander retirement interest-only mortgage, although another affordability assessment may be required.

It is recommended to seek personalised advice from a financial advisor or mortgage broker to assess the suitability of both options based on individual circumstances.

Ultimately, careful consideration and financial stability are key to making a well-informed decision about retirement financing options, including releasing equity from property.

Thank you for reading our guide on retirement interest-only mortgages and equity release. We hope it has provided valuable insights into the pros and cons of each option and helped you navigate the complex world of retirement finance options.

Interest Only Equity Release

Another phrase for interest only equity release is RIO mortgage and could be used to buy the cheapest house london in 2024.

Retirement Interest Only Mortgage vs Equity Release FAQs

Q: What is equity release?

A: Equity release is a way of accessing cash from your property without selling it. It is also known as a lifetime mortgage and does not require borrowers to pass an affordability assessment.

Q: How are retirement interest only mortgages different from equity release?

A: Retirement interest only mortgages (RIO) allow borrowers to continue borrowing into their retirement years. The interest rates on RIO products are generally lower than equity release, and borrowers must make monthly interest payments.

Q: What are the advantages of retirement interest only mortgages?

A: Retirement interest only mortgages offer lower interest rates, the ability to make monthly interest payments, and greater flexibility in terms of repayment. Repayment, downsizing, or moving house can be done without incurring large exit fees.

Q: Are there any tax benefits to taking out a retirement interest only mortgage?

A: Yes, you could save on taxes by starting the clock on the seven-year potentially exempt transfer rule on inheritance tax while still living in your home.

Q: What are the eligibility criteria for retirement interest only mortgages?

A: Eligibility for retirement interest only mortgages is subject to a detailed affordability assessment, highlighting the importance of having a stable pension or income source.