Stamp Duty And Land Tax Rates Guide 2025

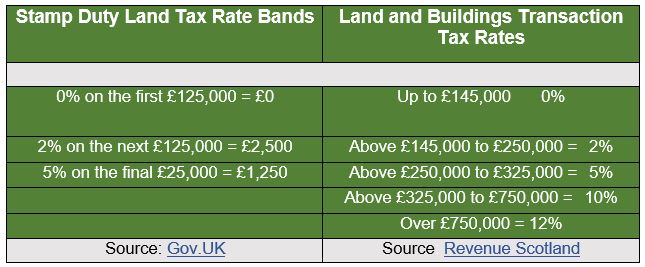

Stamp Duty Land Tax applies to property sales in England, Wales and Northern Ireland. In Scotland, this tax was dissolved in April 2015 and replaced with the Land and Buildings Transaction Tax (LBTT). It’s essentially the same thing. However, the rate bands in Scotland differ from the rest of the UK.

What’s the rate difference?

The table below shows the current rates. The left column applies to England, Wales and Northern Ireland. The right-side column applies to Scotland:

For any property priced at and above £125,000, Stamp Duty Land Tax will be payable. Only properties under the £125,000 threshold don’t pay this tax. In Scotland, the Land and Buildings Transaction rates become due when you buy a property priced at and above £145,000. When you need to pay Stamp Duty Land Tax

No Exemption for First Time Buyers

In 2010, it was announced there would be a temporary exemption to Stamp Duty Land Tax for First Time Buyers provided the property price was under £250,000. That exemption was only for two years. By 2012, it was removed. All properties priced above the thresholds must pay the applicable tax due – first-time buyers included!

Stamp Duty Land Tax on Second Homes

Stamp Duty applies to all second homes. It also applies to those with a second home overseas.

Another thing to consider when determining whether and what you pay is that a second home does not need to be a property you use. If your name is on two property title deeds simultaneously, you will be considered to have a second home.

This should be budgeted for if you plan to move to a new home while your current home is on the market, awaiting a sale. While your name remains on the title deeds, you will be considered to have two properties.

This is important because, for a second home, an additional 3% surcharge is applied on top of the usual rates. If this happens due to a delay in selling a property, you can reclaim the Stamp Duty provided it is sold within three years. A claim must be filed within three months from the sale completion date to reclaim the 3% surcharge.

Stamp Duty Land Tax for Buy-to-Let Properties

There have been a lot of changes taking place recently affecting landlords. From Capital Gains Tax, to Mortgage Interest Tax Relief… landlords must increasingly know and control the costs to remain in business and keep their existing tenants with a home.

In the case of applying for a bad credit buy to let mortgage, it’s imperative to consider the 3% surcharge for Stamp Duty because it will need to be paid within 30 days of a sale completion. If that’s not accounted for and you raise your deposit amount to access finance for any new property, it may lead to a need to take out additional bridging finance to pay the tax by the deadline.

Without accounting for the 3% Stamp Duty surcharge, your available cash flow can suffer, and your risk can increase —sometimes significantly.

Stamp Duty on New Build Homes

Essential to consider with newly built homes is that the Stamp Duty is payable on the property price, driven up with all fixtures and fittings attached to the property.

Fitted kitchens, bathrooms, and bedrooms can increase the property price. Some building firms will include extras such as fitted carpets, laminate flooring, blinds, etc. However, these aren’t part of the build because they aren’t attached.

Property firms building homes are aware of the Stamp Duty that each home buyer will have to pay, and many do offer incentives to cover the cost to the buyer. For that reason, if you’re buying a newly built home, you should ask the property company about any offers they have available to assist with the cost of Stamp Duty.

If you’re working with a mortgage broker, you should also make them aware of any incentives there are from sellers.

Current Stamp Duty Rates 2025

The current stamp duty rates 2025 are similar to 2025, even for cheap houses for sale Burnley as most houses in Burnley don’t have stamp duty on them.

Stamp Duty applies to Residential Leasehold and Freehold Property Transactions.

When you buy a property with a freehold tenure, you will own it and its land. That’s why this is called Stamp Duty Land Tax. It’s a tax on the land based on the property price. However, it’s also applicable to residential and commercial leasehold properties. For residential properties, a leasehold will mostly apply to flats.

The difference is that you can own your home but not the land the property sits on. The leasehold applies to the land on which your home is built.

Stamp Duty still applies to leaseholds, but it’s calculated differently, using the purchase price of the lease for the land.

Working out How Much You’ll Need to Pay

HMRC have a Stamp Duty Calculator you can use. The link to access it is:

https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax

There is a Land and Buildings Transaction Tax Calculator available at Revenue Scotland here:

https://www.revenue.scot/land-buildings-transaction-tax/tax-calculators

When you need to pay the Stamp Duty

The total amount due must be paid within thirty days from the date the sale is completed. Penalty fees may be applied if you pay late.

Related Reading: