Best Help To Buy Remortgage Deals 2024

Large Help To Buy Remortgage Specialist. Access to Private Banks. Specialised Brokers. Simple and Easy.

Searching for help to buy remortgage lenders & rates? Get advice from specialists

- Large Remortgage Specialist. Access to Private Banks. Specialised Brokers. Simple and Easy.

- Poor Credit, Sub Prime, Default, IVA, CCJ All Considered

- Remortgage Interest Rates From 2.15% Fixed For A Minimum Of Two Years And Subsequent Discounted Rates.

- 1st UK Money Have Funding From Lenders Who Offer Great Terms And Are Open-Minded To Those With Adverse Credit.

- From January 5th 2024 – NO BROKER FEES!

- Funding Is Limited With Some Lenders, So Please Complete The Form Below With Your Details.

Exclusive Help To Buy Remortgage Deals Pre-Decision In Principle Application Form:

Specialist Help To Buy Remortgage Lender – “Semi” Exclusive To 1st UK Money!

- Flexible proof of income accepted from many sources including some state benefits

- Fast completions on help to buy remortgages

- Employed and self-employed all considered

- Some less-than-perfect credit history is accepted

- Trusted Brand

- Fixed, Tracker Capped and Discounted Rates for piece of mind

- Low or no fees with one lender in particular

- At least two of our lenders are not available on the Comparison Engines!

- Valuations can be done within 5 working days – some done electronically!

- Independent advice – we a not tied to specific lenders

A Background To The Help To Buy Scheme

The government launched the Help to Buy scheme in April of 2013. It’s reported that over 215,000 borrowers jumped on the offer and with good reason. It is a good scheme that’s helped thousands of FSBs (First Time Buyers) get onto the property ladder.

You needed to buy a new-built home. The Help To Buy equity loan could only be used for new homes, and you had some restrictions on which ones they’d offer in your area through an agent – but overall, it was a successful scheme.

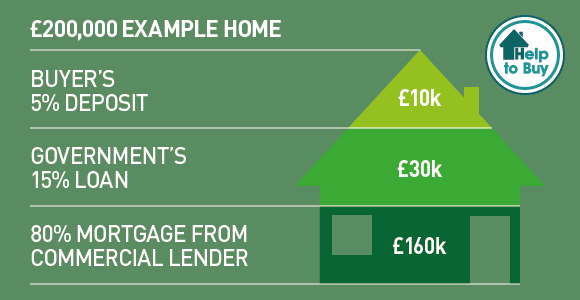

The Help to Buy scheme offers a 20% equity loan based on the home’s market price at the time of purchase. The loan is repayable interest-free for the first five years. After five years, interest is applied at a monthly rate of 1.75%, which is rising annually in line with inflation.

This is five years in, so those who joined the scheme five years ago are now facing equity loan interest repayments of 1.75 % of the outstanding amount of the loan.

It stands to reason that this month sees a spike in the amount of interest there is for remortgaging, but the catch is, the government loan may need to be repaid from the equity to access the vast majority of remortgage products. There’s still a long way to go for more lenders to enter the remortgage market with products tailored to customers with equity loans from the government.

We’ll Compare Hundreds Of Deals To Get You The Best Offers, Tailored To Your Situation. Quick Quote Form

Currently, There Are Five Mainstream Lenders Catering To The Help To Buy Remortgage Market:

- Barclays

- Halifax

- Lloyds

- Leeds Building Society

- Nationwide

Brokers have access to various lenders, each of which uses a varied set of criteria to determine the amount that can be borrowed based on the equity and what’s repayable on the government loan, if any is. It is possible to retain the Help to Buy equity loan and remortgage at a better rate—just not the best rate, as it turns out.

What are the repayment options?

You can keep the loan in place and remortgage what’s left. If you plan on repaying the loan amount from the Help to Buy scheme, you can either repay the whole amount borrowed – 20% of the property price when you bought the home – or you can use staircasing to repay 10% of the amount borrowed. The remaining 10% will accrue interest at the current monthly rate of 1.75%.

The catch

The trap consumers are finding with the remortgage situation is that the limited mainstream lenders have no or low-cost fees associated with remortgaging, such as the Leeds Building Society, which currently offers a no-fee option. Brokers have more options and access to better rates, but the high admin fees make it a distant dream.

Some costs are reported to be in excess of £700 before administration fees are applied. There are exceptions as lenders have products available without consumer advice, and because of that, are only available through intermediaries to ensure consumers have information before entering into any agreements associated with the products.

What Can You Do Now?

If you’re currently subject to the Help to Buy scheme terms, you may find yourself limited in what you can do with the property concerning extending it and upgrading it due to approval issues. You will need approval from a Help to Buy agent to alter the building. If you have plans that require approval, the only way around that is to repay the entire 20% to the government and break yourself out of the agreement.

If you’re okay with the terms and happy to leave things as is, but you’ve reached the end of your mortgage term, the mainstream lenders above are the only ones offering to remortgage homes where Help to Buy schemes are in place.

The problem you’ll encounter is the amount of equity you have in your home because technically, while that 20% equity loan is in place, that’s 20% of your property owned by the government. Therefore, anything you’ve paid off will still leave you with lower equity because there’s 20% owned elsewhere.

The good news is that the Help to Buy loan is based on the original market price of your home. The amount you can borrow is based on the equity you have in your home at the current market price. Therefore, if the value of your home has risen, you’ll have more stake in it. The government won’t because they’ve stipulated that the loan is based on the property’s market price when you buy it. If your home has lost value since then, you will have a more significant problem with remortgaging.

In any case, the valuation costs are the main issue because you need to know the market price of the home now, so you and lenders know the amount you need to borrow.

In addition to that, it’s worthwhile considering whether to retain the Help to Buy loan. While that’s in place, there’s 20% equity you don’t have, which is what’s currently limiting remortgage choices because you already have an existing 75% LTV mortgage, which is low but not unheard of even without the Help to Buy scheme.

The calculations you should be making are whether it makes more financial sense to keep the 20% Help to Buy loan in place and pay the 1.75% interest monthly rather than releasing more equity from your home to repay the Help to Buy loan, thereby increasing the equity you have in your home solely without the government scheme owning any equity.

When it’s only you who holds equity in the property, there’s a larger lender pool and certainly more choice. It’s probably worth considering approaching the broader help-to-buy remortgage market through a broker for advice, as the mainstream lenders offer limited choices.

Besides, some products are only provided through intermediaries, ensuring there’s impartial advice offered to customers, so even going directly to a mortgage lender doesn’t guarantee you’ll get the best deal because you need to be advised before entering into a mortgage agreement.

What stops you getting a help to buy remortgage in the UK?

The first thing that stops most people from getting a remortgage is the thought of losing their home. The second biggest reason, after being unable to afford another mortgage, is the lack of equity in the property.

For many, this means they need at least 75% LTV with a 20% down payment – not easy when you’re living paycheck to paycheck. Even if enough money was saved for this kind of hefty outlay, it could take six months or more to save enough through regular savings accounts before applying for a new mortgage with your bank.

In addition, banks are becoming increasingly strict about lending money due to recent economic events, so credit availability has tightened significantly over the past few years.

If you have bad credit, you could consider releasing equity with a bad credit secured loan subject to the loan to value requirements and affordability assessment.

Other Useful Guides:

- 2018 Remortgage Industry Report

- Options For Pensioners 65-85

- Zero Hour Contract Finance

- Government Mortgage Schemes

- Leasehold Property Good Or Bad?

- Near Prime Or Sub-Prime Borrowing

- No Credit History Property Purchasing

- How To Get An Application Approved

- How To Repair Your Credit

- Credit Refinancing Post Divorce

- Remortgage Without The Risk

- Funding Lending Scheme Mortgages

Homeowner loans for people with help to buy mortgages in 2024

You should consider homeowner loans bad credit direct lender if your existing lender is a good lender with a low rate.

The UK’s Help to Buy scheme has been a boon for many aspiring homeowners, offering a lifeline for those who might have struggled with the significant upfront costs associated with buying property. The scheme essentially allows buyers to secure a property with just a 5% deposit, with the government providing a further equity loan to bolster this initial payment. However, like all loans, the time comes when these sums need to be repaid. This is where the process of remortgaging enters the frame, especially when the five-year interest-free period on the equity loan approaches its end.

Remortgage Help To Buy Equity Loan in 2024

If you are looking to remortgage help to buy equity loan on your house to buy Durham there are currently 3 lenders that will do this product, please contact 1st UK Money to find out more.

Understanding the Help to Buy Remortgage Process

When we talk about a ‘help to buy remortgage’, we’re essentially referring to securing a new mortgage deal to replace the existing Help to Buy agreement. Various factors play crucial roles in this decision-making process, such as help to buy remortgage rates and available help to buy remortgage deals.

After 5 years, interest kicks in on the government’s equity loan. Therefore, many homeowners consider buying a remortgage after 5 years to avoid this additional cost. While the first five years of the equity loan are interest-free, homeowners face an interest rate starting at 1.75% of the loan’s value. This interest rate can increase yearly, influenced by the Retail Prices Index.

Options Available for Help to Buy Remortgage

- Remortgage to Pay Off Help to Buy: This is perhaps the most straightforward route. Here, homeowners secure a new mortgage deal that covers their original borrowing and pays off the government’s equity loan. For this, homeowners can explore options from help-to-buy mortgage lenders, seeking out the best help-to-buy mortgages available in the market.

- Switch to a New Lender: Help to buy lenders are numerous, and some might offer more attractive deals than others. Switching to a new mortgage product can often reduce monthly repayments or shorten the mortgage term.

- Stay with Current Lender: If homeowners are content with their current deal, they might choose a product transfer, staying with their existing lender but moving to a different mortgage product.

Challenges in Remortgaging with Help to Buy

While remortgaging might seem like a logical step, it’s not without hurdles. The homeowner’s property value might have changed since the initial purchase. If the property’s value has increased, homeowners must repay a higher amount on the equity loan, making remortgaging more challenging.

Bad credit poses another issue. The question of helping to buy with bad credit often arises. While securing the initial Help to Buy might have been possible, remortgaging with a less-than-stellar credit history can prove challenging. Still, it’s not impossible. Help-to-buy mortgage brokers are often equipped to guide homeowners through this, even if they have bad credit.

Why Some Believe Help to Buy is Not Ideal

Some voices in the property sector argue why help to buy is bad. The primary critique is that it artificially inflates property prices. Others feel that the scheme ties homeowners to a financial ticking clock, with the looming five-year deadline causing potential financial strain.

The Journey of Paying Off Help to Buy

Homeowners often wonder how to repay a help-to-buy loan or how to pay back the loan. While repaying the loan before the 5-year mark can save on interest, most look into paying off the loan before 5 years due to the interest that starts accruing after this period.

For those considering this route, the process typically involves:

- Valuation: Firstly, the property is valued to determine its current market price.

- Repayment Sum Calculation: Based on the valuation, the exact sum to repay the equity loan is determined.

- Securing Funds: This could be through savings, a gift, or by remortgaging.

Comparison and Making the Right Choice in 2024

Given the range of available remortgage options, it’s vital to compare them. Homeowners are advised to hunt for cheap remortgage deals and to watch the best mortgage deals in UK listings. This ensures that when they remortgage help to buy equity loan or any other type, they get the best rates and terms.

Potential structural concerns related to the property are an essential aspect to consider during this journey. For example, those with homes constructed with raac planks might need to consider additional factors when remortgaging.

Navigating the Future

Help to Buy has been an instrumental scheme for many in the UK. Yet, as with all financial decisions, it’s essential to approach the end of the interest-free period with a clear strategy. Whether seeking advice from brokers, comparing rates, or understanding the nuances of help-to-buy remortgaging, knowledge is the key to navigating this potentially complex landscape.